Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

The cold chain industry is forecast to value at $169 million in 2019, fueled by the development of processing industry and modern trade retails, according to FiinGroup.

Cold chain in Vietnam is divided into two main segments of cold storage and cold transportation.

According to FiinGroup’s database, cold chain market in Vietnam is rather fragmented with 44 specialised providers, serving rising demand from food sectors (meat and seafood import-export, food processing, and so on).

Approximately 80 per cent demand for cold chain comes from food sectors. The robust development of modern trade retail (consumer food services, supermarkets, convenience store) is said to give rise to the growth of the sector. In particularly, modern trade retailers are growing vigorously, reporting a surge of 40 per cent in number of outlets to 4,200 in 2018.

As these retailers tend to outsource cold chain logistics to back their robust expansion and requirements on logistics cost optimisation, they have promoted a bright outlook for domestic cold chain logistics providers.

Given the rising demand for cold storage, many providers, especially foreign firms such as CLK and Anpha, have planned to put new investments with total additional capacity of approximately 60,000 pallets for cold storage during the period 2019-2023.

In addition, given the fragmentation nature of the market and rising demand, FiinGroup also expects the consolidation in cold transportation in the next few years, with the rise of leading specialised players such as ABA Cooltrans and Tan Bao An.

Cold storage in Vietnam has witnessed an aggressive expansion of both local and foreign players in recent years. According to FiinGroup’s Vietnam Cold Chain Market Report 2019, total designed capacity of rented cold storages in Vietnam reached 600,234 pallets in 2018. The market is more developed in the southern region thanks to high demand from seafood export and retail.

Meanwhile, the northern market witnessed a surge in designed capacity from 26,750 pallets (2015) to 71,750 pallets (2018). The region is currently facing a temporary supply surplus and low utilisation rate, especially for new facilities. FiinGroup forecasts that the North market will reach equilibrium in the next 2-3 years.

Cold transportation in Vietnam has two main segments: cold container and bulk. Approximately 11 per cent of container throughputs via seaport in Vietnam (equivalent to 2 million twenty foot equivalent units (TEUs) in 2018) are refrigerated containers, driven by the continuous increment in import-export activities and infrastructure improvement.

The market is now witnessing a fierce competition from many small and medium-sized players. Some of them include local players like ABA Cooltrans, Binh Minh Tai, Tan Hung and Quang Minh. Their competitive advantages are high-capacity fleet of refrigerated trucks, salespersons and service quality (delivery time, temperature control and value-added solution).

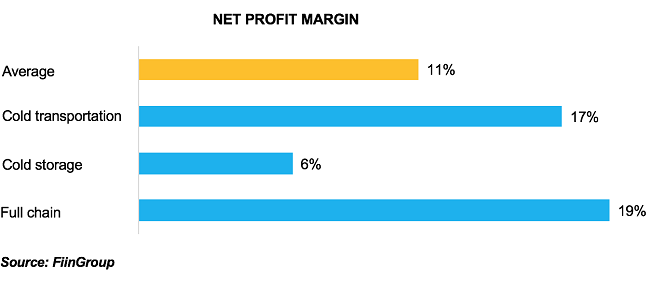

Sector's 2017 net profit margin

According to FiinGroup’s analysis, full chain providers outperformed the market with net profit margin of 19 per cent, thanks to their comprehensive expertise that offers value-added solutions. Cold transportation companies also achieved impressive results as their profitability ratios resemble that of full cold chain logistics companies.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.