Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The pace of Vietnam consumer finance growth has currently shown clear signs of slowing down.

While the consumer finance (CF) market propped up its contribution to the national loan book by 19.7 per cent in 2018, up 3 per cent on-year, the percentage has been perceived to be relatively low compared to the figures recorded in the period of 2013-2017, according the financial data provider FiinGroup (previously StoxPlus).

The local CF sector reported a compound annual growth rate (CAGR) of 59 per cent year-on-year (YoY) during this period. The overall growth of 2018 nevertheless cooled down to 30.4 per cent YoY. Finance companies, despite experiencing strong growth in early years, could not sustain such speed last year. The growth slumped to 15 per cent YoY compared to 38 per cent YoY in 2017.

Competition intensified as new players entered the picture. If in 2015, there were only a handful of finance companies active in the CF market, the 2018 consumer credit segment saw 16 active and licensed CF companies, not including the alternative lending and pay-day loan platforms.

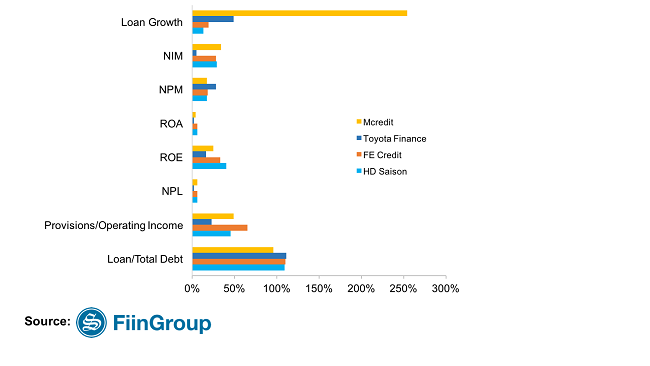

MCredit had an impressive performance last year when it took over 5 per cent of market share by the second year following its launch, thanks to the strong focus on cash loans.

The company, in particular, witnessed a rocketing growth of 254 per cent. FiinGroup expects there is still room for the company’s growth judging from its loan/debt coverage at only 96 per cent. Nevertheless, the focus on only cash loans would increase risks for the company when its non-performing loan (NPL) currently belonged to the most alarming group, at 6 per cent.

Like MCredit, other aggressive players who prioritise market share growth and profitability albeit lower asset quality include FE Credit, HD Saison and Toyota Finance.

FE Credit has been the pioneer in this aggressive strategy through launching new products and investments in technology innovations. Its considerable loan growth of 19 per cent was accompanied by the high NPL at 6 per cent. Accordingly, its provision was marked high at 65 per cent of total operating income.

The company, though the biggest player still, incurred a slight decrease in its market share from 48.9 per cent in 2017 to 47.3 per cent in 2018.

With the unique characteristic of a company which offers collateralised, automobile loans for Toyota cars, Toyota Finance has limited net interest margin (NIM) and profitability. Nevertheless, thanks to Vietnam’s strong demand for cars, the company recorded robust loan book growth.

In contrast to three formers, HD Saison experienced a decline in its growth due to the company’s change of direction from expanding coverage to focusing on existing customers within its ecosystem (HDBank – VietJet – HD Saison).

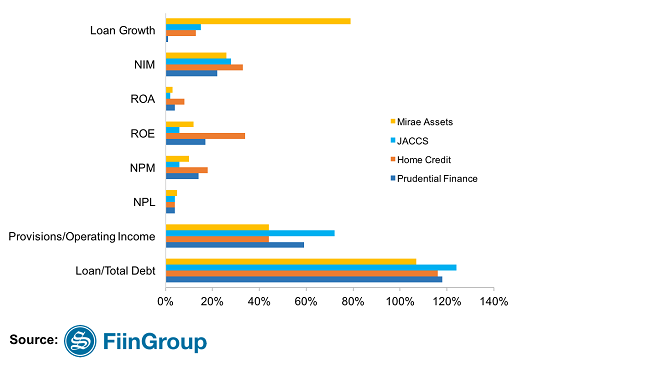

Financial ratios among selected finance companies -Cautious group

As opposed to the aggressive players, caution ones are those seen with relatively slower growth rate and lower NPL, yet attaining stronger asset quality and capital adequacy.

The outlier of this group is Mirae Assets, which gained a drastic growth of 79 per cent as the company started to focus on cash loans as its growth driver, while NPL still approached the average rate of 5 per cent. Nonetheless, this was not translated into higher profitability, according to FiinGroup.

Home Credit, meanwhile, continued enjoying high NIM, return on asset (ROA), return on equity (ROE) and net profit margin (NPM), with a low NPL at only 4 percent, thanks to its robust risk management and technology platform. In the near future, stronger growth is expected due to its strategic partnerships with e-wallet issuer Momo.

JACCS is another case of conservative player when the company experienced a modest credit growth due to the decreased number of new contracts and automobile loans. Being the pioneer in credit card market among finance companies, however, do not guarantee JACCS a prominent position, when the company’s more cautious approach has allowed newer entrants (FE Credit, Home Credit) with more aggressive strategies to take over credit card and other segments.

Currently under transition to the management of Shinhan Bank, Prudential Finance’s growth slowed to the lowest level of 1 per cent among the group because of no new loans recorded. This has allowed a decrease in costs, which resulted in better operational efficiency. However, FiinGroup expects the indicators to change radically once Shinhan Bank has actively participated in the company’s operating activities, which could mean new products, strong financial support, and a change in strategy.

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.