Cen Land transforms into real estate developer with bold goals

Cen Land is shifting from brokerage to development, targeting a 170% revenue increase and 424% profit growth in 2025.

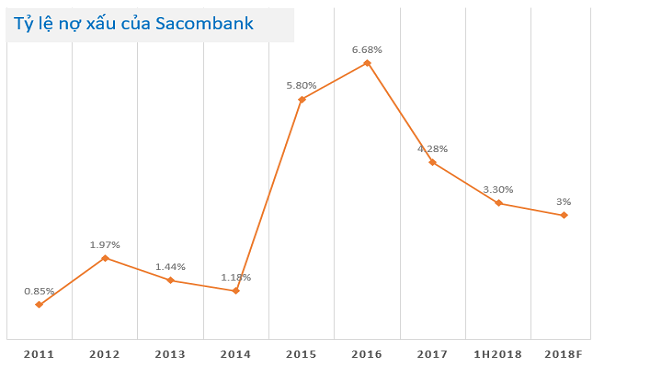

Sacombank's bad debt ratio was reduced to a little over three per cent, which is considered the safety limit, in less than two years.

According to Sacombank, its total assets increased by 8.7 per cent to about $17.4 billion in the first half of 2018.

Sacombank’s asset size has increased mainly due to the growth of capital mobilisation from economic organisations and individuals. Specifically, this source raised by 12 per cent, higher than the industry average, and reached roughly $15.8 billion at the end of June. The bank said its market share in capital mobilization increased from 4.7 per cent to 4.9 per cent.

Regarding lending activities, Sacombank's total credit reached over $10.7 billion, up 9.6 per cent compared with the beginning of the year. Its market share in lending increased to 3.6 per cent from 3.5 per cent of the beginning of the year.

Sacombank’s total revenue is over $217.3 million, up 49.1 per cent year on year. In particular, the service income continued to grow by 35 per cent year on year and reached about $49.3 million. Its profit before tax in the first six months of 2018 reached nearly $43.5 million.

Notably, Sacombank said it had collected more than $156.4 million of bad debt and outstanding assets in the first half of 2018. Its bad debt ratio, which reached 4.28 per cent at the end of 2017, has now reduced to 3.3 per cent.

In 2017, the bank's bad debt fell sharply to 4.28 per cent from 6.68 per cent in 2016. This excellent result was obtained thanks to the success of tackling more than $825.6 million of bad debt and outstanding assets.

Over a half of that debt was land use rights in Duc Hoa III industrial park, Long An province. These assets were assumingly related to Tram Be, former Vice Chairman of the Board of Directors of Sacombank from 2012 to 2015.

Recently, Sacombank has continued to announce a large-scale real estate auction, mainly in Ho Chi Minh city. To be more specific, it was announced that on June 28, land lots in Long An province, Ho Chi Minh City and Ba Ria Vung Tau province, which would be worth roughly $134.2 million.

Among those, the most notable are six land lots of Tan Kim industrial park (Can Giuoc district, Long An province), which have an area of over 291,000 square metres. Their initial value is nearly $45 million.

Other properties being auctioned are also located in District 8, Binh Thanh district or Tan Phu district, Ho Chi Minh city. Their value ranges from $16.6 million to $19.4 million.

On the website, the bank also offers other high-value real estates for sale such as industrial land lots in Binh Duong ($55 million), land lots in District 3 ($17.5 million), land lots in District 7, Ho Chi Minh city ($8 million).

Cen Land is shifting from brokerage to development, targeting a 170% revenue increase and 424% profit growth in 2025.

Menas Group has entered a strategic partnership with Keppel to co-develop an integrated ecosystem of lifestyle services across Keppel’s real estate projects in Vietnam, beginning with the landmark Celesta City development in Saigon South.

Phuc Sinh’s expansion underscores Vietnam’s growing role in sustainable agriculture and its increasing appeal to global investors

PVI Asset Management (PVI AM) and SonKim Capital (SK Capital), a business unit of SonKim Group has announced a strategic collaboration to develop innovative real estate investment products tailored for institutional investors and high-net-worth individuals.

Filum AI has successfully raised $1 million in funding despite a challenging venture capital market, underscoring the potential of AI and shifting investment strategies.

Enterprises are advised to promptly assess and evaluate the impact of the changes in the newly-issued to ensure timely compliance in the upcoming tax finalization period.