Property

HSBC warns of real estate risks

HSBC expects rising housing prices to constrain the SBV’s ability to deliver any further rate cuts.

The persistence of Covid-19 overshadows existing risks to growth in many countries. In the case of Vietnam, it is the real estate sector, HSBC said in its latest report “Vietnam at a glance”.

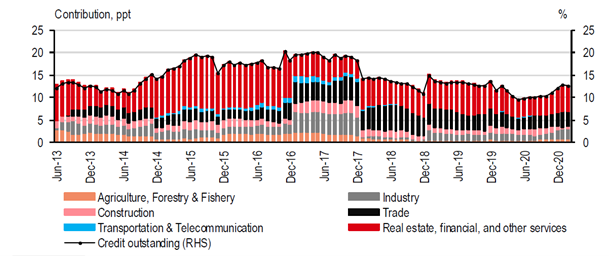

Vietnam’s policymakers have been keeping a keen eye on the real estate sector in recent years cause the property market is essentially too big to ignore. Real estate activity accounts for 5 – 15 per cent of GDP in ASEAN, and in the case of Vietnam, the ratio is around 8 per cent of GDP.

More importantly, the memory of a housing bubble of 2007 – 2012, which ultimately led to a prolonged banking crisis, looms large in the collective conscience.

Even after a gradual recovery in the banking sector, real estate loans continue to account for a large proportion of bank balance sheets. While some banks do not have a specific classification on loans to the real estate sector, balance sheets of the “Big-4” SOE banks reveal a key linkage with the associated construction sector.

“After all, Vietnam still relies heavily on high credit growth to fuel its economy,” HSBC stated.

Domestic investors make price higher

While the real estate market has been hit by the pandemic, there are signs that it is recovering.

Although output fell in year-on-year terms in the second and third quarter of 2020, it registered a strong rebound from the last three months of last year. The same can also be seen in terms of improving new launches and sold units since the last quarter of 2020, according to CBRE.

Meanwhile, property prices continue to rise. For example, in Ho Chi Minh City, the average property price rose 11 per cent year on year as of the third quarter of 2020.

Like many countries, this is partly due to accommodative monetary policy that offers low interest rates and abundant liquidity.

Meanwhile, it is also driven by a sharp rise in the price of luxury condos, growing 9 per cent year on year in 2020 compared to a 4 – 5 per cent year on year price increase in the mid-end and affordable segments, said CBRE.

Demand for luxury and high-end properties remains elevated, with their market share increasing from less than 30 per cent of total units sold in 2019 to more than 70 per cent in 2020.

FDI data suggests that even though new FDI inflows into the real estate sector increased more than 200 per cent year on year as of May, FDI was largely concentrated in manufacturing.

“This means that price rises are mainly due to domestic investors,” HSBC showed.

An eye on property

There is no question this has attracted the attention of policymakers. In mid-April, SBV’s Governor Nguyen Thi Hong called for commercial banks to enhance their risk management operations, vowing to step up measures to tighten credit allocation in risky areas, including real estate.

The rapid growth of credit since the beginning of 2021 was cited as the main reason. Available data suggests that credit growth in the real estate sector accelerated to 15 per cent year on year in January and February, exceeding the SBV’s target of 12 per cent.

By mid-April, total credit growth reached more than 15 per cent year on year.

This is not the first time that the central bank has tightened its control over the property market to mitigate risks. The SBV has historically preferred to use macro-prudential policies to curb credit lending to the sector, targeting real estate developers rather than mortgage borrowers, as Vietnam still has a low mortgage penetration rate in ASEAN.

The SBV is facing a delicate balance of curtailing excessive credit lending to real estate developers while reducing imminent Covid-19 risks to the sector. After all, the sector is also an increasing source of growth.

In last August, the SBV delayed a roadmap to tighten capital requirements for one more year. Under the revised regulation, the SBV will lower the maximum ratio gradually from 40 per cent to 37 per cent in October 2021, then to 34 per cent in October 2022 before lowering it further to 30 per cent in October 2023.

If the property market shows more signs of overheating, there is scope for the SBV to do more, such as introducing more restrictive macro-prudential measures or further tighten its quantitative quota.

There is also a risk that the most recent wave of Covid-19 may complicate the process, given the adverse impact on Vietnam’s growth.

Over the years, the SBV seems to have used monetary policy as a tool to support growth whereas it uses macro-prudential policies to manage property market risks.

Still, HSBC expects rising housing prices to constrain the SBV’s ability to deliver any further rate cuts. Fiscal policy should be tasked with the burden of providing immediate targeted support amid the latest outbreak of Covid-19.

In short, it is encouraging to see that the authorities are concerned that the housing market may run away from economic fundamentals and are thus keeping an eye on the country’s real estate market.

If needed, tighter macro-prudential policies could be used to further contain risks. HSBC stressed, this requires a delicate balance, given increasing downside risks to growth.

Secret from balance sheets of ‘Big 4’ banks

Hai Phong industrial property powers up with new project from Indochina Kajima

The project Core5 Hai Phong from Indochina Kajima and Itochu Corporation will deliver approximately 80,000 square metres of world-class ready-built factory for lease, handover expected in the first quarter of 2027.

A decade of unprecedented apartment price surge

A decade of relentless apartment price growth has pushed the dream of homeownership further out of reach for Vietnam’s middle- and lower-income earners.

Essensia Parkway sells out within hours, marking an outstanding partnership with WorldHotels

Essensia Parkway makes significant impact in the high-end real estate market as 100 per cent of the limited collection was successfully registered within just a few hours at the launching event with the theme “Live lux-well, in a truly refined world”.

Essensia Parkway gains global prestige through WorldHotels - Phu Long collaboration

Essensia Parkway is set to mark a significant milestone as the first branded residences project in Ho Chi Minh City to be operated by WorldHotels – one of the finest portfolios of independent hotels and resorts within BWH Hotels.

Indochina Kajima breaks ground on Grade A office building in Hanoi’s emerging hub

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.