National Focus

Secret from balance sheets of ‘Big 4’ banks

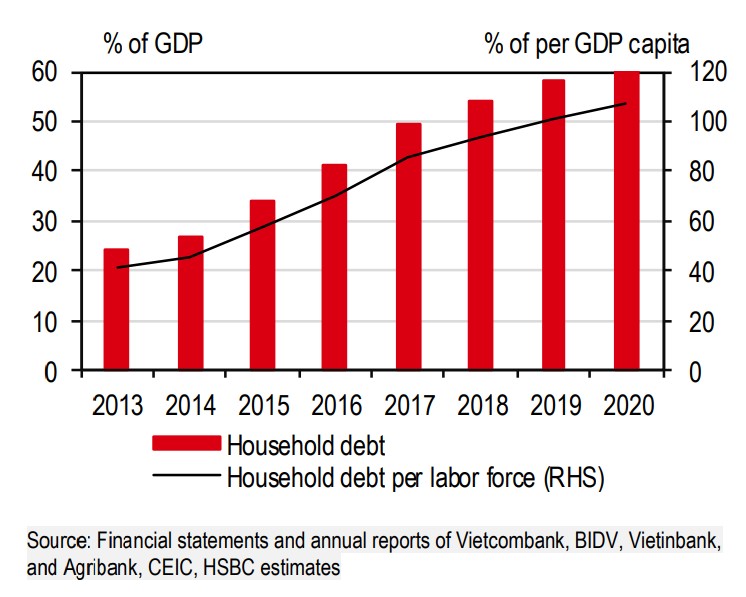

In per-labour-force terms, consumer debt even jumped from 41 per cent of income in 2013 to more than 100 per cent in 2020, according to HSBC.

It’s widely acknowledged that Vietnam has weathered the Covid-19 pandemic relatively well. Thanks to its sharply improved external metrics, it is also in a much stronger position to guard against shocks compare to previous crises. That said, lingering banking issues remain a source of vulnerability.

Dissecting the key data from balance sheets of the “Big 4” SOE banks (Vietcombank, BIDV, Vietinbank and Agribank) which account for half of total loans, HSBC raises concern about the sharp rise in riskier consumer lending, along with elevated household debt.

Loans to households rose substantially from 28 per cent of total “Big 4” loans in 2013 to 46 per cent in 2020, which translated into rapid growth in household debt from 25 per cent of GDP to 61 per cent in the same period.

In per-labour-force terms, consumer debt even jumped from 41 per cent of income in 2013 to more than 100 per cent in 2020, as HSBC said in its “Vietnam At A Glance – What do banks' balance sheets tell us?” report.

It noted that the estimate for household debt is broad, as it includes personal loans used for business purposes. Based on the latest IMF Article IV Consultation, over 50 per cent of household debt was for individual businesses and 25 per cent for mortgages in 2019.

Assuming the same case for 2020, consumer lending would account for roughly 50 per cent of income per labour force, still a high ratio for an emerging market like Vietnam.

Elevated consumer leverage could drag down future consumer spending, especially as labour market conditions have been severely impacted by the pandemic.

Although Vietnam’s economy is in a more robust shape than regional peers, its labour market weakness remains a concern for the recovery of domestic demand.

On the surface, unemployment metrics look decent, with the unemployment rate falling to 2.4 per cent in the first quarter of this year from its peak of 2.7 per cent in the second quarter of 2020.

However, employment was still 950.000 below the pre-pandemic level, while wages fell for the first time in recent years. Moreover, a large chunk of Vietnam’s labour market is still concentrated in the informal sector, which may not be captured in formal employment statistics.

Thus, even Vietnam’s fiscal support is constrained by its elevated public debt-to-GDP, some targeted fiscal stimulus for vulnerable households and workers is still needed, HSBC recommends.

And even more urgently, the spending of support disbursements, such as cash transfers and tax deferrals for household businesses, needs to be accelerated, which would in turn support a rapid recovery in private consumption.

Other potential risks

Turning to debt composition, in terms of loan maturity, short-term debt dominates with almost a 60 per cent share in the “Big 4” SOE banks in 2020, suggesting 2021 is a crucial year for timely debt collection. It is estimated that if including other impaired loans, such as those sold to Vietnam Asset Management Company (VAMC), overall non-performing loans will rise from below 5 per cent in 2019 to 7 per cent in 2020.

Although each bank has a different breakdown of loans by industry, manufacturing and wholesale/retail stand out, boding well for Vietnam’s bright prospects in industrial production.

However, credit to riskier sectors like real estate has accelerated since the end of last year, prompting the State Bank of Vietnam to flag potential risks.

HSBC stated that Vietnam needs to resume its reforms in the banking sector, which have been partly disrupted by the pandemic.

Looking through the lens of the most important indicator capital-adequacy ratios (CARs), Vietnam lags behind regional peers as it is the only ASEAN country that has not fully met the Basel II minimum standard of 8 per cent. In particular, CARs remain low at some SOE banks.

Thus, Vietnam needs to progress its recapitalization plans and accelerate its adoption of Basel II requirements, which has been delayed from 2020 to early 2023.

While its robust economic growth may prevent a sharp deterioration in the health of the banking sector, HSBC believe it is time for the sector to restore reforms and build strong capital buffers against potential risks.

Vietnam needs a stronger sales pitch to realise supply chain potential, says HSBC

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.