Business

Foreign investors finance to help HDBank expand lending to smaller businesses

As Vietnam accelerates economic recovery amid Covid-19, IFC, LeapFrog Investments, and DEG have invested $165 million in convertible Tier 2 bonds issued by HDBank, a leading Vietnamese private retail and SME bank.

While strengthening the bank’s capital base, the funding will help increase lending to retail and small and medium enterprises (SMEs), including women-owned or-led ones.

While Vietnam’s SMEs account for about 98 per cent of all businesses, generate 40 per cent of gross domestic product and 50 per cent of employment, they have limited access to finance, hindering their growth.

Further, given the economic challenges of a global pandemic over the past two years, smaller businesses in Vietnam need more working capital urgently to sustain operations and recover from Covid-19.

In this context, HDBank aims to expand its retail and SME portfolio, reaching more rural populations and informal household businesses as well as women entrepreneurs.

In response, IFC and its Asset Management Company (AMC), LeapFrog Investments, and DEG - the German Development Finance Institution have subscribed $95 million, $60 million, and $10 million respectively to the US dollar-denominated five-year-plus-one-day convertible Tier 2 bonds.

The investors will have the option to convert the bonds into common shares of HDBank over the mutually agreed time period.

“The funds give us greater ability to offer thousands of additional loans to retail, rural, and smaller businesses, including women entrepreneurs, who need finance to sustain through the Covid-19 crisis and beyond,” said Pham Quoc Thanh, HDBank's CEO.

The investments will help HDBank improve its capital position after having met the Basel II capital safety and risk management standards required by the State Bank of Vietnam, and at the same time realize its own growth strategy to become a leading SME and rural bank in the local market.

Over the last few years, the bank has been focusing on expanding lending to SMEs, especially those in rural areas which accounts for about half of the its portfolio.

With one of the largest rural networks among Vietnamese banks, it aims to significantly grow the number of its rural customers, mainly small-scale agri-based and informal businesses.

The bond raise will also help HDBank enhance its environmental and social risk management capacity by introducing IFC Performance Standards, while improving the bank’s corporate governance policies in line with international best practices, including a commitment to not fund coal-related projects.

“Our investment not only enables HDBank to strengthen its capital base to seize growth opportunities and further expand its core business of lending to SMEs, but also sends a positive signal to boost international investor confidence in the resilience of Vietnam’s financial sector and the country’s continued growth prospects, despite the impacts of an ongoing global pandemic,” said Kyle Kelhofer, IFC country manager for Vietnam, Cambodia, and Lao.

IFC provides $70 million-package for HDBank to boost climate finance

Cen Land transforms into real estate developer with bold goals

Cen Land is shifting from brokerage to development, targeting a 170% revenue increase and 424% profit growth in 2025.

Menas signs to elevate lifestyle experiences at Keppel’s properties in Vietnam

Menas Group has entered a strategic partnership with Keppel to co-develop an integrated ecosystem of lifestyle services across Keppel’s real estate projects in Vietnam, beginning with the landmark Celesta City development in Saigon South.

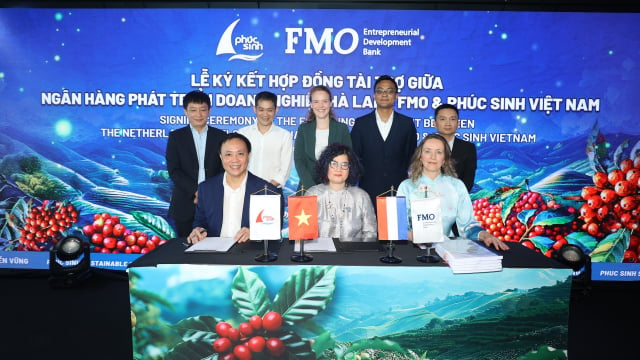

Phuc Sinh secures $15 million investment from Dutch investor for sustainable expansion

Phuc Sinh’s expansion underscores Vietnam’s growing role in sustainable agriculture and its increasing appeal to global investors

PVI Asset Management and SonKim Capital partner to revolutionize real estate investments

PVI Asset Management (PVI AM) and SonKim Capital (SK Capital), a business unit of SonKim Group has announced a strategic collaboration to develop innovative real estate investment products tailored for institutional investors and high-net-worth individuals.

Filum AI secures $1 million amidst funding winter

Filum AI has successfully raised $1 million in funding despite a challenging venture capital market, underscoring the potential of AI and shifting investment strategies.

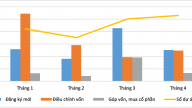

New decree eliminates barriers and enhances access to financing for enterprises

Enterprises are advised to promptly assess and evaluate the impact of the changes in the newly-issued to ensure timely compliance in the upcoming tax finalization period.