Cen Land transforms into real estate developer with bold goals

Cen Land is shifting from brokerage to development, targeting a 170% revenue increase and 424% profit growth in 2025.

Oil prices have approached $70 a barrel and Vietjet Air will have to adjust its profit plan in case they exceed this threshold.

On the New York Stock Exchange, WTI oil prices rose to $68.05 a barrel on April 25. On the London bourse, Brent crude also rose to $74 a barrel, the highest price since 2014.

According to ANZ bank, the peak of crude oil prices over the past three years has resulted from concerns over geopolitical tensions in the Middle East, which supply nearly half of the world's oil output.

Peak oil prices have a strong impact on transport companies, especially airlines. The aviation industry is characterized by a very high ratio of fuel costs to operating costs, approximately 50 per cent. Oil prices only inch up a few per cent, airlines are likely to lose profits.

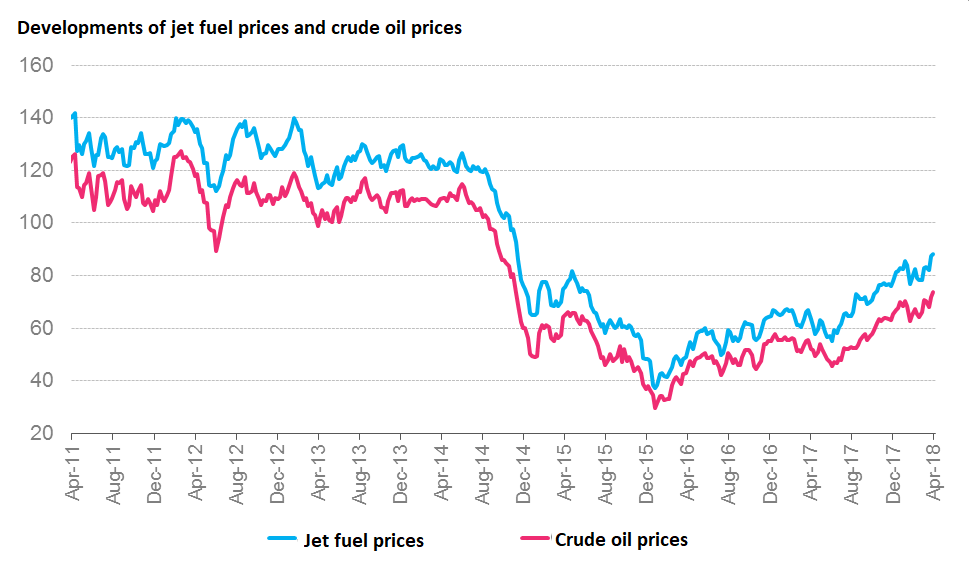

Currently, Vietnamese airlines use Jet-A1 fuel for their flights. Statistics from the International Air Transport Association (IATA) show the close relationship between fuel prices and airline profits.

In 2008, when oil prices peaked at nearly $150 a barrel, gasoline prices also increased sharply. Gasoline prices rose by 8 per cent, immediately causing losses to the airlines. As the price of gasoline stabilized in the later period has helped steady airlines’ profits. Since 2015, oil prices have fallen sharply, increasing airlines’ profits.

In 2018, as oil prices have risen continuously and reached a peak of three years, airlines will certainly have to set up new profit scenarios that are better suited to market conditions.

Bao Viet Securities said that the cost of Jet-A1 fuel is difficult to control and forecast. Fuel prices have a tendency to rise again since 2016 subject to oil price fluctuations. Low-cost carriers like Vietjet Air will be affected by higher fuel prices than normal airlines due to the high ratio of fuel cost to operating costs. At present, Vietjet Air has a 41-46 per cent ratio while Vietnam Airlines has a 25-30 per cent ratio.

In the general meeting of shareholders, Vietjet Air's representative said to date, the airline’s business plans are based on crude oil prices at $70 a barrel, adding that besides the provision of fuel, the airline has taken other measures such as investing in fuel-saving vehicles, exploiting other fuel-saving management programs. .. to minimize costs.

In 2017, the airline reported profits of near to $90 million (about VND2 trillion) from passenger transport. In 2018, Vietjet targets profits up to $120 million (equivalent to VND2.7 trillion), up 35 per cent.

However, the current oil prices have approached $70 a barrel. In case oil prices exceed this threshold, Vietjet Air will have to adjust its profit plan.

This will certainly be a bad news for this airline. In 2018, Vietjet Air has set a very low-profit growth plan compared to previous years. The airline’s pre-tax profit is set to rise by only 9.5 per cent, far lower than the 96 per cent last year.

In the event that profit from the airfreight segment also drops due to the price of oil, the profits of Vietjet Air in this year will continue being thinned.

Cen Land is shifting from brokerage to development, targeting a 170% revenue increase and 424% profit growth in 2025.

Menas Group has entered a strategic partnership with Keppel to co-develop an integrated ecosystem of lifestyle services across Keppel’s real estate projects in Vietnam, beginning with the landmark Celesta City development in Saigon South.

Phuc Sinh’s expansion underscores Vietnam’s growing role in sustainable agriculture and its increasing appeal to global investors

PVI Asset Management (PVI AM) and SonKim Capital (SK Capital), a business unit of SonKim Group has announced a strategic collaboration to develop innovative real estate investment products tailored for institutional investors and high-net-worth individuals.

Filum AI has successfully raised $1 million in funding despite a challenging venture capital market, underscoring the potential of AI and shifting investment strategies.

Enterprises are advised to promptly assess and evaluate the impact of the changes in the newly-issued to ensure timely compliance in the upcoming tax finalization period.