Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

While the hypermarket segment is dominated by foreign players, key players in supermarket segment are locals.

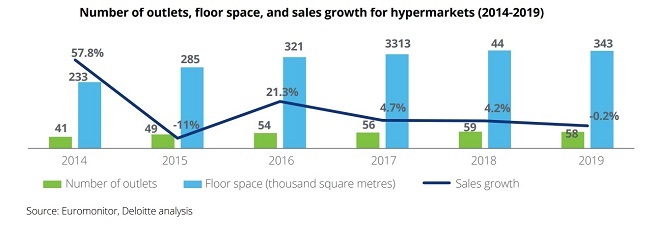

Before the onset of Covid-19, the hypermarkets segment in Vietnam appeared to have somewhat stabilised in terms of expansion – as evident from the number of outlets and floor space – and sales, which declined slightly by about 0.2 per cent in 2019, Deloitte’s “Retail in Vietnam: An accelerated shift towards omnichannel retailing” report revealed.

One reason for this could be the fact that as hypermarkets are not typically located near residential areas, given the large floor space that they require and higher rental costs in these areas, urban consumers typically prefer supermarkets and convenience stores for their convenient locations.

Visits to hypermarkets are typically made when larger volumes need to be purchased, such as during holiday seasons.

Key players in this segment include Big C, Lotte Mart, AEON, Saigon Co.op, and E-Mart, most of which are foreign brands. Thailand’s Big C dominating the market with a 57.6 per cent market share.

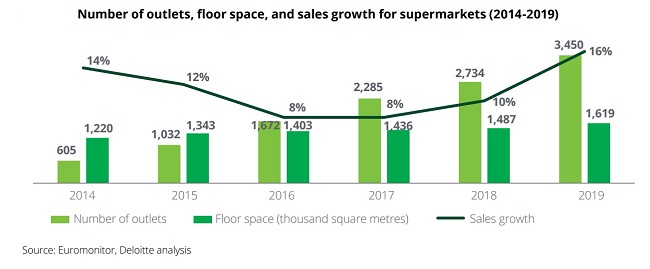

On the other hand, the supermarket segment is dominated by local players, such as Saigon Co.op and Bach Hoa Xanh, which are leading the pack with market shares of 43 per cent and 14 per cent respectively.

The segment’s consistent growth over the last four years can be attributed in large part to a deep understanding of their local markets, as well as increasing popularity of private label products.

In the context of Covid-19, the growth of large modern trade formats – including hypermarkets and supermarkets – have been outpacing that of traditional trade formats.

This is due to the wide variety of products, brands, and pack sizes that they offer – which give Vietnamese consumers the confidence that they are able to purchase everything that they need in a single shop, thereby reducing travel and contact.

During this time of uncertainty, Vietnamese consumers visit hypermarkets and supermarkets more often than before, making a purchase every 10 days on average, according to Kantar’s research.

In addition to their brick-and-mortar stores, modern trade retailers also saw their other channels facing a surge in demand. Supermarket operator, Saigon Co.op, for instance, saw its telephone orders surge upwards by four to five times, and visits to its e-commerce platform increase tenfold since January 2020. This suggests an overall shift towards greater omnichannel shopping, a behaviour which can be expected to persist even after the pandemic subsides.

According to Nguyen Anh Dzung, executive director of retail measurement services, Nielsen Vietnam, there’s going to be a really big impact on certain industries as the result of this crisis and that may linger. However, in consumer-packaged goods, while we know that consumers may hold things like air travel or trips to the theatre, they will continue to have needs for things like toilet paper, soft drinks.

Consumer Packaged Goods represents some normal seen human behavior, so while there are differences in how they buy, what sizes they buy, where they buy from, where they store it, consumers’ underlying needs and how they use these products and generally not going to meaningfully change.

In Vietnam, the consumer confidence index remains high, ranking in the top 4 of most optimistic countries in the world. Compared to the last quarter of 2019, Vietnam consumer confidence remains stable with one-point increase, from 125 to 126. Therefore, this is also a factor that expects a rapid recovery of consumer purchasing power, he stated.

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.