Unicap reveals 'ambitious' plan to mobilize US$66 million to inject in real estate

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

VinaLand Limited (VNL) managed by VinaCapital Investment Management Ltd company (VinaCapital) has gained US$112 million since the beginning of 2017, after divesting of many real estate projects in Vietnam.

VNL has announced to sell its stake in the three-hectare Vina Square project located in Ho Chi Minh City to Tri Duc Real Estate Company for US$41.2 million, which is equal to the net asset value of June 30. After repaying shareholder loans, VNL received US$41 million. The project has been developed by Vina Alliances Co Ltd which was established in 2008 and has a charter capital of $55 million, with 62 per cent of the equity owned by VinaCapital.

“This is in accordance with the divestment policy of projects in a controlled manner,” said Managing director of VinaLand David Blackhall.

Since the beginning of this year, VinaCapital has divested of a series of real estate projects, including Hanoi-located Times Square project and the Dai Phuoc Ecological Tourism Urban Area with US$112 million profit.

Currently, there are VNL’s investments in Pavilion Square, Trinity Garden and Green Park in Ho Chi Minh City, Aqua City and Phu Hoi City in Dong Nai; and Capital Square in Đa Năng. The fund’s total assets were about US$244 million.

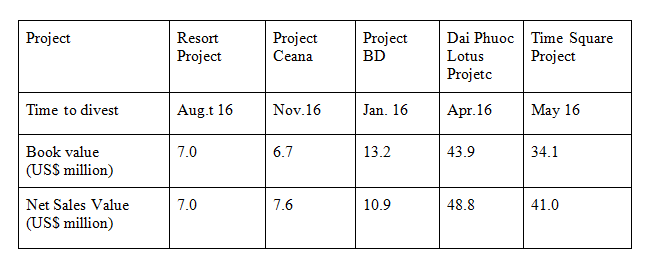

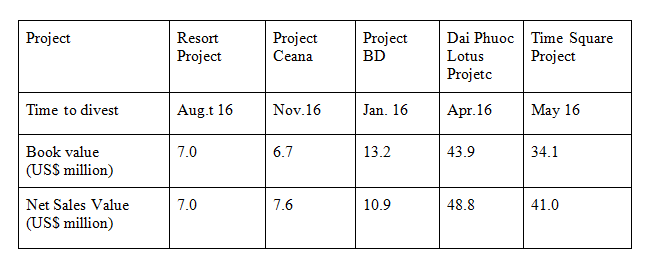

VNL’s divested projects since 2016 (Source: VinaCapital)

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Techcombank has announced that two separate legal entities managed by Warburg Pincus will invest over US$370 million into the Bank, subject to appropriate regulatory approvals.

In only the first two months of this year, the banking, financial services and insurance sector (BFSI) of Vietnam received up to US$1.45 billion worth of investment.

It is feared that the escalating trend of trade protectionism will hinder global growth and make many businesses struggle for survival.

According to the World Bank, remittances to Vietnam in 2017 are estimated at a record high of US$13.81 billion, increasing by US$1.9 billion, equivalent to 16% over 2016.

Within less than five months leading the Southeast Asia Joint Stock Commercial Bank (SeABank), Nguyen Canh Vinh has resigned from this position since February 8, 2018, for personal reason.