Unicap reveals 'ambitious' plan to mobilize US$66 million to inject in real estate

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

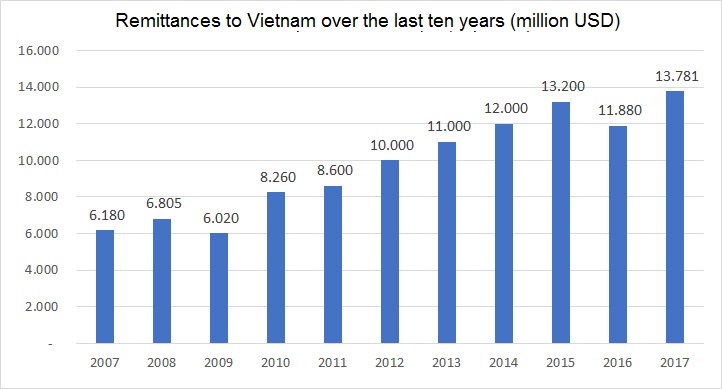

According to the World Bank, remittances to Vietnam in 2017 are estimated at a record high of US$13.81 billion, increasing by US$1.9 billion, equivalent to 16% over 2016.

After six years of a stable increase, in 2016, the figure on remittances to Vietnam suddenly dropped by US$1.3 billion (10%) over the previous year, reaching US$11.88 billion.

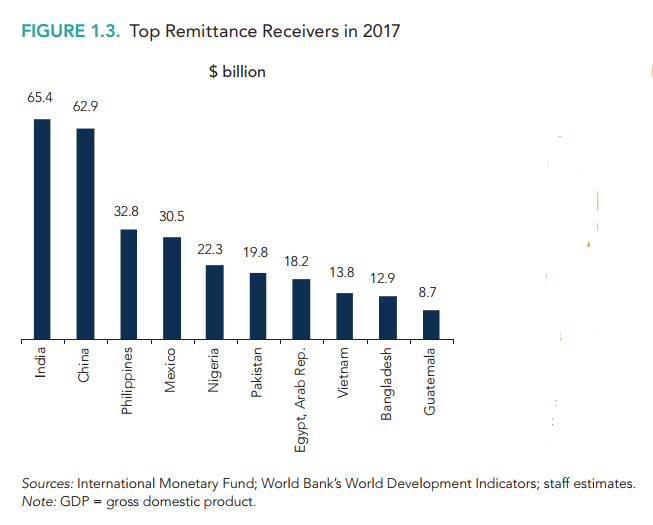

In 2017, Vietnam replaced the position of Bangladesh in the Top 10 countries and territories having the most substantial remittances in the world.

Ranking second to none is India with US$65.38 billion, which has secured this position in nine straight years. It is followed by China with US$62.85 billion. These two countries with the largest population in the world far outnumber the rest.

Only two developed countries, France and Germany, are in the Top 10, while the rest are developing countries, half of which are Asian countries.

With such developing countries as the Philippines and Vietnam, remittances are an important source of income, contributing significantly to expenditure and investment in their home country. In Vietnam, with the 0% interest rate policy for the US dollar, the State Bank has greatly helped convert remittances into foreign exchange reserves. This has become a powerful tool to regulate exchange rates and ensure the financial security.

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Techcombank has announced that two separate legal entities managed by Warburg Pincus will invest over US$370 million into the Bank, subject to appropriate regulatory approvals.

In only the first two months of this year, the banking, financial services and insurance sector (BFSI) of Vietnam received up to US$1.45 billion worth of investment.

It is feared that the escalating trend of trade protectionism will hinder global growth and make many businesses struggle for survival.

Within less than five months leading the Southeast Asia Joint Stock Commercial Bank (SeABank), Nguyen Canh Vinh has resigned from this position since February 8, 2018, for personal reason.

Techcombank announced that its pretax profit in 2017 reached over VND8.03 trillion (US$354.4 million), doubling that in 2016 and naming Techcombank in Vietnam’s top five profitable banks.