National Focus

Vietnam's inflation forecasted to rise as food and oil prices add to upside pressure

Inflation in Vietnam has been on a gradual uptrend, reaching 3.9 per cent this May and expected to be 3.6 per cent in 2018, according to ANZ bank.

A recent report of Australia and New Zealand Banking Group Limited (ANZ) points out that in the past, Vietnam's economic growth tended to be lowest at the start of the year and followed by an acceleration in activity through the year.

However, with the Gross Domestic Product (GDP) growth rate of 7.4 per cent in the first quarter of this year, the bank says that growth may have peaked and there will be some pull-back in growth momentum towards a more sustainable rate of 6.8 per cent for 2018, followed by 7.0 per cent next year.

In terms of production, the agricultural sector expanded by 4.1 per cent in the first quarter of this year, the fastest rate since 2012. The industry also bucked the historical trend by accelerating to 10.1 per cent in the first three months of 2018.

More recently, growth in industrial production has already eased. The introduction of a new product in 2017 pushed up growth in consumer electronics. However, now that production has normalised, favorable base effects have started to fade. In the absence of additional production capacity this year, ANZ expects real industry growth to moderate.

Meanwhile, the growth in merchandise exports has eased, reflecting the trend in manufacturing production. Nevertheless, with an average rise of 15.8 per cent in the first five months of this year, Vietnam’s exports remain robust. On the other hand, import growth is lagging the expansion in exports, leading to a $3.4 billion trade surplus.

According to ANZ's report, the widening of the overall trade surplus has aided the central bank in rebuilding its foreign exchange reserves. As of this May, the government reported that the foreign exchange reserves have reached $64 billion.

While export production is still supportive of growth, the net contribution of domestically-owned production has been limited. Indeed, the improvement in the trade balance is mostly attributable to the FDI-related sector.

Newly registered FDI continues to come in, although at $4.7 billion as of this May, it is lower than the $5.6 billion print over the same period last year.

After the US withdrew from the TPP agreement, the remaining members of the trade pact are now pursuing the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). With Vietnam expected to uphold its commitment to pursue significant economic reforms, ANZ assesses that the prospects for more FDI are positive.

The bank also shows that inflation has been on a gradual uptrend, reaching 3.9 per cent this May and the figure for this year is likely to rise as food and oil prices add to upside pressure.

Food prices turned a corner at the start of the year, transport costs have also risen. Meanwhile, health-related prices have only been adjusted 3.9 per cent in the first five months of this year, compared to an increase of 16.8 per cent over the same period last year.

ANZ says that if the adjustments are delayed further, there will be heightened risks of higher price increases down the road. In the past, when health prices were capped over a prolonged period, the subsequent changes tended to be dramatic.

As such, the bank expects inflation to rise to 3.6 per cent in 2018, still below the maximum threshold of four per cent set by the government early this year. The inflation is also expected to remain on an upward path, averaging 4.2 per cent in 2019.

The bank assesses that fundamentals remain modestly supportive to the VND. However, the advance of the USD in recent months has seen VND losing ground against the greenback; having declined 0.3 per cent against the USD since early this year.

Also, the VND would have to face some risks going forward. Trade issues between the US and Asia (notably South Korea and, to a smaller extent, China) could impact Vietnam. Also, higher global oil prices could push up inflation in Vietnam. In addition, it appears that the State Bank of Vietnam is guiding USD/VND higher, especially since April 2018.

ANZ forecasts that USD/VND will end 2018 at 22,780, a 0.4 per cent depreciation in VND for the year.

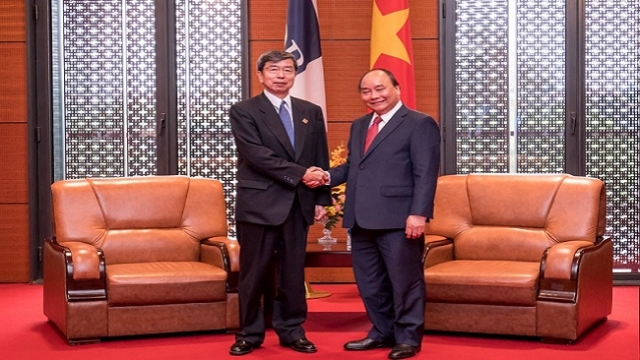

ADB projects Vietnam’s economic growth to exceed 7 per cent in 2018 and inflation at around 3.5 per cent

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.