Leader Talk

Vietnam tops world in crypto adoption as investor confidence falls

Despite the impacts of the Terra Luna collapse and billions of crypto stolen by hackers this year, the growth of responsible innovation in the crypto industry is unlikely to be stopped, said Joshua Foo, Regional Director of Chainalysis ASEAN and Central Asia.

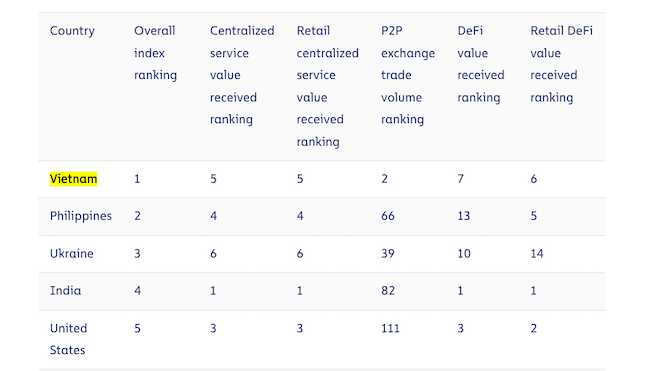

For the second consecutive year, Vietnam is the top-ranked market in Chainalysis Global Crypto Adoption Index. When the study was done for the first time in 2019, the country was ranked 10th.

"Our data found that emerging markets have dominated the adoption index because of the unique, tangible benefits users get from cryptocurrency, especially those living in unstable economic conditions," said Joshua Foo, regional director of Chainalysis ASEAN and Central Asia to TheLEADER.

Why is Vietnam leading in the global cryptocurrency adoption index?

Joshua Foo: Taking a deep dive into our sub-rankings, Vietnam displayed extremely high purchasing power and population-adjusted adoption across centralized, DeFi, and Peer-to-peer (P2P) cryptocurrency tools.

Other sources have also noted Vietnam’s love of cryptocurrency. A poll from 2020 in Statista Global Consumer Survey found that 21 per cent of Vietnamese consumers reported using or owning cryptocurrency, second only to Nigeria at 32 per cent, and the adoption rate has likely only grown since then.

Cryptocurrency-based gaming, including games following the play-to-earn (P2E) and move-to-earn (M2E) models, is gaining tremendous traction in Vietnam and is one of the key growth drivers that have led to the country’s top spot this year’s index. We found that 23 per cent of Vietnamese citizens have played a P2E game. This popularity is not just for users, but for builders too. The top-grossing P2E game Axie Infinity is based in Ho Chi Minh City, with its success inspiring more crypto gaming startups to find success in Vietnam.

Another growth driver is the fact that Vietnam is a massive remittance market, with remittance inflows accounting for 5 per cent of the country-wide gross domestic product. Cryptocurrency has provided a convenient, accessible, and efficient alternative to traditional remittance channels that some individuals may not have direct access to.

What are the opportunities for blockchain and cryptocurrency in Vietnam? How can Web3 and blockchain technologies advance Vietnam's economy?

Joshua Foo: Looking at the key growth drivers behind Vietnam’s soaring cryptocurrency adoption, there are many opportunities for blockchain and cryptocurrency to enhance financial inclusion, create new business avenues and support the advancement of Vietnam’s digital economy. The vibrant blockchain developer community that continues to grow, could also bolster innovation to boost the economy.

Web3 is ultimately a technology that changes traditional paradigms and thinking. Therefore, Web3 will be highly adopted by businesses looking to extend their reach and services beyond the current Web2 constraints, and create a competitive advantage by adopting blockchain technology and rolling out Web3 services to their customers. This phenomenon is not limited to the NFT and DeFi space, but also medical records, property ownership, logistics, and other use cases.

Vietnam’s digital economy revenue reached $53 billion in the first quarter of this year and is expected to see continued growth. Web3 and blockchain technologies can propel this growth further, through the streamlining of existing financial activity, unlocking new cases in finance because of the liquidity in digital assets, and tokenization.

What about challenges?

Joshua Foo: Crypto crime has been an ongoing challenge and will continue to be. As long as crypto assets have value and there are vulnerabilities in the services and platforms that withhold them, bad actors will try to steal them.

That said, the great thing about blockchain is its transparency. Blockchain analysis tools and Know Your Customer (KYC) information can help law enforcement gain transparency into blockchain activity in ways that aren’t possible in traditional finance. Likewise, with transaction monitoring, cryptocurrency exchanges and financial institutions can flag high-risk activity and fulfill their regulatory obligations to report them.

This transparency is critical to weeding out bad actors and building trust in blockchains to pave the way for the more mainstream adoption of cryptocurrencies.

A recent report by Chainalysis reveals that more than $2 billion in digital currency has been stolen in hacks this year, putting the crypto world on edge. Do you think this case, together with other negative collapses such as the LUNA token, could hammer the confidence of cryptocurrency investors?

Joshua Foo: The Terra Luna collapse, and the various bridge hacks that have happened this year, may have posed a threat to consumer confidence in blockchain and cryptocurrency, but this is likely for the short term. With regards to long-term impact, this will serve as a legislative catalyst and prioritization of security.

Despite these impacts, the collapse is unlikely to stop the growth of responsible innovation in the crypto industry. Because of the transparency of blockchains, we can learn from these incidents, educate others, and continue to build trust in cryptocurrency. In fact, we recently announced that with the help of law enforcement and leading organizations in the cryptocurrency industry, more than $30 million worth of cryptocurrency stolen by North Korean-linked hackers has been seized for the first time ever.

Our Crypto Incident Response team played a role in these seizures - we utilized advanced tracing techniques to follow stolen funds to cash out points and liaised with law enforcement and industry players to quickly freeze funds. This success has proven that with the right blockchain analysis tools, world-class investigators and compliance professionals can collaborate to stop even the most sophisticated hackers and launderers. There is still work to be done, but this is a milestone in our efforts to make the cryptocurrency ecosystem safer.

Do you have any advice for cryptocurrency investors?

Joshua Foo: We can’t provide specific financial advice, but we recommend that investors do their due diligence and understand the web3 projects they are investing in.

What are the lessons Vietnam can learn from the success and failure of other markets in the world?

Joshua Foo: Much has happened around the globe in cryptocurrency this year - from sanctions, to bridge hacks, new regulations, and a bear market. Cryptocurrency adoption growth has become more sporadic following the bear market but interestingly, global adoption remains well above the levels that preceded the 2020 bull market.

Our data found that emerging markets have dominated the adoption index because of the unique, tangible benefits users get from cryptocurrency, especially those living in unstable economic conditions.

Thank you very much!

The rise of the use of blockchain and crypto in Southeast Asia

Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Cutting red tape in APA approvals to speed up tax negotiations

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.