Unicap reveals 'ambitious' plan to mobilize US$66 million to inject in real estate

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Vietnam is leading the world regarding market capitalization growth in the period 2016-2017 at the rate of 61 per cent, according to Credit Suisse's Global Wealth Report 2017 just released.

The growth rate of market capitalization of Vietnam in 2016-2017 reached 61 per cent, Credit Suisse stated.

Austria ranked second with growth rate of 51 per cent. The growth rate of 20 per cent is a common place, with only a few countries witnessing negative growth such as Qatar (-10 per cent), Egypt and Ukraine (-25 per cent).

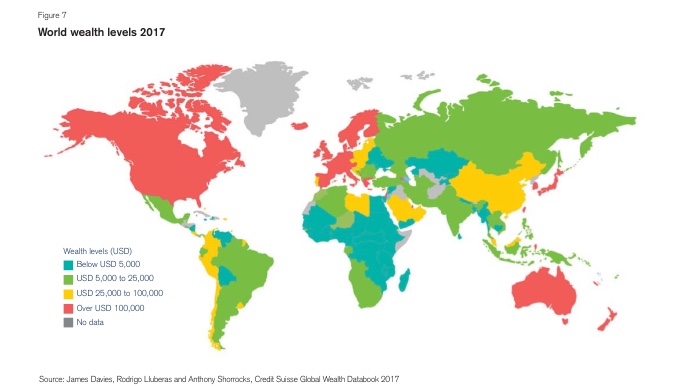

Overall, aggregate global wealth rose by US$16.7 trillion to US$280 trillion, up 6.4 per cent compared to 2016.

Wealth growth also outpaced population growth, hence, global wealth per adult grew by 4.9 per cent. This figure reached US$56,540 per adult, a new record high.

This report indicates that the reasons for wealth rise across the globe include positive changes in asset prices, exchange rates and non-financial assets.

Most notably, the stock market is booming at a rocketing rate. However, it is believed to be a signal that the world is returning to the growth model before the crisis.

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Techcombank has announced that two separate legal entities managed by Warburg Pincus will invest over US$370 million into the Bank, subject to appropriate regulatory approvals.

In only the first two months of this year, the banking, financial services and insurance sector (BFSI) of Vietnam received up to US$1.45 billion worth of investment.

It is feared that the escalating trend of trade protectionism will hinder global growth and make many businesses struggle for survival.

According to the World Bank, remittances to Vietnam in 2017 are estimated at a record high of US$13.81 billion, increasing by US$1.9 billion, equivalent to 16% over 2016.

Within less than five months leading the Southeast Asia Joint Stock Commercial Bank (SeABank), Nguyen Canh Vinh has resigned from this position since February 8, 2018, for personal reason.