Leader Talk

Vietnam may cope with many obstacles when joining EVFTA

Vietnam addressing obstacles related to legal issues and business environment will be the positive signs in the preparation and implementation of the EU-Vietnam Free Trade Agreement (EVFTA).

When EVFTA is approved, it would become one of the most ambitious and comprehensive investment agreements that have been signed between the European Union (EU) and developing countries.

After the agreement are put into effect, Vietnamese enterprises can get access to a potential market with the population of more than 500 million people and the total Gross Domestic Product (GDP) of US$15,000 billion which accounts for 22 per cent of global GDP. By contrast, investors coming from EU can enjoy a market that has the most rapid economic growth in the region with the population of more than 90 million people.

Economic experts said that if EVFTA is signed, it will contribute about 2.5 per cent to Vietnam’s GDP in 2020 and 4.6 per cent in 2025. However, Vietnam must strive in addressing challenges posed in the EVFTA framework, especially the obstacles related to legal issues and business environment.

Vietnam is currently the third largest commercial partner of EU in ASEAN, following Malaysia and Singapore.

Gellert Horvath, Co-chairman of the European Chamber of Commerce in Vietnam (EuroCham) said that EU and Vietnam are striving to promote the preparation of EVFTA, hoping to sign the agreement in the mid of 2018.

What is your opinion about the role of free trade agreement (FTA) to the economic development of Vietnam?

Gellert Horvath: FTAs play a vital role in the development of not only Vietnam but also other countries in the world. Free Trade Agreements have proven to be a key driver of economic reform and the most effective instruments to boost trade and investment. Experience has

shown that each time an FTA is ratified and implemented, it has a rapid and significant impact on the participating countries’ economies, largely because it secures trade/services and long-term investment which are the top priorities for sustained and successful business development.

That is why Vietnam, since the start of the open door policy, has followed a consistent and effective strategy of developing FTAs with its major trade partners, including Japan and South Korea, to consolidate its integration into the global economy. And EVFTA, the new-generation FTA between EU and Vietnam, is the must-mention agreement.

How has EVFTA been prepared?

Gellert Horvath: It is expected that EVFTA would be signed and come into effect in the mid of 2018. EuroCham has been working intensively on the EVFTA from an early stage and has organized seminars, conferences and working meetings in Vietnam over the last few years to promote the agreement and echo the positive feedback of our 1,000 members, in close cooperation with the EU Delegation to Vietnam.

In parallel, EuroCham was invited to make presentations at the European Parliament’s International Trade Commission, a key body that will present the EVFTA to Members of the European Parliament. We also joined the official Vietnamese delegation of Deputy Prime Minister Vuong Dinh Hue in Brussels on 18 September to again promote the EVFTA.

But ratification is not an easy process. It requires a majority vote in the European Parliament, and we have already had a taste of the issues that Members of the European Parliament will raise during the INTA hearing.

What should Vietnam and EU do in the preparation and implementation of EVFTA?

Gellert Horvath: We should make the best of the trade opportunities between Vietnam and the EU. Current products exported to the EU focus on goods produced using traditional, natural and human resources: electronic and telephone assembly products; footwear; textiles; coffee; seafood and wood/timber products.

However, we see great potential in natural commodities such as fruits and vegetables like dragon fruit, rice, green tea, and coffee; pepper; bamboo and rattan products and rubber that could be further promoted and exported.

Vietnam has many local and regional products which are protected under the EVFTA and Geographical Indications, protecting high potential agricultural products originating from particular areas of Vietnam, such as Moc Chau tea; Buon Ma Thuot coffee, Dai Hoang bananas; Cao Phong oranges and Trung Khanh chestnuts need to be further promoted and branded. These also include high-grade products like Nutri nest products, ceramics, precious stones, and metals.

However, we realize that EU exports to and investments in Vietnam have not yet reached their full potential. We would like to see further opening of the market to our members and potential European investors in Vietnam, and we need your support to achieve this.

European businesses operate and invest in sectors throughout the Vietnamese economy, including food, agri-aquaculture; pharmaceuticals and healthcare; energy and green growth; automotive and motorcycles; machinery and appliances; garments and footwear; wines and spirits and other high-tech and smart products. Now, with the new opportunities arising from the EVFTA and the Government’s efforts to improve the business environment and attract investors, the potential for growth has significantly increased.

Could you please clarify the benefits that each field can gain from EVFTA?

Gellert Horvath: Firstly, Vietnam has the opportunity to position itself as a hub for ASEAN pharmaceutical manufacturing and future exports. However, in order to achieve this, improvements are needed in such areas as greater transparency and accountability; inclusion and implementation of Intellectual Property Rights provisions; and better clarification regarding goods purchases and sales activities of Foreign Invested Enterprises (FIEs) in Vietnam.

Besides, Vietnam has the potential to become a global leader in agricultural and food production with the potential for further growth include fruits; cocoa; coffee; cashew nuts; cassava and lychees, which are a recent success story of high-quality exports to the EU. If the target of food safety challenges posed in our White Book is achieved, Vietnam will enjoy benefits including enhanced systems of quality and risk management, better hygiene and safety procedures, as well as improved identification and traceability.

Vietnam also has the potential to export its domestic energy sources, which include biomass, wind, solar and natural offshore gas, with an appropriate roadmap for attracting investment and establishing a foundation for building high-tech industries such as batteries and solar panels.

Transportation and logistics are the key supporting industry for export activities and it is essential for Vietnam to become a regional transportation hub. The EVFTA contains a comprehensive chapter on trade and sustainable development, and this is a unique opportunity for Vietnam to improve some aspects of its economy.

These are just a few short examples of the opportunities available to Vietnam today. Alongside the economic advantages, there are more benefits related to environmental protection, sustainable development and Corporate Social Responsibility (CSR).

What are the challenges that Vietnam must deal with when joining EVFTA?

Gellert Horvath: In order to make the most of FTAs in general and EVFTA in particular, Vietnam must address some challenges related to different issues.

The EU offers a single market import procedure for Vietnamese exports, especially food and healthcare products, entering the European market. Therefore, it should be the same for EU exports to Vietnam, regardless of which Member State products originate from. This system has to be operational from day one of the EVFTA’s implementation. EuroCham and its members are ready to offer their expertise to contribute to this process.

Vietnam must also take immediate measures to address the situation of Illegal, unreported and unregulated (IUU) fishing. Unless progress is shown, Vietnam will suffer damage to its reputation for good quality fish exports and its ability to achieve long-term sustainability goals in this sector, on top of food safety concerns. This will not help in the context of the EVFTA ratification process.

Currently, activities of FIE, especially import activities, are still restricted. In the pharmaceutical field, we acknowledge Vietnam’s reservation of distribution rights for 100 per cent Vietnamese-owned companies, within the limits of the definitions in the WTO and relevant FTAs. However, by expanding the definition of “distribution”, FIEs providing warehousing and transportation services that have been operating in Vietnam for over 20 years may be forced out of business.

Besides, Vietnam should create a viable FIE model and clear legal framework for multinational pharmaceutical companies to establish a legal entity in Vietnam with associated rights that make business sense and maximise economic resources.

There should also be a complete removal of the Local Clinical Trial requirement at all stages for chemical drugs, vaccines and biologics registration in Vietnam.

Regarding the human resource challenges, Vietnam needs to ratify the International Labor Organization (ILO) Conventions and revises its Labour Code accordingly, including No. 87 about Freedom of Association and Protection of the Right to Organise; No. 98 about Right to Organise and Collective Bargaining; No. 105 about Abolition of Forced Labour; and No. 111 concerning discrimination in respect of Employment and Occupation.

Also, the European wine and spirits industry has suffered from successive reforms of the Special Consumption Tax. The increased tax burden on imported wine and spirits will have an impact on the retail price of legitimate products and make them less affordable for Vietnamese consumers. This will intensify the economic incentive for illicit cross-border activities and counterfeit of popular high-value items, and thereby exacerbate revenue loss from tax leakage and increase the risks to public health.

Once these issues are addressed, it will send a strong and positive signal to the European Parliament and to other trade partners with whom Vietnam is now negotiating Free Trade Agreements.

Thank you very much!

Garment exports increased by 40 times as a result of FTAs

Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Cutting red tape in APA approvals to speed up tax negotiations

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

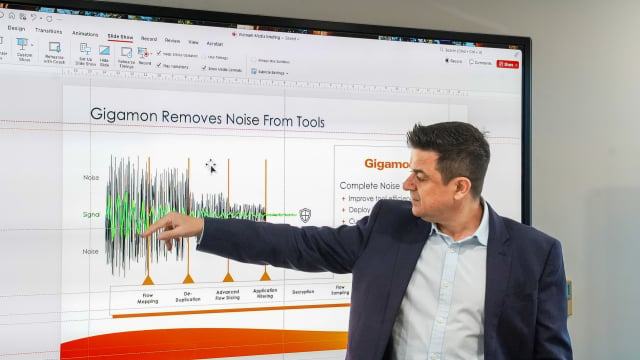

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.