Unicap reveals 'ambitious' plan to mobilize US$66 million to inject in real estate

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

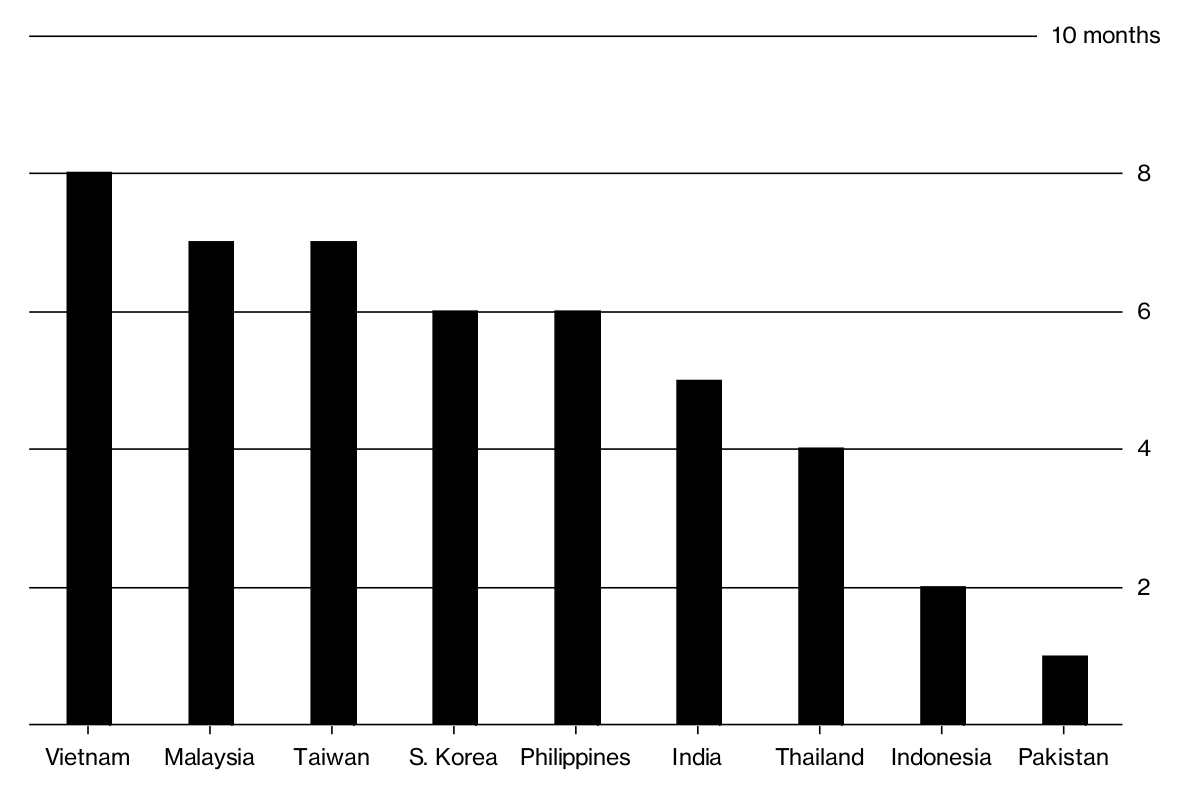

Vietnam is the only Asian stock market to attract stable capital flow in all months this year.

Most of the newly emerging Asian stock markets can attract foreign capital this year, but only Vietnam can do that in all months.

According to the Hochiminh Stock Exchange (HOSE), nearly VND14,000 billion (roughly US$617 million) was poured into shares traded on HOSE after 8 continuous months of purchasing.

Vietnam’s total market capitalization has expanded by 37 per cent in 2017 thanks to the participation of large state-owned enterprises in the stock market.

According to Viet Dragon Securities Corporation (VSD), 1,656 transaction codes were issued to foreign investors, 8% higher than the beginning of the year.

CEO and Fund Manager of Asia Frontier Capital Ltd Thomas Hugger explained that Vietnam’s shares are very attractive to foreign investors due to the reduction of interest rate, the increase in foreign direct investment and credit growth as well as the reasonable prices.

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Techcombank has announced that two separate legal entities managed by Warburg Pincus will invest over US$370 million into the Bank, subject to appropriate regulatory approvals.

In only the first two months of this year, the banking, financial services and insurance sector (BFSI) of Vietnam received up to US$1.45 billion worth of investment.

It is feared that the escalating trend of trade protectionism will hinder global growth and make many businesses struggle for survival.

According to the World Bank, remittances to Vietnam in 2017 are estimated at a record high of US$13.81 billion, increasing by US$1.9 billion, equivalent to 16% over 2016.

Within less than five months leading the Southeast Asia Joint Stock Commercial Bank (SeABank), Nguyen Canh Vinh has resigned from this position since February 8, 2018, for personal reason.