Unicap reveals 'ambitious' plan to mobilize US$66 million to inject in real estate

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

12 individuals have acquired the Unicap Investment and Finance Company and elected FLC Group-related individuals to lead the Company.

According to the valuation report of Unicap Investment and Finance Company (Unicap), the total assets of FLC Group Joint Stock Company (FLC Group) is US$9 billion, dozens of times higher than its current market value. The figure was estimated based on the total value of projects, investment portfolios, and other assets, taking the future profitability of the Group into account.

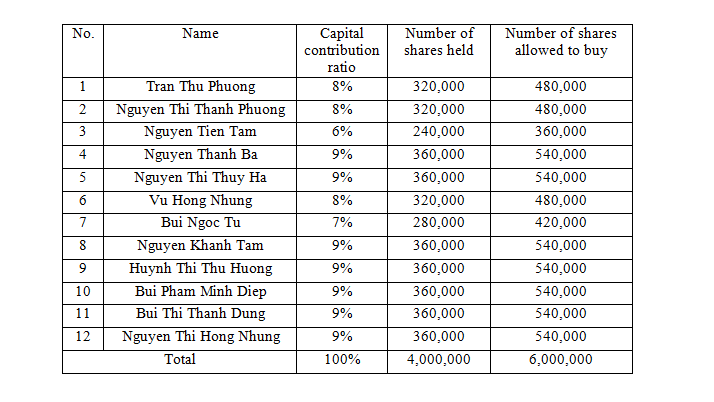

Unicap (formerly the Synergy Capital Group) was established in 2008. Lately, all stakes of this company have been transferred to a new group of shareholders, including 12 individuals. Each of new shareholder holds an under 10 per cent stake.

Unicap has the charter capital of VND40 billion (roughly US$1.76 million); however, it has accumulated losses of VND30 billion (roughly US$1.32 million) due to the inefficient operation in many years. After the acquisition, the new group of shareholders decided to increase the Company’s charter capital to VND100 billion (roughly US$4.41 million).

The new chairman of Unicap’s Board of Directors is Nguyen Tien Duc, also the chairman of the Management Board of AMD Group Investment JSC (AMD), 24 per cent stake of which are held by FLC Faros.

Luu Duc Quang, vice chairman of FLC’s Board of Directors, is appointed to be Unicap’s vice chairman of the Board.

The new group of shareholders also plan to turn Unicap into a public company and list its shares on the Unlisted Public Company Market (UPCoM) or the Stock Exchange.

Unicap’s new shareholders

The United Capital Management Joint Stock Company (Unicap) which manages investment funds will provide financial services to FLC and Faros in the near future.

Techcombank has announced that two separate legal entities managed by Warburg Pincus will invest over US$370 million into the Bank, subject to appropriate regulatory approvals.

In only the first two months of this year, the banking, financial services and insurance sector (BFSI) of Vietnam received up to US$1.45 billion worth of investment.

It is feared that the escalating trend of trade protectionism will hinder global growth and make many businesses struggle for survival.

According to the World Bank, remittances to Vietnam in 2017 are estimated at a record high of US$13.81 billion, increasing by US$1.9 billion, equivalent to 16% over 2016.

Within less than five months leading the Southeast Asia Joint Stock Commercial Bank (SeABank), Nguyen Canh Vinh has resigned from this position since February 8, 2018, for personal reason.