Leader Talk

Thailand's largest retailer pointed out weaknesses of Vietnam’s agriculture

Agricultural production in Vietnam remains very family oriented with limited cultivation area and small scale while the large models of big farm is not popular, according to Tran Thanh Hai, senior executive vice president of Thailand’s retail giant Central Group.

“In Thailand, a chicken farm with 500 chickens is categorized as a household-based investment model, in Vietnam, 90 per cent of the households raises less than 50 chickens”, said Central Group leader.

In the developing countries, the investment in the big cooperative model, agricultural corporations are encouraged, so the cost of investment per product would be low. Products would be more competitive in the market and investors would have more opportunities to focus on quality control, product diversification, expansion or modernization.

He added that in Thailand, the number of large-scale chicken farms (over 500 chickens) accounts for about 14.5 per cent out of the total 42,000 farms, and more than 70 per cent of those farms raise 5,000 chickens or more.

Meanwhile in Vietnam, there are about eight million ‘what-so-called-farm’, but the number of farms which raises from 100 to more than 1,000 chickens only accounts for less than three per cent; the number of farms that raise more than 1,000 chickens accounts only 0.2 per cent of the total number of the farm in the country.

Besides, the application of new technology in agriculture in the world has made a great move, allowing farmers to greatly improve the productivity such as biotechnology, automation, high technology application in agricultural production, harvesting, processing, etc.

However, representative of Central Group said that Vietnamese farmers are still very reluctant to change, afraid of risk and still stay with traditional production practice. Their opportunity is limited due to the small scale of investment.

Another challenge Vietnam is facing is the quality of products. During the first nine months of 2016, there were 542 seafood shipments of 110 export companies from Vietnam that were rejected by 38 importing countries. This is mainly due to the compliance with the food hygiene and safety requirements, residues of antibiotics.

According to Central Group’s leader, there are always strict regulations and standards for import of which many Vietnamese exporters are still indifferent, or they have not thoroughly studied or updated. This can result in customs clearance rejection or even loss of market.

He also said that Vietnamese exporters need to invest in understanding the needs of the targeted markets, consumer insights, to invest in new technology to improve and enhance the product design, product packaging and process, to create more value to the product, to be able in penetrating more deeply to the value chain of the product and to make profits.

Besides, he highlighted that Vietnam should invest more in market connection and logistics.

“Central Group works closely with farmers to build the regular purchasing plan at the reasonable market price for distribution at our Big C stores across the country. This allows our farmers to invest in their production and to ensure the livelihood for their family. They can remain focused on improving production quality and expansion possibility in a sustainable way,” said Hai.

New push for Vietnam’s tourism: Agriculture

Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Cutting red tape in APA approvals to speed up tax negotiations

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

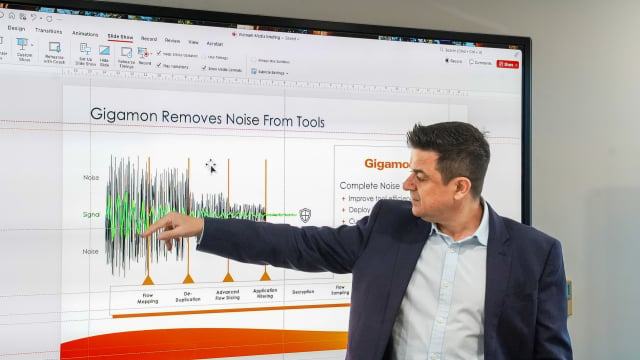

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.