Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Enthusiasm for real estate in special economic zones might seem justified when considering the impressive plans, but investors should listen to skeptical voices as well.

Vietnam is no stranger to real estate speculation, but recent developments may have surprised even veteran observers of the property market. Earlier this month, local authorities decided to freeze property transactions around Van Don(Quang Ninh) and Bac Van Phong (Khanh Hoa) until after the National Assembly meets in June. This move comes after a rapid rise in land prices in those areas. According to recent reporting from TheLEADER, land price in Bac Van Phong had increased by 100 times in the past two years.

Increased interest in Van Don and Bac Van Phong real estate is clearly driven by the creation of Special Economic Zones (SEZs) in those areas. The government’s goal is to use tax-and-tariff incentives, streamlined customs procedures, and less regulation to attract investment in various fields, such as manufacturing, residential property, retailing, tourism and casino resorts.

Enthusiasm for SEZs might seem justified when considering the impressive plans, but investors should listen to skeptical voices as well. As Warren Buffet famously said, “be greedy when others are fearful, and fearful when others are greedy.”

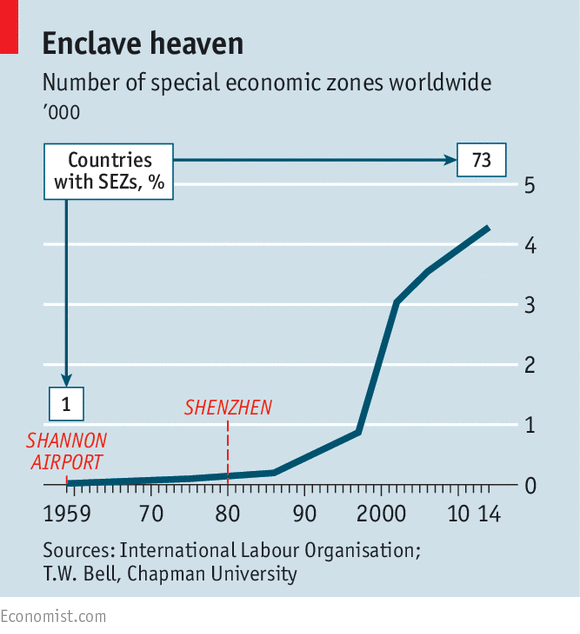

The case for skepticism is simple: most SEZs have not lived up to the initial hype. According to The Economist magazine, SEZs around the world fall into three broad categories; a few incredible success stories, a larger number of moderately successful projects, and a long list of failures. Many of the failures never got off the ground and remain empty plots of fallow land many years after being established. Some others had a more promising start, but they did not achieve lasting success (often due to onerous procedures, mismanagement, and corruption.)

Despite this dubious track record, the allure of SEZs persists because the success stories are so inspiring. Economic planners around the world are amazed by the development of Shenzhen SEZ near Hong Kong, where favorable policies helped transform a sleepy fishing village into a massive and highly developed city within 20 years.

However, it should be noted that Shenzhen SEZ was created in 1980 when China was still in the early stages of opening up. There was a large gap between the investment environment in the SEZ and the broader Chinese economy in those days, and SEZs were a relatively new concept.

Since then, broad-based tariff reduction and structural economic reforms have taken place in China, as well as globally. These reforms have reduced the above-mentioned investment environment advantages of SEZs. Additionally, there are now a huge number of SEZs competing for attention, with more than 4,000 around the world as of 2016, compared to barely more than 100 in 1980. Because SEZs aren’t that “special” anymore, many have failed to attract meaningful investment.

Vietnam’s three new SEZs could be successful, but policymakers should heed the lessons from successful and failed SEZs around the world. One takeaway is that tax incentives can spark investor interest in an SEZ, but they are not enough to ensure a durable project by themselves. Infrastructure is critically important to connect SEZs to global markets. The government may hope to increase the private sector’s participation in building infrastructure, but in all likelihood, significant public funds will be necessary to support this effort.

Second, it is important to find a good balance between political oversight (to guard against money laundering and other abuses) and investor freedom (to avoid excessive red tape). Finally, successful SEZs like Shenzhen had a pragmatic focus. They fostered links with local suppliers and emphasized relatively simple manufacturing industries, such as garments and food processing. SEZ’s geared toward more glamorous sectors like high-tech and financial services have been far less successful.

Perhaps property investors who purchase SEZ land will be rewarded in the future. But history indicates they are making a long shot bet.

*The article reflects the view of the author. Michael Modler is Business Development Manager at Global Integration Business Consultants in Ho Chi Minh City.

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.