Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

As soon as becoming Vinatex’s strategic shareholder in 2014, VID Group used the majority of the shares held in Vinatex as collateral for its debt repayment obligations at Maritime Bank, of which the company is also a shareholder.

VID Group borrows loan from banks to purchase strategic shares

At the end of last March, Vietnam National Textile and Garment Group (Vinatex)’s major shareholder VNTEX Development and Investment Joint Stock Company (VNTEX) announced the sale of 35 million shares in Vinatex. Japan-based Itochu Corporation was believed to be the purchaser.

VNTEX, which is formerly known as Vietnam Investment Development Group (VID Group), bought 70 million shares of Vinatex (stock code: VGT) when Vinatex was equitized in 2014.

Vinatex’s equitization attracted the huge interest of private enterprises, including Vingroup. Vingroup's financial statement in 2015 showed that VND552 billion ($24.2 million) was invested in purchasing 50 million of VGT shares on January 01, 2015.

VGT shares sold to strategic shareholders was priced at around VND11,000 ($0.48) each.

If buying at the same price, VNTEX must have spent about VND770 billion ($33.7 million) on acquiring 70 million of VGT shares, equivalent to a 14 per cent stake in Vinatex.

It is noteworthy that after signing a share purchase agreement with Vinatex on September 26, 2014, VID Group (now VNTEX) used 64.2 million of VGT shares as collateral for the loan at Maritime Bank.

VID Group was also a shareholder holding tens of millions of shares in Maritime Bank (stock code: MSB) in 2015. In 2017 the company used MSB shares as collateral at another bank.

VNTEX gains a big profit after divestment

According to Vinatex’s charter, the strategic shareholders have to hold VGT shares for five years. However, after only 3 years, VNTEX’s desire for divestment has been met. In Vinatex shareholders' meeting in 2017, VNTEX was approved to transfer the entire shares prior to investment term commitment.

Over a year later, VNTEX sold half of shares held in Vinatex. After that, Itochu Corporation announced it had bought 50 million of VGT shares at a price of VND810 billion ($35.5 million).

This transaction helps Itochu hold a 13 per cent stake in Vinatex and become the second largest shareholder followed by Vingroup with a 10 per cent stake and VNTEX with a 7 per cent stake. Ministry of Industry and Trade is the biggest shareholder holding a 53.49 per cent stake.

Based on the value of transaction made by Itochu, it can be seen that the Japanese corporation paid VND16,200 ($0.71) per VGT share, 47 per cent higher than that Vinatex sold to strategic investors in 2014.

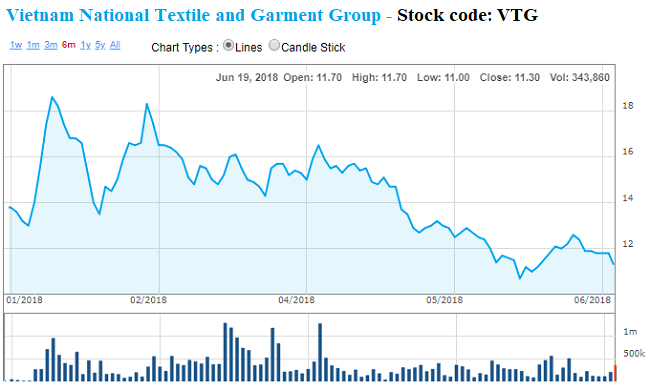

Divestment prior to investment term has brought a big profit to VNTEX after four years of investment. After VNTEX’s divestment, VGT shares dropped continuously from March to the end of May and are trading at VND11,300 each ($0.49).

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.