Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

Customers are generally satisfied with their consumer finance (CF) experience, with over 80 per cent of respondents would apply for CF products again and would recommend to friends and family, according to a survey by FinnGroup.

FiinGroup’s survey on customer satisfaction with CF products in 2019 has found out that over 80 per cent of respondents who had used CF products before would not hesitate to reapply for CF products should they need it. They would also likely recommend these products to friends and family.

As ‘simple procedure’ being one of the top factors of satisfaction, ‘fees and fines’ is the top for dissatisfaction. It is worthwhile to note that 40 per cent of respondents rated their experience with the borrowing procedure at finance companies (fincos) as “very satisfied”.

The findings were based on the financial data company’s CF Consumer Survey 2019 with a total sample of 1,000 respondents in three major cities in Vietnam: Hanoi, Ho Chi Minh City, and Danang.

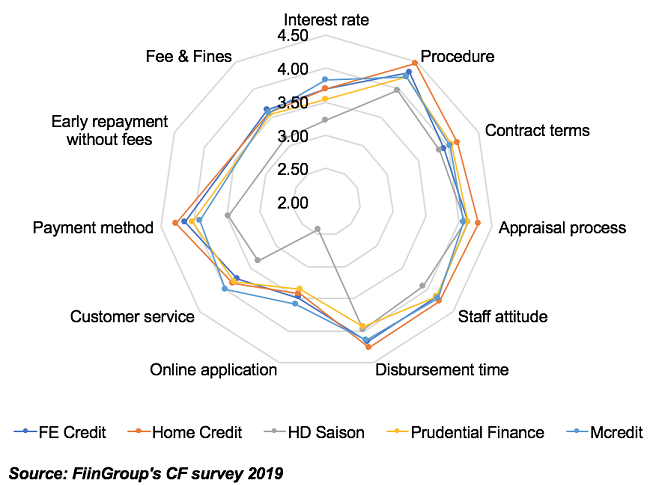

Apart from giving feedback on the penetration and awareness of CF services, the respondents were also asked about their experience with fincos in Vietnam, including HD Saison, Home Credit, FE Credit, ACS Vietnam, Mirae Asset, Prudential Finance, JACCS, SHB Finance, MobiVi, Mcredit, Dr Dong and some others.

Awareness about CF products and services has increased significantly after two years, with Ho Chi Minh City consistently outperforming Hanoi and Danang in the perception of CF and participation of new fincos in the city. Fincos are now regarded as an alternative for customers’ funding needs, especially for cash loans, rather than banks or other lending entities. This is seen as an improvement in terms of awareness since 2017.

Among peers, FE Credit and Home Credit are the most well-known fincos. Although HD Saison has the largest network of POS, the company only ranked third in people’s awareness, a drop from 2017’s rankings. The presence of fincos with their parent bank (Mcredit, HD Saison, SHB Finance and other) has in reality increased fincos’ reputation among the consumers.

Meanwhile, although interest rates and simple procedures remain the top concerns in deciding to borrow from fincos, short appraisal time has risen to the top three. Potential customers are attracted to fincos with simple documentation and quick loan appraisal process.

When asked about positive impressions about CF, respondents most likely talked about quick disbursement, simple procedures, and friendly staffs, as opposed to negative comments including high fees and interest rates, frequent debt reminders and unprofessional debt collectors. For those customers who do not want to borrow from CF, while high interest rates and fees are main deterrents, bad impression about fincos plays a role in 25 per cent of respondents.

With a more competitive CF market, more people now want to change to new fincos (21 per cent of customers would like to change to a new finco, up from 17 per cent in 2017).

Home Credit maintains the top position in customer satisfaction. Mcredit, a new entrant, also maintains high customer satisfaction score.

Meanwhile, HD Saison does not do so well in terms of procedures, no. of payment methods, customer services, online channels and others.

Advertisement at retailers outperformed friends and relatives’ word-of-mouth, becoming the most popular channels used to learn about CF products.

Traditionally preferred channel like direct sales agents (DSA) is gradually being replaced. Only 27 per cent of people surveyed learned about CF via agents.

Overall, the CF market has witnessed significant credit growth of 59 per cent annually over the period of 2014-2018. The last year has been particularly eventful, with four new entrants to the market (VietCredit, EasyCredit, Lotte Finance, SHB Finance), putting pressure on the market shares of the ‘Big Four’ (FE Credit, Home Credit, HD Saison and Prudential Finance).

As more competitors enter the market, more concerns have been raised regarding some of the high-risk products such as unsecured cash loans, as well as social impact from debt collection activities. The central bank has tightened its supervision and monitoring on fincos’ operations and lending activities, such as the draft for amendment of Circular No. 43/2016/TT-NHNN, setting a limit on the percentage of cash loans in fincos’ portfolios, and restrictions on debt collecting activities to protect consumers from unprofessional debt collectors.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.