Leader Talk

Leading the boardroom with flexibility

Having lengthy and strict workspace commitments can stifle a company’s growth strategy and inability to pivot when it needs to.

Southeast Asia has long established itself as one of the fastest-growing economies globally, with dynamic growth opportunities. The International Monetary Fund (IMF) has forecasted the region’s growth to be at 4.7 per cent this year, surpassing the global’s forecast growth of 2.7 per cent.

Interest in this region can be attributed to several factors. Its population of over 675 million people brings about a lucrative consumer segment, and its lower barriers to entry and inter-regional trade have made it easier for companies to expand into and within this region.

Despite the optimism in this region, Southeast Asia has not been spared from the ongoing global corporate restructuring and layoffs. Many of these companies impacted here are from fast-growth industries such as payment and technology, which have witnessed aggressive hiring and expansion, some driven by demands brought on by the pandemic.

What many companies had failed to anticipate was a sharp decrease in consumer demand; specifically for online and technology-driven services when consumers revert to pre-pandemic consumption habits. This together with rising operational costs has led to many companies tightening their expenses and slowing down their expansion plans.

So how can business leaders shift from rapid growth to a more sustainable one, to align with the opportunities that Southeast Asia continues to offer?

Growing with confidence

Companies expanding or establishing in Southeast Asia will usually adopt a multi-market strategy with a commitment to local market presence and manpower. Beyond the fundamental differences in languages and cultures across the region, companies will also have to navigate varying levels of development, regulations, and consumer preferences.

Against today’s economy, it would be ambitious to have the same level of presence and resources across multi-markets.

In my conversations with business leaders, I came across many of them having to evolve their expansion strategy; in alignment with the respective market’s readiness, challenges, and opportunities.

A recent example was a financial services company with plans to expand into Malaysia, Indonesia, and the Philippines. They have a presence with us in all three markets but when they decided to reduce their presence in Malaysia, we provided them with the transferability option to scale their operations and transfer their WeWork commitment to support their growth in Indonesia, and the Philippines.

Unfortunately, having lengthy and strict workspace commitments can stifle a company’s growth strategy and inability to pivot when it needs to. Rising operating expenses have also led to many companies prioritizing sensible growth over a speedy one.

For example, Vietnam has long been a key investment market for Korean companies. When a Korean start-up was looking to expand into Ho Chi Minh City, they turned to us for a workspace for only five employees as they wanted to be conservative with operational expenses. However, when their business took off, they were able to triple their presence with us within a short period of time to accommodate the additional headcounts.

Employee experience

The purpose of the office has also changed, with an emphasis on collaboration. In fact, according to recent research by JLL, more than 55 per cent of organizations prioritize collaboration as the primary purpose of their office space.

Having experienced working from home for a prolonged period during the pandemic, employees are keen to return to the office, but only with intention and purpose, instead of just focused work. They would prioritize in-person collaborations and meetings, to make their trip back to the office “commute worthy”. In fact, we saw tracked a 46 per cent increase in large meeting room bookings in March from the start of the year.

The design and infrastructure of the office will have to be refreshed to support the needs of a hybrid workforce. Think workspace with no dedicated desks and interactive space that supports productivity and empowers collaboration. Designing and renovating your office in today’s economic climate would not be the most practical financial decision. Fit-out costs were up across Southeast Asia by an average of 18 per cent according to Cushman & Wakefield’s 2023 Asia Pacific office fit-out cost guide. Shortages of skilled resources, material price increases, and supply chain disruption drive this.

Certainty in uncertain times

From small businesses to large enterprises, companies want the ability to grow or scale their space as needed with the option of short or long-term leases that can optimize their real estate costs.

Now more than ever, companies would not want to commit to 10-15 year lease agreements; especially in the face of inflation and operational pressures.

A regional financial company with over 200 employees in Singapore moved away from its traditional lease and took up a private office space with us that accommodates 120 employees. Since not all their employees are in the office every day and some of their functions are required to be on the go, they complemented their workplace strategy by providing their employees with flexible options such as access to all other WeWork locations. Our All Access bookings echoed this trend, with a 31 per cent increase across Southeast Asia in the first three months of 2023.

Contrary to popular belief, the slowing down of the economy does not necessarily equate to the decreased demand for workspace. It actually provides an opportunity for business leaders to recalibrate and adopt a more strategic and flexible approach to workspace, to support changing business needs.

Co-working spaces blooming in Vietnam

Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Cutting red tape in APA approvals to speed up tax negotiations

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

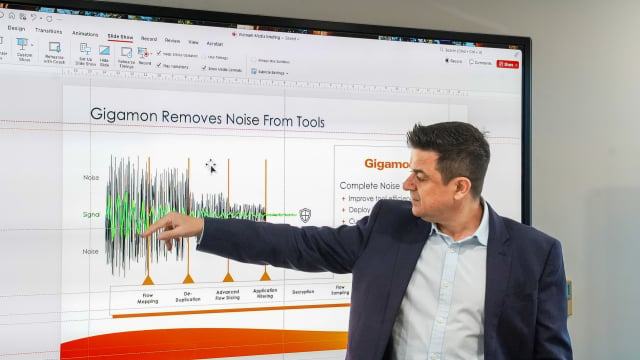

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.