National Focus

Key for Vietnam's economic recovery

A fast vaccination roll-out will help Vietnam quickly re-open up its economy after the novel pandemic.

Delta damage on supply chain

Despite hard lockdowns in major cities across Vietnam, the Delta wave continued to rage in August. Daily cases have consistently jumped over 10 thousand since 19 August, leading to a tripling of total cases in a month’s time.

Unsurprisingly, August data speaks for itself in revealing the pain Vietnam’s economy is facing. The impact is much more severe than that during the three-week national lockdown in April 2020, HSBC said in its latest report.

On the domestic front, private consumption saw a big hit, as mobility fell as much as 60 per cent on average from the pre-pandemic level. This translated into an almost 40 per cent year on year fall in retail sales, with August’s level even 10 per cent lower than last April’s.

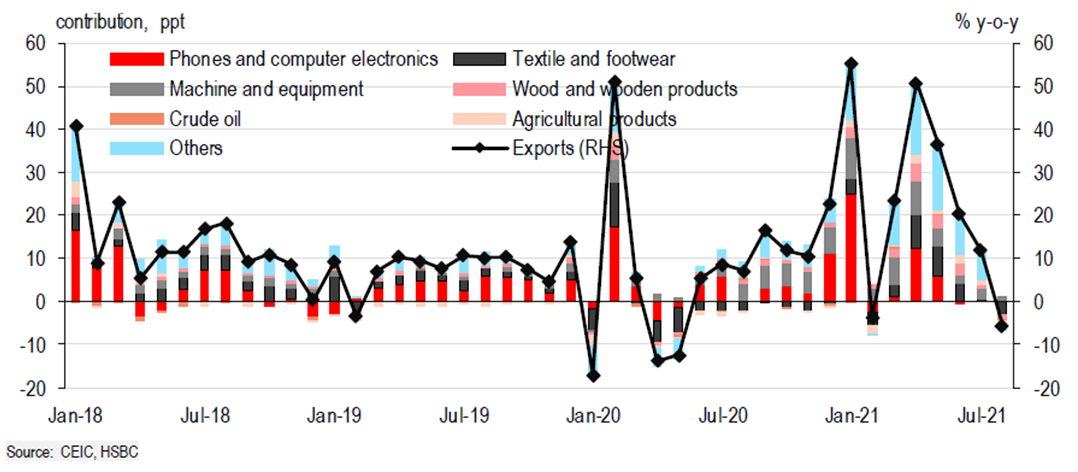

HSBC emphasized that: “The most evident challenge lies in the footwear and textile sectors, as Vietnam’s southeast region is a main global hub. Not surprisingly, these two industries were the main drags on August’s 5.4 per cent year on year decline in exports”.

On footwear, Vietnam has doubled its global market share to 15 per cent in the last ten years, despite China’s dominance of 30 per cent. With the upcoming holiday season in the West, consumers in the US and Europe will increasingly feel the pain.

Take Nike as an example to illustrate Vietnam’s significance in the global textile supply chain. 88 of Nike’s 112 factories in Vietnam are located in the southeast region, in total producing 50 per cent of Nike’s branded footwear.

Similarly, Vietnam is also the world’s largest garment producer after mainland China and Bangladesh. The severe supply chain disruptions will likely hit US consumers particularly hard, as the US alone purchases close to half of Vietnam’s garment exports. Global brand Adidas is facing a hiccup in its production, as Vietnam accounts for almost 30 per cent of its global production.

However, the impact on electronics exports showed some divergence. Phone exports remained surprisingly resilient, defying recent Delta headwinds with 11 per cent year on year. It may seem odd at first glance, but this is largely due to the geographic distribution of the electronics clusters.

Samsung, the single largest foreign investor in Vietnam, produces its smartphones in two factories in the north, one in Bac Ninh and one in Thai Nguyen. While the Delta outbreak first started in the north in May, key industrial zones have gradually returned to normal operations.

Meanwhile, Samsung’s facility in Saigon Hi-Tech Park that produces household electronics has been hard hit. Although the company has set up on-site sleeping facilities for workers, the plant is reported to be operating only at 30 – 40 per cent capacity.

On a larger scale, the Delta wave also raises questions on Vietnam’s supply chain resilience, particularly among tech giants. Apple and Google are just among a few examples that are reported to have slowed their supply chain relocation to Vietnam.

However, HSBC affirmed that despite imminent challenges, Vietnam remains an attractive investment destination in the medium-term. Vietnam’s robust fundamentals should help investors to look through near-term Covid-19 volatilities.

Indeed, South Korean investors are already starting to make the move. Samsung is set to expand its phone plant as early as 2H21, aiming to ramp up its foldable phone production by 47 per cent to $25 million. Meanwhile, LG Display has just received approval for an additional investment of USD1.4bn in its Hai Phong plant, aiming to boost its monthly OLED display output from 9.6 – 10 million to 13 – 14 million.

The key is fast vaccination roll-out

HSBC said that the earlier Vietnam can contain the fourth Covid-19 wave, the better it can restore foreign investors’ confidence, and a key part in the equation is a fast vaccination roll-out.

Compared to the first half of 2021, Vietnam has made substantial vaccination progress in the third quarter, with daily shots jumping as high as 8 thousand per million at one point in mid-August.

That said, it is still facing a lack of consistent vaccine shipments, thus making it lag behind regional peers, with only 18 per cent of its population being vaccinated with at least one dose.

Recently, the authorities have appeared to shift their Covid-19 strategy, with the Prime Minister’s recent emphasis on developing a recovery plan to “live with Covid-19”. This will largely depend on achieving high vaccination rates; thus, the priority for policymakers is to secure diversified vaccine sources and accelerate vaccine roll-out.

In particular, the roll-out of the second dose is crucial, as only 3 per cent of Vietnam’s population has been fully vaccinated. Positively, Vietnam is expected to see a meaningful pick-up in vaccine commitments in the last quarter of this year, with estimation that Vietnam will have a total of 112 million vaccines by end-2021, enough to fully vaccinate over 56 per cent of its population.

“The sooner Vietnam is able to vaccine at least 70 per cent of its population (which is likely in the second quarter of 2022), the sooner it can re-open its border for mass tourism and foreign investors,” said HSBC.

Vietnam economy will persist at least through the third quarter: HSBC

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.