Leader Talk

Japanese investors express robust interest in Vietnam

According to Hiroyuki Ono from ACA Investments, a Japanese fund manager under the Sumitomo Group, Vietnam market is more attractive to Japanese enterprises than Thailand and Indonesia.

Since 2018, more than a decade after joining the World Trade Organization (WTO), Vietnam would have to implement all the commitments included in the free trade agreements it have signed, particularly opening the market and removing the trade barriers for foreign enterprises including Japanese firms.

Specifically, according to the Japan-Vietnam Economic Partnership Agreement (JVEPA), this year, Vietnam will reduce 50-67 per cent in the tax of 2,918 Japanese products, 20-45 per cent of tax for 604 products and 4-18 per cent for 1,567 products.

Meanwhile, under the ASEAN-Japan Comprehensive Economic Partnership (AJCEP), from April 1, 2018, Vietnam will apply tax exemption for 3,426 products.

As a foreign investor, Hiroyuki Ono from ACA Investments believes that the average Gross Domestic Product (GDP) growth rate of around 6.5 per cent in recent years together with the increasing actual individual consumption (AIC) per capita have made Vietnam a potential market for investment.

On the sidelines of the "Navigate – Startup pitch event" held by the Training and Support Center for Technology Commercialization (TSC) under National Agency for Technology Entrepreneurship and Commercialization Development of the Ministry of Science and Technology and the Japan External Trade Organization (JETRO), TheLEADER had a talk with Hiroyuki Ono about the opportunities and challenges of Vietnamese enterprises in the context of increasing investment wave from Japan.

What do you think about the investment environment in Vietnam in recent years?

Hiroyuki Ono: For more than a decade, investment environment in Vietnam has been improved significantly, attracting more bigger foreign investments. The number of newly opened companies has increased sharply and there were more companies joining the initial public offering (IPO).

Recently, people discuss a lot the topic of the ecosystem with a lot of related factors, one of which I think the most important is the sophisticated capital market, meaning that IPO is critical for entrepreneur investors to find the common goals and strategies to invest. This would significantly contribute to the sustainable development of the economy as well as the investment environment.

Can you make a comparison between Vietnam and other countries in the region in terms of Japanese investment?

Hiroyuki Ono: With the average GDP growth rate of around 6.5 per cent for many years, Vietnam is seen as a potential market. AIC per capita is tenfold higher than 10 years ago thanks to the growth of the supply chain, which has made Vietnam become one of the most potential markets in Asia.

The investment from Japan to Vietnam has changed significantly with larger number and size of projects which are in different areas including retail, service, electronics and information technology.

Vietnam has also surpassed Thailand and Indonesia to become the most attractive investment market for Japanese companies. Many Japanese firms are planning to set up factories, branches, and stores in Vietnam; and a number of small and medium-sized enterprises in Japan want to cooperate with Vietnamese companies.

What are Vietnamese enterprises’ strengths attracting Japanese investors?

Hiroyuki Ono: It is great that many Vietnamese people have their ownership of the business. Most Japanese people work for other people. Therefore, this would support Vietnamese to have a mind of an entrepreneur and realize the importance of taking responsibility and solving the problems by themselves.

As the foreigners, Japanese enterprises invest in Vietnam, they would play a role as a supporter and Vietnamese would deliver a clear message about their strategy and their goals.

What are the challenges posed by Japanese firms that Vietnamese companies must address?

Hiroyuki Ono: Japanese people are very careful, believable and they are the partners who Vietnamese companies can cooperate in the long time period. However, due to the pressure of high quality of products, Japanese enterprises usually do a lot of thorough researches which cost a lot of time.

Especially, Japan’s listed companies require more about the issues related to administration and management. Therefore, the two sides should discuss carefully the development strategy before deciding to cooperate.

I also believe that the game now is much bigger than ever. Vietnamese enterprises should utilize all of its resources and strengths to attract investors. They also should apply the breakthrough of technology to promote their products.

What are the prospects of investment wave from Japan to Vietnam in the coming years?

Hiroyuki Ono: Japanese enterprises are coming to Vietnam. Currently, many Japanese newspapers talk about the investment of Japan in Asia in general and Vietnam in general.

Thanks to the support of media, more investors would find the investment opportunities in Vietnam.

However, we should not only talk about the number but we should also discuss the methods to achieve that number. Vietnamese enterprises must know clearly about their partners. Besides, foreign investors should understand the Vietnam market by learning not only the economy of Vietnam but also its language, culture, and lifestyle.

I believe that Japanese investment to Vietnam would increase; however, the level of that increase would depend significantly on the coming policies of the Government of Vietnam.

Thank you so much!

Japan surpassed South Korea to lead foreign direct investment in Vietnam

Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

Cutting red tape in APA approvals to speed up tax negotiations

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

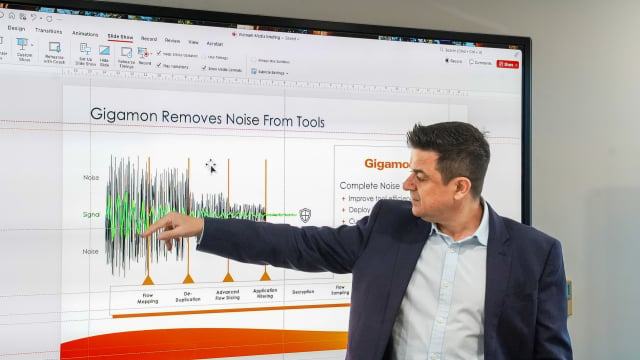

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.