National Focus

IFRS raises potential challenges in real estate business strategies

A recent Ministry of Finance ruling is set to send ripples across Real Estate businesses, especially those with extensive asset portfolios. The International Financial Reporting Standards (IFRS) adoption roadmap commits to improved transparency and brings financial reporting in Vietnam closer to global standards.

Decision 345/QD-BTC establishes revised compliance requirements for specific groups of enterprises but allows flexibility on adoption timelines and how IFRS is approached. The new reporting standards will become mandatory for almost all businesses after 2025.

The broad thrust of IFRS is that financially reported asset values and liabilities should align with their actual or estimated fair market prices. The most accurate approach is using fair value (FV) accounting, or ‘mark-to-market’, a generally accepted accounting principle.

Generally, when any asset or liability value increases or is expected to, the value or liability is adjusted to its current market price to reflect its liquidated value.

Troy Griffiths, deputy managing director of Savills Vietnam said that: “This requires close attention of business leaders and CFO’s as assets and liabilities will require accurate and up to date valuations and extensive changes to financial statement applications. Hard value is great for investors and shareholders wanting an accurate gauge of corporate financial health but involves experience and expertise that CFO’s generally lack.”

For example, IFRS 16 covering leases. The new standard will no longer differentiate between finance and operating leases. For any contracts that meet the definition of a lease, a Lessee balance sheet will show an asset right-of-use with a lease liability.

For lessees owning property rights or benefiting from large ‘right-of-use’ asset portfolios, the change in value will significantly affect their financial position. For occupiers with portfolios of leased properties such as retailers, hoteliers or cinema operators, the additional assets and liabilities on balance sheets will be significant.

At commencement a lessee shall measure the lease liability present value by unpaid lease payments on that date. Lease payments are discounted referencing the interest rate aimplicit in the lease if that rate can be readily determined. If not, the lessee uses the lessee’s incremental borrowing rate.

The interest rate implicit in the lease effects the lease payments present value. The unguaranteed residual value comprises the underlying asset fair value, and any initial direct costs of the lessor.

Nguyen Hong Son, head of Savills advisory services commented that companies required to prepare financial statements for external reporting, face potentially serious issues. Failure to file or comply with FV standards could lead to fines or more serious consequences.

Due to more complex reporting standards and the downside potential in getting it wrong, most are turning to reputable valuation firms. Registered Valuers are a key part of the process, to assess the ‘right of use’.

Market experienced, objective and reputable valuation companies are required. Early IFRS adopting enterprises have grasped how FV affects operations and are already reducing implementation costs and compliance risks. “At Savills, our advice is to get ahead of this now, rather than put it off until it becomes urgent,” said he.

Businesses engaging reputable and experienced consultancies will see a smooth, effective transition and all stakeholders fully comprehending the new IFRS normal. However, early action is required to avoid the inevitable last-minute rush to compliance in 2025.

Jack Nguyen, partner of Mazars Vietnam said that this should not be considered as a purely accounting change. The potential for multiple impacts across different problems exists and there will not be a one-size-fits-all solution. For risk management, consultancies can undertake in-depth analyses of contract terms, IFRS 16 impacts on reporting systems, financial communications, key performance indicators, debt covenants, etc.

From 2018-2020 the IFRS adoption roadmap describes 10 to 20 simple standards for implementation which have been required for listed companies since early 2020. An entity shall apply IFRS 16 for annual reporting beginning on, or after 1 January 2019. Earlier application is permitted for entities applying IFRS 15 covering Customer Contract Revenues.

Within the context of Covid-19, business leaders need to be closely involved in IFRS conversion as it affects every part of their business. A successful implementation involves the time needed for appropriate assessment and decision-making to avoid cheaper, less thorough, and ultimately more expensive solutions.

A state-owned conglomerate needs average US$10 million to adopt IFRS

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

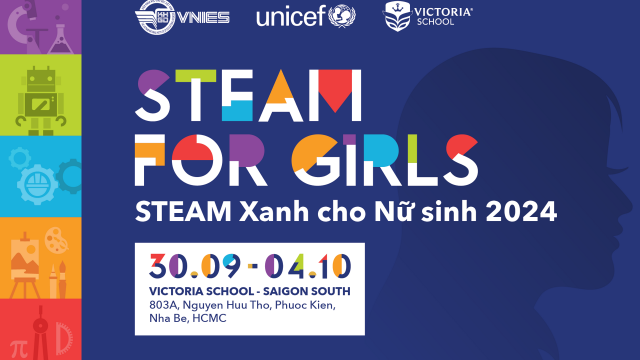

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.