National Focus

Falling global trade trapped Vietnam in slowest output growth in August

Vietnam’s PMI has slumped to a six-month low in August due to slower client demand and US-China trade tensions restricting new orders and production, according to IHS Markit.

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) posted 51.4 in August, falling from 52.6 in July to signal a weaker overall improvement in business conditions. In fact, the health of the sector strengthened to the least extent since February, IHS Markit wrote in its latest Vietnam Manufacturing PMI report.

“The slowdown in growth in August, and panellist reports of the US-China trade tensions harming demand, show that the Vietnamese manufacturing sector is not immune to the impacts of global trade issues,” noted Andrew Harker, associate director at IHS Markit.

The rate of growth in manufacturing output during August was the weakest in the current 21-month sequence of expansion. While rising new orders supported increased production at some firms, others reported softer client demand and reductions caused by US-China trade tensions.

These factors were also linked to a slowdown in new order growth. While new business increased at a solid pace, it was still the weakest since January. New export orders, on the other hand, rose modestly for the second month running.

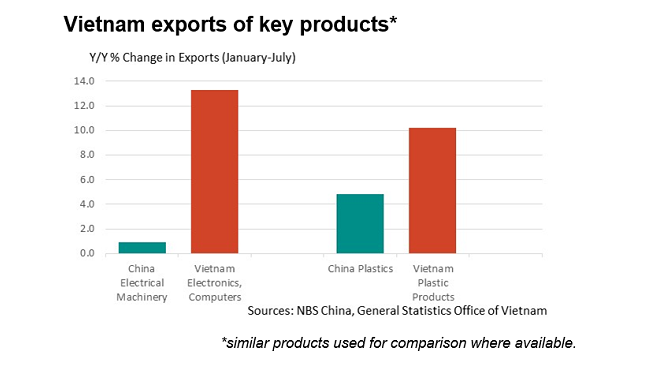

Part of the positive export performance, according to Harker, looks to be replacing trade between the US and China. While US imports from China over the first six months of 2019 were down 12.4 per cent year-on-year, their imports from Vietnam were up 33.4 per cent.

Vietnam, in this case, has been one of the better performers in terms of export orders of the 28 manufacturing PMI surveys conducted by IHS Markit, for which exports data are available. When taking an average of the New Export Orders Index reading for January to July this year, Vietnam sits in third place, behind only Greece and India.

Meanwhile, business confidence has fallen to a six-month low and was below the series average. Companies were still confident that output will rise over the coming year, however, with optimism reflecting expectations of improving customer demand.

“The resilience of the Vietnamese manufacturing sector should not be underestimated. We have seen slowdowns such as that recorded in August before during the current sequence of growth, and rates of expansion have always then rebounded in the following months. This could therefore be the case again as 2019 draws to a close”, commented Harker.

Sharpest rise in Vietnam’s manufacturing output for eight months

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.