Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

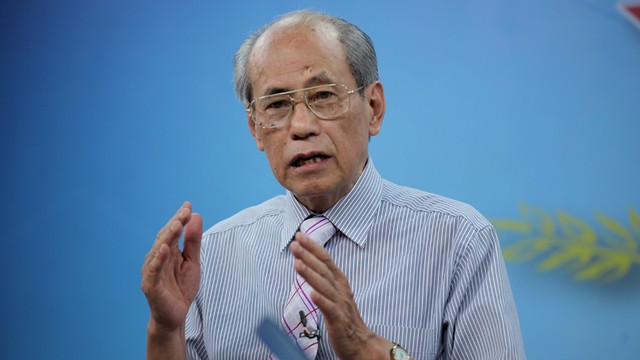

Economist Pham Chi Lan said that providing incentives for too many fields in special economic–administrative zones would increase the tax inequality for businesses.

Currently the National Assembly is discussing the Law on Special Administrative – Economic Zones (or special economic zones, SEZs). Accordingly, to attract investors, especially foreign ones, the draft law has proposed special incentives.

However, regarding tax incentives in SEZs, at the seminar "Discussion on tax incentives in SEZs", economist Pham Chi Lan said that they should not be the top priority there.

According to Lan, the SEZ is an institutional laboratory that tests the latest regulations in a fully integrated economy with international trade commitments that Vietnam makes.

"There have been plenty of incentives in Vietnam’s open economic zones, but they are unsuccessful. This results from ineffective incentives rather than the lack of them," Pham Chi Lan said.

On the other hand, the expert also said that businesses in the SEZs are subjected to a 10% corporate income tax, only a half currently applied in other areas. Hence, despite operating in the same field, a business can enjoy more benefits than another just because it is located in the SEZs. This is thought to increase the tax inequality for businesses.

Besides, the fact that the incentives are offered to too many industries in three SEZs will cause massive losses to the State budget due to price transfer and tax evasion. If there is no way to compensate for these losses, do people have to pay extra tax and will the number of poor people increase?

Sharing the same view, economist Luu Bich Ho also expressed concern about the budget deficit.

"Vietnam has to restructure the whole tax system as many taxes are decreasing during the integration process, making the budget revenue shrink. Now, three SEZs will need huge capital. Where can we get the money? The budget is not capable of allocating the whole amount of money. Even if we call for capital from private sources, we still need seed money," the expert said.

According to Ho, most countries in the world have already abolished corporate income tax incentives and tried to create a common ground with open mechanisms to facilitates businesses the most. Hence, keeping incentives as in the draft law is "wrong".

According to Henrique Alencar, Tax and Inequality Consultant, Oxfam Novib, tax incentives in SEZs lead to budget revenue reduction and even budget deficits.

As a result, the government may have to cut down on the investment in education, health, welfare programs or reduce incentives in other areas, as they have to make long-term commitments to the regions that enjoy privileges. More seriously, decade-long incentives will lead to much more substantial losses than predicted by policymakers, Henrique emphasised.

Regarding leasing land for up to 99 years in the SEZs, economist Pham Chi Lan said: "It is bad and should not be done because no enterprise dares to declare that they will run a factory in 99 years."

Leasing land for a too long time in the SEZs along with easy land concession mechanism will benefit real estate businesses the most as they are allowed to own land in the long term.

Lan said that in this incentive of land leasing duration, there is obviously a lobby of real estate and tourism companies. Meanwhile, what Vietnam needs in the SEZs is not real estate but the manufacturing industry.

Vietnam’s dream of industrialisation and modernisation has not been realised yet, while land fevers in the SEZs are attracting capital and resources, hence reducing the interest of enterprises in other fields.

Economist Luu Bich Ho also said that it is unnecessary to attach land to ownership and leasing duration incentives for a too long term. This is not beneficial to Vietnam’s long-term interests and the national security.

At international SEZs, the maximum permitted leasing duration is only 50 years, even only 20 years in some places. Therefore, Vietnam should consider and recalculate this incentive to guarantee the best development of the SEZs, the expert emphasised.

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.