Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

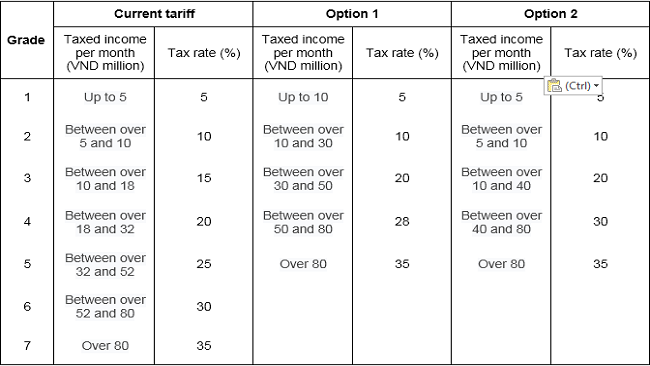

According to economist Ngo Tri Long, both options on changing the calculation methods of personal income tax proposed by the Ministry of Finance (MoF) are irrational.

MoF has transferred the draft law on amendment of tax laws, including personal income tax (PIT), to the Ministry of Justice for evaluation before reporting to the Prime Minister for consideration and submission to the National Assembly in 2018.

In Option 1, the number of tax grades subject to PIT will decrease from seven to five and the taxed incomes will be rounded.

Specifically, individuals with income up to VND5 million (US$220) will not be subject to PTI. Individuals with income up to VND10 million (US$441) will pay 5 per cent of PIT instead of 10 per cent.

However, MoF found that although Option 1 meets the goals of reducing the tax grades and adjusting taxed incomes at each grade, the budget revenue will decline by about VND1.3 trillion (US$57.3 million). At the same time, it is argued that the amendment of PIT would benefit the rich other than individuals with taxed income at the first grade.

For example, individuals with taxed income of VND10 million per month will receive tax reduction of VND250,000 (roughly US$11) per month. Individuals with taxed income of VND30 million (US$1,323) per month will have a reduction of VND850,000 (US$33) per month, so on and so forth.

Thus, MoF has proposed the second option, which will reduce four tax grades from the grade 3 to 6 to only two grades.

Based on this option, individuals with taxed incomes of VND15 million, VND30 million and VND50 million (US$661, US$1,323 and US$2,205) will pay additional VND250,000, VND400,000 and VND500,000 (US$11, US$17.6 and US$22) in PTI respectively, etc. Therefore, total budget revenue will increase by about VND500 billion (US$22 million).

However, MoF’s second option, according to experts, will affect strongly the majority of Vietnamese people because the majority of Vietnamese people have taxed incomes at grade 3 (between over VND10 million and 18 million (US$793)).

At the current rate, individuals with income at grade 3 pay only 15 per cent of PTI while they will be subject to a 20 per cent PIT under the second option.

According to the provisions of the current Personal Income Tax Law, which came into effect in 2009, individuals with income higher than the level of reduction based on family circumstances must pay PIT following the partially progressive tariff with seven grades from 5 per cent to 35 per cent. This means that individuals with the same incomes but different family circumstances will pay different PITs.

Specifically, from July 2013 to present, the reduction based on family circumstances for taxpayers is VND9 million (US$396) per month and the deduction for each dependent is VND3.6 (US$158) million a month.

Many argued that this regulation is unreasonable, causing many obstacles.

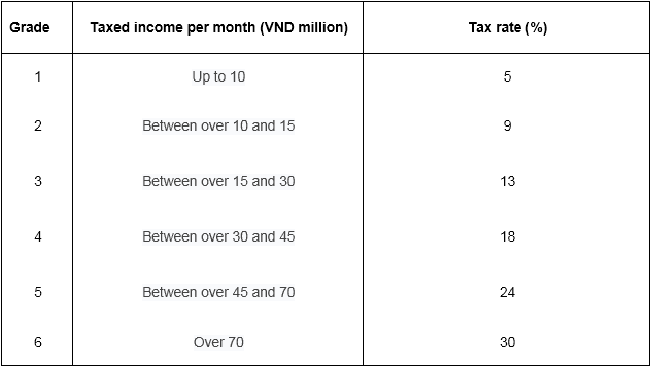

Talking with TheLEADER, Dr. Ngo Tri Long, former head of Price and Market Research Institute under MoF said that both proposed options for calculating PTI are unreasonable in the gap between tax grades in the partially progressive tariff, the tax rate as well as the highest income level considered for PIT.

Long suggested to change the tariff by decreasing the number of tax grades from seven to six as the chart below:

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.