Leader Talk

CFOs are not yet transforming to take on more frontline roles

While an overwhelming majority of chief finance officers (CFO) in Southeast Asia recognize the need to transform key areas of their finance functions to navigate the complexities of the new normal, many have yet to begin their transformation journey.

Transforming finance in strategic areas

A large majority of CFOs recognized the need to transform in key areas as the role of finance pivots towards the delivery of financial insights, according to a study by Deloitte Southeast Asia on 105 Southeast Asia-based CFOs and finance leaders across a wide range of industries and finance team sizes.

However, more than a quarter have not yet begun a transformation in these areas despite acknowledging their importance – business finance, risk monitoring and compliance, and data analytics and management.

“For most Southeast Asia CFOs, their focus was initially to ensure operational and business continuity. This year, CFOs are now focusing on long-term priorities to become more agile to support the evolving business needs,” says Timothy HO, Deloitte Southeast Asia CFO program leader.

In particular, as the pandemic continues to demand fundamental shifts in their businesses, it is imperative for CFOs and their finance function to pivot from operational finance to financial insights, and turn their attention to developing new finance roles and the accompanying skillsets required for the future. Specifically, they will need to take on more frontline roles and become the ultimate owner of data within the organization.

Enabling the finance workforce

One thing is clear from the survey respondents – remote working is here to stay, with almost three-quarters indicating that their organizations will continue remote working, and potentially use remote work as a means to supplement talent to the finance team.

“A key driver for remote working is a skills shortage. Even as CFOs in the region adapt to a remote workforce, drawing from other geographies to plug the skills gap, they will still need to consider how their finance teams can develop or acquire more diverse skillsets – and fundamentally reimagine the future role of finance in their organization,” says Ho.

Delivering next-generation finance

Through analysis of the survey findings, Deloitte postulates that there are three priorities on the CFOs’ to-do list for their teams to deliver next-generation finance defined by remote work and their increasingly frontline role.

Firstly, they should craft the finance transformation vision. CFOs who wish to accelerate their readiness to operate in the new normal will need to understand the mix of human and technology required to meet changing expectations, update roles and job descriptions, and importantly, ensure that their talent is ready.

This requires an ambitious but realistic finance transformation vision that articulates which technology investments to prioritize, defines the talent that will thrive, and decides how best to upskill them.

The second priority is defining future roles. Future finance roles will likely fall into three main categories including storytellers, interpreters, and machine managers. These roles are likely to differ not only in terms of the skills required but also in terms of the human-machine mix. Even if these roles depend heavily on machines, they are unlikely to be fully automated. This means that finance talent will be required to operate in new and different ways – with creativity, intuition, and judgment remaining high on the human value chain.

They should also decide whether to build, borrow, or buy. Often, a CFO’s first instinct is to upskill their team through training and development in order to acquire new capabilities and build a future-ready workforce. While upskilling should be part of any future workforce plan, it may not always be sufficient to meet all future talent needs.

But this also does not mean that CFOs need to go on a hiring spree - there is a good chance that these capabilities already exist within the organization, if not within the finance team. CFOs should therefore look within their organizations to see if they can borrow or share employees with transferable skillsets from other functions.

It is becoming increasingly clear that doing one or two things exceptionally well and working in isolation is unlikely to cut it. In its future role, finance will be about managing across functions, building the right combination of talent and capabilities, as well as owning and operating a robust organization-wide data foundation.

“Our advice to CFOs is for them to focus less on the pursuit of perfection, and more on continually improving the value that finance delivers to the organization. As an example, as more businesses place emphasis on sustainability, and the requirements continue to evolve, how can CFOs play a more active role in driving the measurement, reporting, and management of these initiatives?

After all, the future is not set in stone, and it is up to the CFOs and their finance teams to take action, and reshape and reimagine in order to sail beyond the horizon,” Ho concludes.

Transforming towards sustainable business models

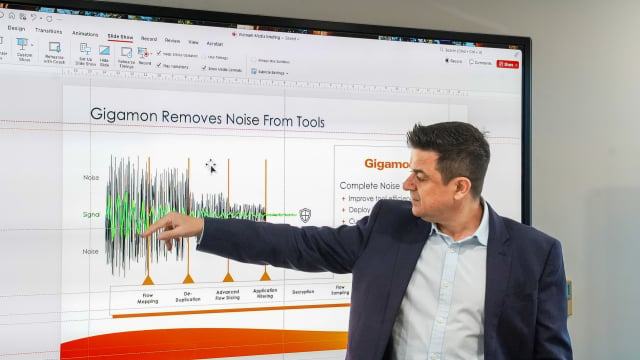

Enterprise cybersecurity is under threat from the inside

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

Breakthrough for the international financial center ambition

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

How leadership philosophy redefines hospitality in Nha Trang

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

When organic becomes an inspiring wellbeing lifestyle

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.

Garment factories embracing respectful workplaces

Embracing respectful workplaces could very well be the key to unlocking a more prosperous future for Vietnam's garment industry.

Vietnamese corporates in new era: The reborn dragon

Vietnamese businesses have had a long journey with great achievements, and this path will continue and blossom in years to come.