Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The Danish brewery Carlsberg currently holds a 17.3 per cent stake in Habeco, one of Vietnam's biggest brewers based in Hanoi, and has a preemptive right to buy Habeco shares when the government divests its stake in the company.

According to the plan, the government of Vietnam will fully divest its stake from Habeco and Saigon Beer Corporation (Sabeco), two largest beer companies in the country. While Sabeco plans to auction 54 per cent stake on this December 18, Habeco is expected to sell its shares to strategic partners in the first quarter of next year.

Carlsberg already owns 17.3 per cent stake in Habeco and it has negotiated and discussed its priority purchase rights with the government to buy shares in Habeco for many years. The Danish brewer wants to own 51 per cent of shares in Habeco.

"Carlsberg, the government of Vietnam and Habeco have achieved some common understanding on a number of issues during the negotiations and we hope this will accelerate the process," said Carlsberg representative to Reuters.

Vietnam is one of the most attractive beer markets in the world and the largest beer market in Southeast Asia, fueled by a young population with nearly four billion liters of beer consumed last year.

Habeco has been the leading company in the segment of cheap beer in the market in the north of Vietnam for many years. But more and more new beer brands appear attracting more consumers and are gradually occupying the market share of the company.

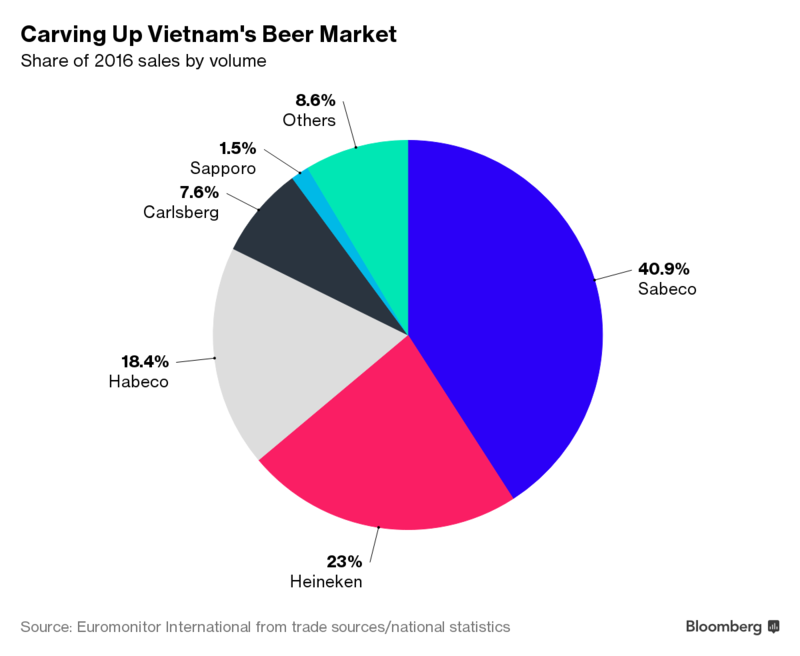

The company currently holds about 18 per cent of the market share in Vietnam beer market, 20 per cent lower than the previous years.

Meanwhile, Sabeco and Heineken hold about 40 per cent and 23 per cent of domestic beer market share. Sabeco is the only large brewer in Asia not to have any strategic partner. Recently, ThaiBev has registered to buy 51 per cent of shares in Sabeco in an auction taking place at the end of this December.

Sabeco is currently valued at US$9 billion, making it one of the most valuable beer companies in Asia.

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.