Vietnam turns semiconductor vision into action

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

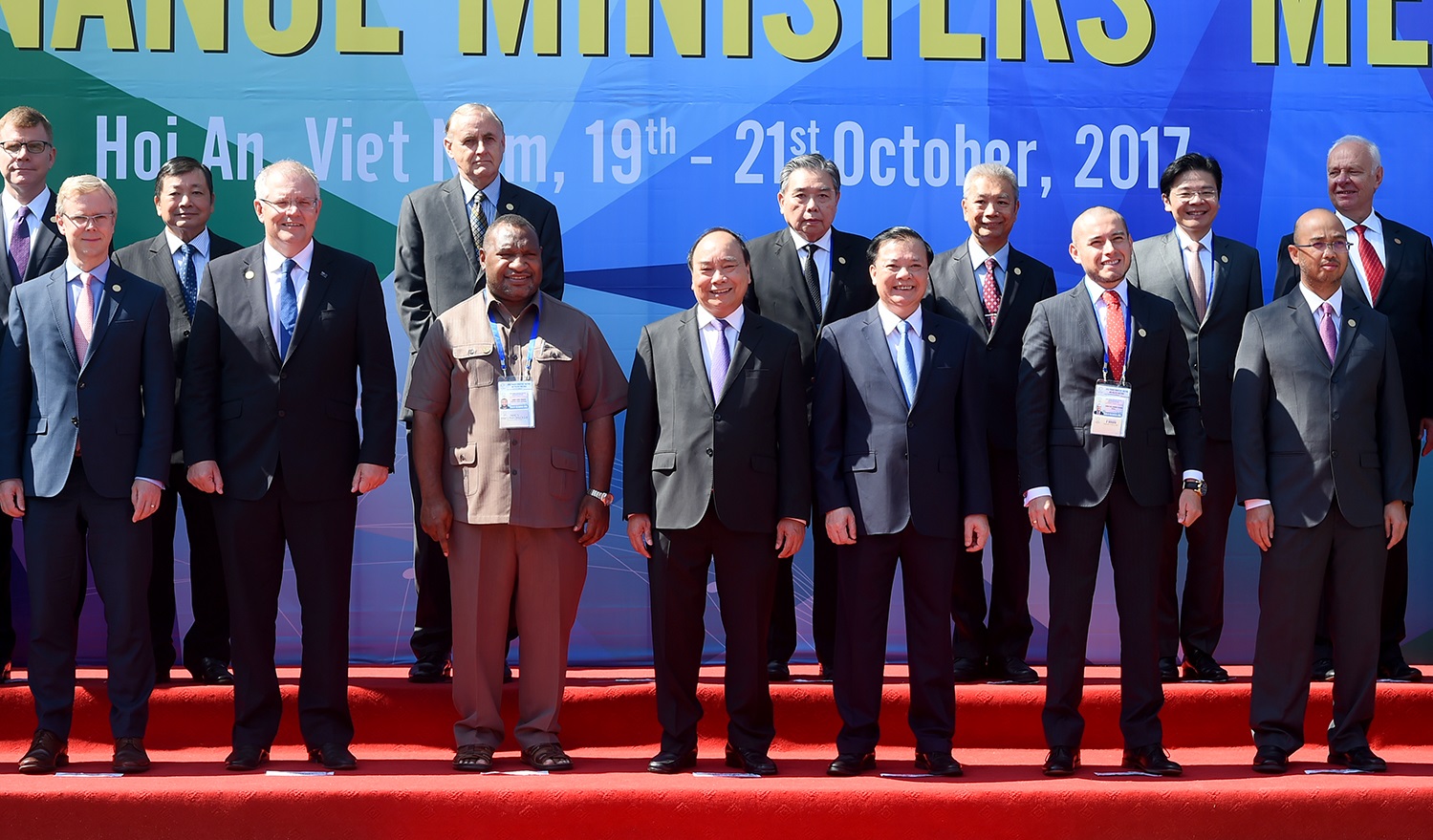

The Finance Ministers of the economies of Asia-Pacific Economic Cooperation (APEC Finance Ministers), convened the meeting in Hoi An, Viet Nam on 21 October 2017 under the chairmanship of H.E. Dinh Tien Dung, Minister of Finance of Viet Nam.

Regarding the global and regional economy, APEC Finance Ministers said that the near-term outlook for global economic growth is encouraging, with a more broad-based pick up across both emerging markets and advanced economies. In the medium term, the risk of global financial conditions tightening remains and slower productivity gains continue to inhibit sustainable growth.

“We will refrain from competitive devaluation and will not target our exchange rates for competitive purposes. We reaffirm the key role of structural reforms in strong, sustainable, balanced and inclusive growth”, APEC Finance Ministers committed.

Regarding Cebu action plan, APEC Finance Ministers welcomed the efforts made by member economies in identifying and implementing activities under the Cebu Action Plan (CAP); encouraged member economies, on a voluntary and non-binding basis, to continue to submit activities and initiatives in alignment with the CAP for implementation as appropriate to their domestic circumstances.

APEC Finance Ministers also recognized the active engagement of international organizations and appropriate APEC sub-fora and encourage their continued assistance to help member economies achieve the goals of the CAP. We welcome ABAC and the APFF’s contribution to the implementation of the CAP, including the recommendations on financial market infrastructure and microinsurance. We encourage continued collaboration among interested relevant stakeholders in advancing these initiatives of the CAP.

Regarding long-term investment in infrastructure, APEC Finance Ministers recognized the importance of mobilizing long-term investments in infrastructure and reiterate the relevance of quality infrastructure for sustainable economic growth. While recognizing the role of public investment in APEC economies, diversification of financing sources and fostering private sector involvement in infrastructure projects is an important solution to meet the significant demand for long-term capital for infrastructure.

APEC Finance Ministers called on OECD, the World Bank Group (WBG), ADB, GIH and other international organizations to continue to work with APEC economies to study good practices and provide technical assistance and capacity building on quality infrastructure investment for member economies.

Regarding base erosion and profit shifting, APEC Finance Ministers recognized the importance of base erosion and profit shifting (BEPS) issues in APEC member economies, and the need for enhanced regional cooperation in sharing experiences, approaches and good practices on tax policy development, legislative design and tax administration, in order to address the challenges of BEPS in the region while enhancing the certainty, transparency and fairness of the tax system.

Regarding disaster risk financing and insurance, APEC Finance Ministers recognized the importance of improving institutional and legal frameworks on disaster risk insurance against the increasing impacts of natural disasters and their contingent liabilities in economies in the region. Effective strategies on disaster risk financing and insurance, including solutions for financial risk management of public assets, will help mitigate and transfer risks, thereby better support timely rehabilitation and reconstruction when the disaster occurs.

Recognizing the essential role of the private sector in providing innovative market-based risk transfer solutions, APEC Finance Ministers encouraged member economies to explore partnership with the private sector for potential solutions.

APEC Finance Ministers were committed to enhancing our cooperation and knowledge exchange on disaster risk finance and insurance, particularly on financial risk management of public assets.

Regarding financial inclusion, APEC Finance Ministers recognized that agricultural finance makes an important contribution to the sustainable development of agriculture and rural areas, and helps narrow income gaps through capacity building for people and businesses in developing household business, micro, small and medium enterprises, value chains, and scientific and hi-tech based agricultural production.

“We also call on World Bank, IFC, ABAC and other development partners to continue supporting APEC economies in implementing initiatives to further improve financial infrastructure development in the region and promote the cooperation on credit information to support cross-border trade and investment”, APEC Finance Ministers said.

Furthermore, APEC Finance Ministers’ Joint Ministerial Statements also mentioned other issues as good progress on the development of the Asia Region Funds Passport (ARFP); the enhanced collaboration and coordination between APEC Senior Officials’ Meeting (SOM) and Senior Finance Officials’ Meeting (SFOM) officials this year; the joint activities between senior finance officials and the APEC Economic Committee (EC) this year…

The global semiconductor industry is being reshaped by geopolitical tensions, shifting supply chains, and the surge of digital technologies.

The change in APA approval authority is expected to shorten processing time and enhance business proactiveness in international tax negotiations.

As hybrid cloud systems grow more complex, Vietnamese enterprises are struggling to detect cybersecurity threats moving laterally within their own networks.

The submission of the draft resolution on Vietnam’s international financial center to the National Assembly heralds a new developmental era for the country.

More than just running a 5-star resort, Kristian Petersen is redefining the art of hospitality with a humane and sustainable leadership philosophy.

For Tyna Huynh, co-founder of Drinkizz, organic is not just a food choice but a way of life that fosters a deep connection between people, nature and community.