National Focus

ADB provides $116 million loan to develop wind farms in Quang Tri

It is ADB’s first financing of a wind power project in Vietnam, comprising a $35 million A loan directly funded by ADB and an $81 million syndicated B loan.

The Asian Development Bank (ADB) has signed a $116 million green loan with Lien Lap Wind Power Joint Stock Company (Lien Lap), Phong Huy Wind Power Joint Stock Company (Phong Huy), and Phong Nguyen Wind Power Joint Stock Company (Phong Nguyen) to build and operate three 48MW wind farms, totaling 144MW, in Quang Tri province.

In last February, the total investment of over $250 million in these projects was approved.

The project will generate an average of 422 gigawatt-hours of electricity and avoid an average of about 162 thousand tons of CO2 emissions annually. A gender action plan under the project will provide women from the local community with access to training on wind power operation and management.

Lien Lap, Phong Huy, and Phong Nguyen are owned by Power Construction Joint Stock Company No.1 (PCC1) and RENOVA, Inc.

PCC1 has nearly 60 years of experience in Vietnam’s power infrastructure sector, specializing in constructing power transmission networks and substations. It is among the largest hydropower developers domestically and is listed on the Ho Chi Minh Stock Exchange.

RENOVA is a Japanese renewable energy developer and operator of renewable energy power generation facilities including solar, wind, biomass, and geothermal power plants. Established in 2000, the company is listed on the first Section of the Tokyo Stock Exchange.

The loan forms part of a $173 million green loan project financing package arranged and syndicated by ADB as mandated lead arranger and bookrunner.

It is ADB’s first financing of a wind power project in Vietnam, and is certified by the Climate Bonds Initiative, which administers the international Climate Bond Standard and Certification Scheme.

The ADB loan comprises a $35 million A loan directly funded by ADB and an $81 million syndicated B loan.

“Lien Lap, Phong Huy, and Phong Nguyen will add to ADB’s extensive experience in large-scale renewable energy projects in Vietnam, and underlines our commitment to helping the country map a clean energy future,” said ADB private sector operations department infrastructure finance division director for East Asia, Southeast Asia, and the Pacific Jackie B. Surtani.

This is a milestone project which demonstrates how private financing can be effectively mobilized to develop wind power projects in Asia and the Pacific.

PCC1 Chairman of the board of directors and General director Trinh Van Tuan, said that this transaction is its first wind power project and the first time that they engaged with a group of international finance institutions and commercial banks.

ADB’s leadership in deal structuring, due diligence, and loan syndications is very crucial for the success of this transaction.

ADB mobilized long-term US dollar limited-recourse financing from commercial banks and other development finance institutions that was unavailable locally. This was done through a combination of B loans and parallel loans.

Parallel lenders include the Japan International Cooperation Agency and Export Finance Australia. B loan participants include Bank of China (Hong Kong) Limited, Bank of China Limited Macau Branch; Société Générale, Singapore Branch; and Triodos Groenfonds N.V.

IFC provide $57 million to two wind power plants

Resolution 68: A turning point in Vietnam's private sector policy

As Vietnam sets its sights on becoming a high-income country by 2045, Resolution 68 lays a crucial foundation. But turning vision into reality requires not only good policy - but also unwavering execution, mutual trust and national unity.

Vietnam plans upgrade of Gia Binh airport to dual-use international hub

Vietnam plans to upgrade Gia Binh Airport in Bac Ninh province into a dual-use international airport to support both military and civilian operations, the government said on Friday.

Lives under the scorching sun: Outdoor workers racing against climate change

Under unforgiving conditions, the outdoor workers - the backbone of urban economies - endure the harshest impacts of climate change while remaining overlooked by social safety nets. Their resilience and struggles highlight the urgent need for better protection in the face of rising temperatures and precarious livelihoods.

CEO Group chairman unveils guide to Vietnam real estate for foreigners

Doan Van Binh, Chairman of CEO Group and Vice President of the Vietnam National Real Estate Association, introduced his latest book, “Vietnam Real Estate for Foreigners,” at a launch event in Hanoi on Friday.

Women leading the charge in Vietnam's green transition

Acting for increased women’s participation and leadership in climate action, Vietnam can accelerate a transition that is more inclusive, just, and impactful.

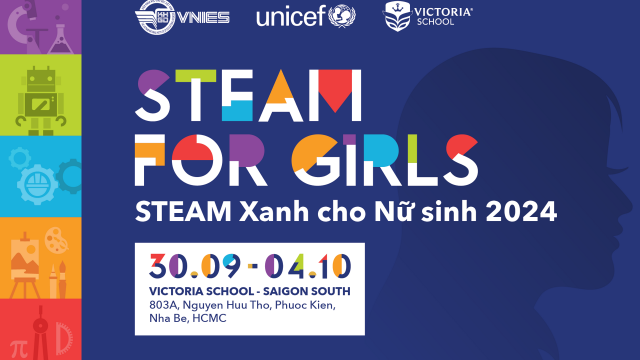

Steam for girls: A journey of passionate and creative girls

The "Steam for girls 2024" competition provides a creative platform for Steam and an opportunity for students to connect with peers from various regions within Vietnam and internationally.