Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Being the first media company in Vietnam to be listed on the stock exchange, Yeah1 has made the largest successful divestment deal ever when VinaCapital got the return up to $127 million from its only $3 million investment in Yeah1.

Desiring to help startups get a better overview and judge the potential of the market in the future, Topica Founder Institute (TFI) has published an annual report on the investment in Vietnam’s startups in 2018.

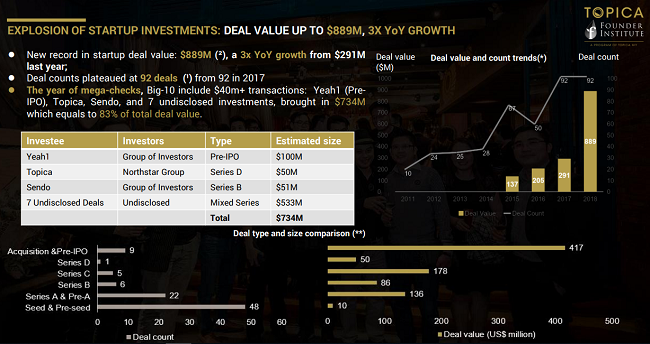

The report showed that the total investment in Vietnamese startups now has reached up to $889 million, three times higher than the previous year. At the same time, 2018 witnessed 92 investments in Vietnam’s startups, similar to 2017, and nearly doubling 2016 in terms of number of deals (50 investment deals worth $205 million).

In particular, the highlight of 2018 is that Vietnam continued to receive "huge" investment deals when the top 10 transactions brought in $734 million, accounting for 83 per cent of the total agreed value including $30-million investments in Yeah1, Sendo and Topica and seven other undisclosed deals.

Most notably, Yeah1 - Vietnam's first media company was listed on the stock exchange and VNG has become Vietnam's first "unicorn" startup in the field of technology, with valuations up to $1.2 - $1.5 billion.

M&A deals of startups in the last year were also very bustling such as Grab’s acquisition of Moca, Sea’s acquisition of Foody and Giaohangtietkiem, etc.

TFI’s report also stated that the six sectors which are currently attracting the most investments include Fintech ($117 million), E-Commerce ($104 million), TravelTech ($64 million), Edtech ($54 million), Logistics ($54 million) and online Real Estate ($47 million).

As for the field of ride-hailing, Vietnamese startups like FastGo, Vato and newcomer Be Group have successfully raised funding to compete with foreign rivals like Grab and Go-Jek. Be Group, founded by Tran Thanh Hai, was thought to have raised hundreds of millions of US dollars.

Another good sign is that last year, startups witnessed the emergence of many domestic venture capital funds such as VietCapital Ventures, Startup Viet Partners, Teko Ventures. Vingroup's investment fund Vingroup Ventures announced the investment budget of $300 million, $100 million of which VinaCapital Ventures accounts for.

Meanwhile, Vietnamese’s existing venture capital funds such as ESP Capital, 500 Startups and VIISA continue to boost their operations with 32 deals in 2018, accounting for 60 per cent of the pre-seed and seed investments.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.