Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

With their two famous brands Adidas and Reebok, Adidas Vietnam, is winning the local market against their rival company, owner of Nike and Converse brands. And now an emerging local brand called Biti’s is also joining the race.

Vietnamese consumers have grown their interests in branded sportswear, especially those produced by “big names” like Nike and Adidas companies.

In 2016, along with the country’s better economic performance, the sportswear sector also rose by 11% to reach US$280 million, according to Euromonitor’s report on Sportswear in Viet Nam.

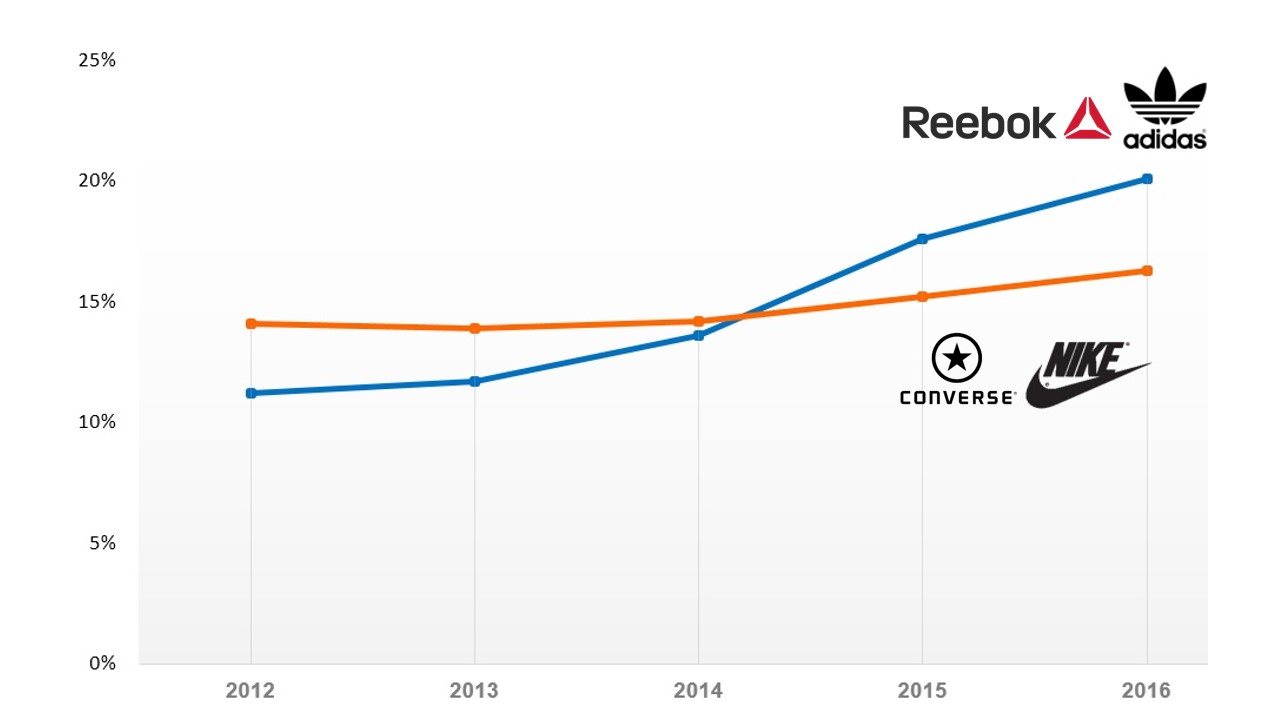

Nike and Adidas are like “Cocacola and Pepsi” on the sportswear world.The two rival brands are also competing fiercely for market shares in Viet Nam. According to Euromonitor, in the past years, Nike has remained as the leading brand in the local market, with a share of 14.5% in 2016. However, Adidas almost caught up with its competitor with a very narrow gap of 0.5%.

Another point of note is that Adidas is accelerating its market share growth. While Nike’s share rose by a negligible 2% in the last three years, Adidas doubled its proportion during the same period. The year 2016 also witnessed Adidas’ highest value sales growth of 27%, thanks to the expansion of its distribution network and dynamic marketing campaigns throughout the year.

The competition between Nike Inc. and Adidas Vietnam Co. is even tougher with participation of two other brands also belonging to these companies, Converse by Nike Inc. and Reebok by Adidas Vietnam Co.

With Reebok gaining 5% of the market and Converse only 2%, the balance now shifts in favor of Adidas Vietnam Co. Its total shares of the Viet Nam market reached nearly 20%, while the figure for Nike Inc was 16%.

The majority of local brands struggle to compete with these foreign giants, except for one name: Biti’s. The domestic company behind this brand, Binh Tien Co., has a long history of more than 30 years making sandals and shoes.

The successful campaign called Biti’s Hunter since 2016 has gradually brought widespread fame to this brand. Its viral marketing strategy has proved a success with millions-view videos featuring famous singers and thousands-like posts by top celebrity on social media.

It is still unknown whether the local or the foreign will win this race in the long run. However, with a dynamic population, and growing standards of living, Viet Nam is obviously an active but competitive market for all sportswear makers.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.