Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

Enterprises are cashing in on positive outlook of the stock market to mobilize capital from shareholders as bond interest rates tend to increase.

Vietnam's biggest real estate developer Vingroup has announced a plan to increase its charter capital by offering 250 million shares to five foreign institutional investors, aiming to raise at least $1.078 billion.

According to Vingroup, 60 per cent of the proceeds is expected to fund its expanding business and the remaining will be used to pay off loans and due interest.

Investors are considering Vingroup's share issuance as a prompt move to cash in on growing stock market to raise capital for investment expansion and debt repayment.

In addition, the group is also facing the possibility of paying higher interest for bonds in the coming years as some of the bonds have floating interest rates.

Although Vingroup has developed into a multi-sector group, most of its assets and revenue are still generated from the real estate sector. Due to huge investments in real estate projects as well as the multi-billion-dollar VinFast automobile project, which is under construction, Vingroup nearly doubled its debts last year.

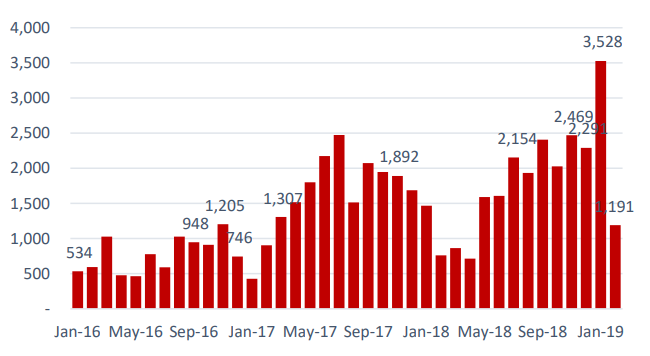

Its total loan and debt value increased from over VND51 trillion ($2.2 billion) at the end of 2017 to about VND91 trillion ($3.93 billion) at the end of last year. Of the debts, VN22 trillion ($950 million) came from bond issuance and nearly VND19 trillion ($820 million) are long-term loans.

Over VND19 trillion ($826 million) of debts and short-term loans is due this year and part of the proceeds raised from share offering to foreign investors this year will be used to pay these debts and loans.

In addition, Vingroup will have to pay the interest worth trillions of dongs this year. Last year, due to the increase in debts, the group spent VND4,337 billion ($187 million) to pay interest.

The wave of bond issuance to raise capital in the financial market has developed strongly in recent years, particularly among real estate enterprises.

Real estate developer Novaland also increased its debts in the form of bonds last year. By the end of 2018, its bonds reached over VND13.8 trillion ($596 million), accounting for around 85 per cent of the group's total debts.

Dat Xanh Group also doubled the value of bonds issued in 2018 to VND2,277 billion ($98 million).

Techcom Securities (TCBS) said that in 2018 it successfully issued nearly VND62 trillion ($2.68 billion) of bonds for large enterprises in Vietnam.

According to fund management company Techcom Capital, the corporate bond market will become bustling this year as giants such as EVN, Masan, Vingroup and Sun Group will continue to issue medium-term bonds of up to hundreds of millions of US dollars.

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.