Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Forbes magazine has also ranked Hoa Phat Group and VietJet Aviation as rising stars to crack the Asia's Fab 50 Companies in the years ahead.

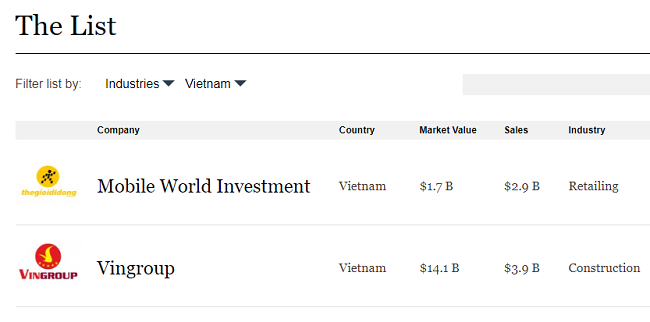

Vingroup and Mobile World were honoured by Forbes magazine in its list of Asia’s top 50 listed companies (Asia’s Fab 50 2018).

Mobile World is known as Vietnam's leading retailer, with 2,166 stores nationwide. According to its performance report in the first quarter of 2018, Mobile World recorded the consolidated net revenue of VND44,570 billion (approximately $2 billion).

The consumer electronics chain (Dien May Xanh) contributed 56 per cent of the net turnover, following by the mobile phone chain (The Gioi Di Dong) with 41per cent and the grocery chain (Bach Hoa Xanh) with three per cent.

Last year, Mobile World was the only Vietnamese company named in the Fab 50 List. Meanwhile this is the first time Vingroup has made it to the list.

Vingroup JSC is engaged in multisectors including real estate, tourism, retail, agriculture, education, healthcare services and technology - industry. Vingroup announced the goal of becoming a world-class conglomerate specializing in technology-industry-service, of which technology is the main focus.

Regarding business results, Vingroup has continuously maintained impressive growth. According to the consolidated financial statement for the second quarter of 2018, Vingroup recorded a total consolidated revenue of VND32,741 billion (over $1.4 billion) and pre-tax profit of VND3,606 billion ($155 million). The Group's total assets reached VND242,176 billion ($10.4 billion) and equity was VND 86,838 billion ($3.73 billion).

According to Forbes, to arrive at the Fab 50, it starts with a pool of 1,744 publicly traded companies in China, India, Japan, South Korea, Australia, Vietnam, etc.

Companies named in the list are those which have at least $2 billion in annual revenue, carry long-term debt that's equal to less than half of their total capital, have less than 50 per cent state ownership and have revenue higher than it was five years ago.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.