Business

VinaCapital identifies three promising investments in 2022

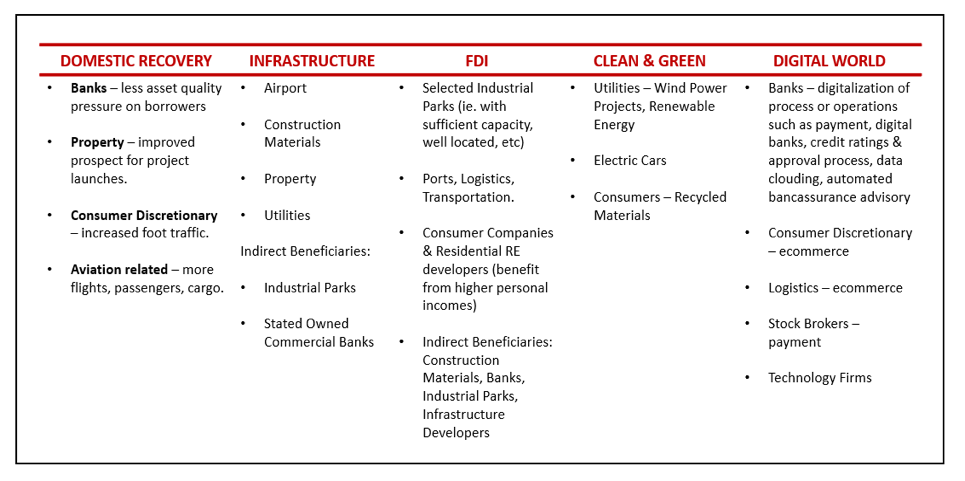

There are three sectors that VinaCapital expects to benefit from very strong outlook for Vietnam’s GDP growth, including banking that has a circa 30 per cent weighting in the VN-Index), property (23 per cent), and consumer discretionary stocks (3 per cent).

Banks’ earnings are likely to grow by about 30 per cent this year, driven by 14 per cent credit growth, and the fact that Vietnam’s banks are less likely to be impacted by Covid-19 in 2022, VinaCapital estimated in its latest report.

Specifically, asset quality issues should have less of an impact on banks’ earnings, and it do not expect banks to sacrifice profitability to help support the economy again in 2022.

Furthermore, two ongoing trends will support Vietnamese banks’ profitability, including an improving loan mix (more retail and SME loans), and lower funding costs, driven by a higher contribution from low-cost current account savings account sources.

In addition, the government’s non-performing loans forbearance measures will enable banks to spread their loan losses from Covid-19 over three years, which will support their profitability this year.

VinaCapital noted that it is not overly concerned about asset quality issues. It estimates that more than one-third of the loan losses that banks could eventually suffer from Covid-19 have already been provisioned against, as well as the fact that a high proportion of loans are backed by real estate collateral, and property prices continued to climb over the last two years.

Although being quite optimistic about the overall prospects of the banking sector, it expects earnings growth of individual banks to vary from circa 6 per cent to circa 50 per cent, partly because the State Bank of Vietnam will allocate credit growth quotas based on asset quality, and expect credit growth to average 14 per cent this year.

In addition, there are many idiosyncratic factors that could impact both earnings and share prices, including bancassurance deals with foreign insurance companies (which typically entail generous up-front payments) and turn-around/restructuring stories.

The next key sector in Vietnam’s stock market this year is property.

VinaCapital forcasts the earnings of real estate development companies to grow by nearly 25 per cent in 2022, driven by a near-doubling of sales/pre-sales of new housing units following a drop of more than 50 per cent in 2021 because of the Covid-19 lockdowns, as well as legal/regulatory issues that are now starting to be addressed and resolved.

In addition, the earnings of real estate firms that have recurring revenues are also set to rise.

Continued enthusiasm for investing in real estate – thanks in-part to the low deposit rates banks pay savers – should ensure that property prices continue to increase in 2022.

“We believe that the continued increase in real estate prices and a pent-up demand to purchase homes to live in or for investment purposes will drive the above-mentioned, anticipated jump in the pre-sales of new housing units,” emphasized VinaCapital.

Finally, consumer spending should continue rebounding in 2022, cause the pandemic has accelerated the trend of consumers shopping in the modern retail channel as well as e-commerce.

That said, incomes were severely hit during the pandemic, so some consumers are likely to shift to cheaper products, resulting in some non-essential or high-end goods not recovering to their pre-Covid sales levels this year.

The very strong outlook for Vietnam’s economy is expected to propel the stock market higher, which follows last year’s 36 per cent surge in the VN-Index.

The investor participation in the stock market will continue growing vigorously in the years ahead. Despite the large number of stock market accounts opened over the last 18 months, the proportion of Vietnamese people who invest in the stock market is still fairly small.

In addition, despite 2021’s remarkable rise in corporate earnings, VinaCapital expect a further 26 per cent increase in earnings this year. It observes that bull markets that are driven by earnings growth are healthier and more sustainable than those that are driven mainly by P/E multiple expansion.

Foreign investors finance to help HDBank expand lending to smaller businesses

Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek secures $200 million IFC loan following revenue drop

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

Leading with empathy in Vietnam’s billion-dollar investment flows

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land’s new logo marks a new growth trajectory

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

SAP positions Vietnam as key R&D hub with €150 million investment

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam returns, leading sustainability and innovation in energy sector

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.