Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

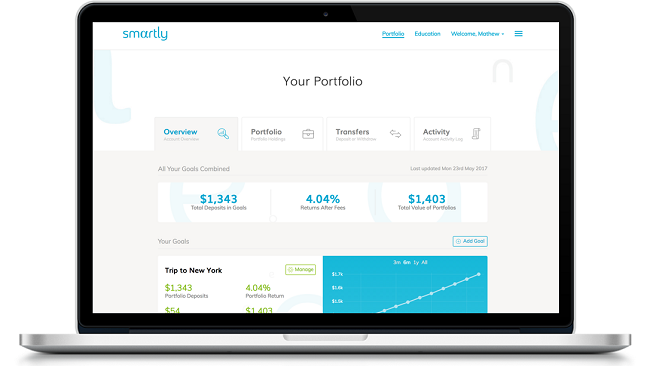

VinaCapital has acquired the business operations of Smartly, one of the first robo-advisory investment platforms launched in Singapore.

Terms of the transaction were not disclosed.

Smartly was founded in 2015 by entrepreneurs Keir Veskivali, Artur Luhaaar and Kentwell Kwok. It targets Southeast Asian millennials to offer basic financial literacy and opportunity to invest easily with full transparency and low fees.

Veskivali will continue to support the company as a consultant and will work with VinaCapital on other tech ventures.

In 2016, Smartly began discussions with VCG Partners, the Singapore subsidiary of VinaCapital and a fully licensed fund manager regulated by the Monetary Authority of Singapore, about joining together to launch the platform.

Under the partnership, Smartly successfully launched in September 2017. It uses smart algorithms to make investing simple and accessible to more people. Investors complete a simple questionnaire that assesses their risk tolerance, financial situation and goals. The robo-advisor then recommends a portfolio made up of a basket of exchange-traded funds (ETFs). The algorithms then rebalance portfolios on a periodic basis, accounting for changes in the global economy.

“By partnering with VinaCapital, we took a different approach to launching a robo-advisory platform than the rest of the pack. We were able to allocate valuable capital to places where it was most needed, stay focused on execution, and maintain strong financials and unit metrics. VCG Partners clearly saw the potential of the market and the platform. This acquisition of Smartly’s operations and the additional capital injections will enable Smartly to scale-up, expand to new markets, and realize its full potential to become the leading digital wealth management platform in the region,” said Veskivali.

Today, robo-advisory services manage more than $980 billion in assets around the world, with forecasted compounded annual growth of around 27 per cent between 2019 and 2023 according to Statista. Markets like Singapore and other countries in Southeast Asia, with large digitally native populations, high smartphone penetration, and increasing wealth are ripe for robo-advisory investment platforms.

“Smartly has been a trailblazer in robo-advisory services in Singapore, and we look forward to building on the momentum and expanding to other Southeast Asian markets as their regulatory environments allow. For example, in Vietnam, current laws do not address robo-advisory services, creating significant risks for investors who elect to invest with some of the start-ups in the market that claim to offer such services,” said Jason Ng, VCG Partners’ CEO.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.