Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

Despite being the exclusive distributor of the Premier League in Vietnam, the leading pay-TV K+ still suffered an accumulated loss of $103 million.

Founded in 2009 from a joint venture between Vietnam Television (VTV) and Canal+, a French premium cable television channel, Vietnam Satellite Digital Television Company Limited (VSTV), the service provider of Kplus (K+) is one of the largest pay television service based on satellite television system.

Currently, K+ has a system of 130 diversified television channels and is the exclusive distributor of the Premier League, the top level of the English football league system in Vietnam, which is a crucial factor contributing to the success of K+ in the market.

Yet, the business outcomes of K+ is not very optimistic. Particularly, after building a subscriber base thanks to the exclusive distribution of the Premier League, the growth of K+ subscribers started to fall from mid-2016.

The decline in subscribers of K+ occurred even when the company announced to reduce its service fee to VND125,000 monthly ($5.38/month) since the beginning of 2016, nearly half lower than the fee of premium HD service previously known as VND220,000 monthly ($9.47/month).

According to the statistics from Vivendy, the owner of Canal+, K+ only had 789,000 subscribers by the end of 2017, a decrease of over 60,000 subscribers compared to the same period of 2016, despite the strong increase in the number of paid subscribers in the country. Specifically, the number of paid subscribers in 2017 reached 14 million, an increase of 1.5 million subscribers compared to 2016.

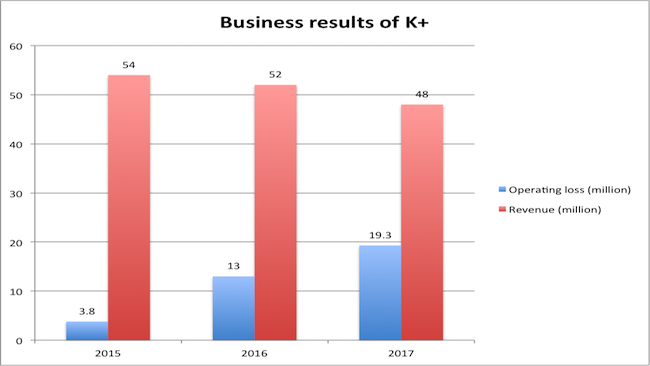

The decrease in subscribers resulted in a much lower revenue and profit of K+. In particular, the company’s revenue in 2017 reached roundly $48 million, a decline of seven per cent compared to the previous year. This fall also marked the second consecutive year of decrease in revenue of K+.

In addition, the strategy of a single subscription fee with the price of VND125,000 monthly ($5.38/month) made K+ suffered severe losses. In 2017, the company reported a loss of approximately $19.2 million, up roundly 50 per cent compared to 2016.

The increase in loss of K+ resulted from the expense of being the exclusive distributor of the Premier League in Vietnam and other exclusive programs of K+. In particular, K+ spent a large amount of money, around $46 milion, buying the broadcast copyrights of the Premier League in Vietnam for three seasons from 2016 to 2019.

By the end of 2017, the accumulated loss of K+ reached roundly $103 million in less than 10 years of operation in Vietnam. Meanwhile, the company only has a charter capital of approximately $15 million. Hence, to maintain its operation, K+ often has large-scale short-term loans, specifically, these figures came to over $50.2 million in the end of 2017.

The downturn of K+ partly reflects the fierce competition of the pay-television market in Vietnam. In addition to several large television stations such as SCTV or VTV, the market is now filled with many new and competent names like Viettel, Mobifone or FPT.

Especially, the appearance of OTT (over the top) media services, content providers that distribute streaming media as a standalone product directly to consumers over the internet, bypassing telecommunications, multichannel television, and broadcast television platforms, worsened the situation for K+.

After an ineffective year of operation, K+ is trying to regain its position in the market. At present, K+ has provided full services on all platforms, including on OTT. With its strength in football field, K+ plans to excessively exploit all big football events in this year.

Initial changes of K+ is starting to pay off as by the end of June this year, the number of subscribers of K+ has surged significantly. Currently, the number of K+ subscribers have reached one million, the highest number ever.

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.