Indochina Kajima breaks ground on Grade A office building in Hanoi’s emerging hub

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.

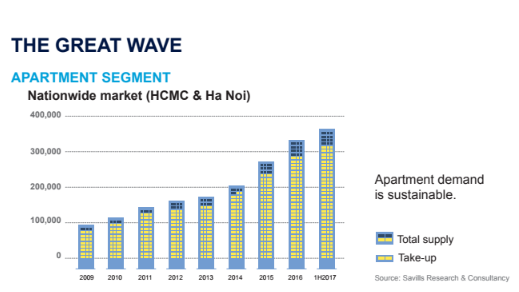

According to a dwelling research just launched by Savills, one of the largest property consultancy firm in Vietnam, in Q2 2017, there was a 67 per cent year-over-year (YoY) increase in sales to 11,600 units in Ho Chi Minh City whilst in Hanoi it was 13 per cent to 6,800 units.

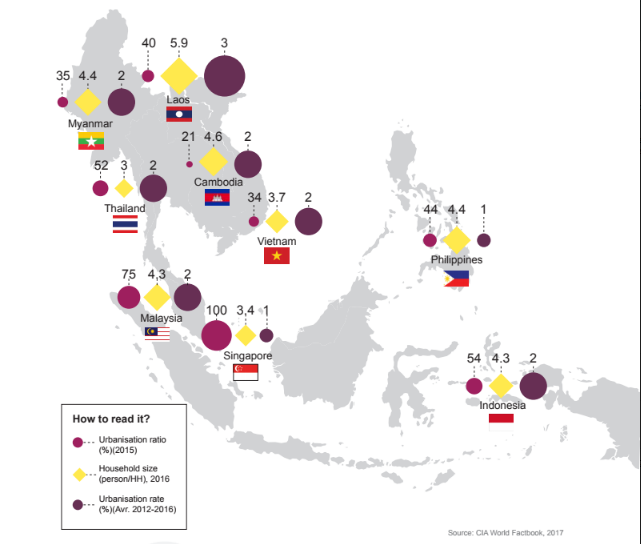

In a regional context, Viet Nam has a low proportion of the urban population but a huge flow of rural migrants, resulting in a high urbanization rate. This factor combined with a large but declining household size, resulting in robust new dwelling formation.

Viet Nam has a low proportion of the urban population but a high urbanization rate. (Source: Savills)

According to the research, there were around 31 million people in Vietnam living in low-quality houses, accounting for 27 per cent of the population.

And the need for dwelling replacement has increased dramatically. In Ho Chi Minh City and Hanoi, there are about 58,000 and 42,000 households formed respectively, increasing the demand for new living places. Besides, there is an emerging paradigm of single living in urban areas in Vietnam.

According to the General Statistics Office of Vietnam (GSO), the percentage of people choose to live alone in urban areas of Vietnam has increased significantly from 4.6 per cent in 1989 to 9.1 per cent in 2014; and the figure is predicted to reach 10.1 per cent in 2019.

The apartment demand in Vietnam is sustainable, with Ho Chi Minh City and Hanoi being strong regional markets. Specifically, both total supply and the take-up of departments in the two cities rose strongly since 2009, with the former rose by 100,000 apartments, meeting the increasing needs of dwellers.

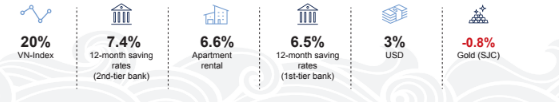

Besides, Hanoi and Ho Chi Minh City are strongly leading regional cities and yield with favorable investment channel, with limited alternatives. The gross rental yields in Ho Chi Minh City and Hanoi are 7.4 per cent and 5.8 per cent per annum respectively while the figure for Singapore is just 3.7 per cent.

Favourable investment channel, with limited alternatives (Source: Savills)

However, according to Savills, the recent hand-over apartments will put pressure on the rental sector in Vietnam as the first-time home buyers and occupiers are increasing in share.

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.

While the average price of apartments in Hanoi has reached new heights, with supply primarily concentrated in the premium and luxury segments, there are still no signs of a price slowdown.

The supply of luxury apartments in central Hanoi is becoming increasingly scarce, pushing starting prices to new highs.

Vietnam's hospitality industry is undergoing a major transformation with a brand repositioning strategy that emphasizes unique, sustainable, and community-focused experiences.

High demand and limited supply drive transactions in major urban areas despite soaring costs.

Despite the real estate market's lackluster performance, several companies are accelerating land acquisition efforts.