Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

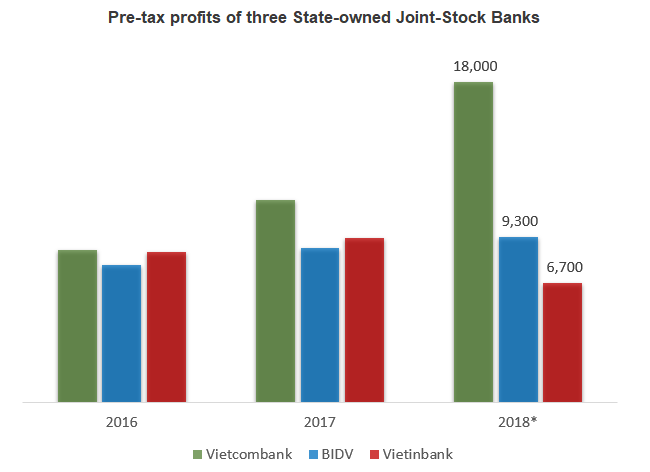

While both Vietcombank and BIDV announced significant profit growth, Vietinbank remained quiet and kept secret until the end.

The group of state-owned commercial joint stock banks - the largest-scale credit institutions in Vietnam’s banking sector shows the different picture.

Vietcombank, one of the largest banks in Vietnam, reported record business results. In 2018, the bank boosted mobilization with total deposits of VND910,926 billion ($39.3 billion).

Vietcombank's credit outstanding balance reached VND635,452 billion ($27.4 billion), an increase of 14.9 per cent compared to 2017, in which retail credit increased from 36.9 per cent in 2017 to 46.2 per cent at the end of 2017.

Accordingly, the bank's pre-tax profit reached VND18,016 billion ($778 million), an increase of 63.5 per cent compared to 2017, the highest growth rate in many years. The consolidated profit reached VND18,346 billion ($792 million), up 62 per cent.

In addition, the highlight of Vietcombank in the past year was the bad debt ratio of 0.97 per cent with the internal bad debt balance at VND6,181 billion (nearly $267 million), the risk provision fund worth VND10,490 billion ($453 million).

Vietcombank is also the first bank to apply Basel II standards. In early 2019, the bank successfully raised $265 million from selling shares to foreign partners.

Despite not being "majestic" like Vietcombank, Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) also ended 2018 with good business results.

According to BIDV, in 2018, the bank's total assets reached over VND1,283 trillion ($55.4 billion), up 9.1 per cent compared to 2017; total mobilized capital reached over VND1,036 trillion ($44.7 billion), up 11 per cent; total credit outstanding balance and investments reached over VND1,214 trillion ($52.4 billion), outstanding loans balance to the economy increased by 13.3 per cent; revenue and expenditure difference grew by 13 per cent.

Although it has not announce the net profits in 2018, the bank said it had completed the business targets set by the General Meeting of Shareholders in earlier 2018. Therefore, BIDV's pre-tax profit in 2018 reached at least VND9.3 trillion ($401 million) as planned.

More importantly, at the end of the year, BIDV was approved by the SBV to sell shares to foreign partners. It is expected that the sale of 15 per cent stake to Korean bank KEB Hana will soon be completed in early 2019. The deal which is estimated at $700 - $800 million will remarkably raise BIDV’s capital to meet Basel II capital standards, thereby, helping the bank maintain credit growth.

With abundant resources, in earlier this year, both Vietcombank and BIDV decided to reduce lending rates on a large scale for the group of priority enterprises.

In contrast, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) in 2018 got unfavorable business results. In the last quarter of 2018, while many banks asked the State Bank of Vietnam (SBV) to extend the credit limit, VietinBank was forced to reduce the size of loans to ensure capital safety.

According to Vietinbank, the bank’s credit outstanding balance in the fourth quarter of 2018 decreased by VND26 trillion ($1.12 billion), lowering credit growth to 6.1 per cent at the end of the year, much lower than the overall growth of the banking sector.

The reluctant decline in credit growth resulted from VietinBank’s difficulty in increasing its equity. While Vietcombank meets Basel II standard even without raising capital, VietinBank needs more external resources to improve its capital adequacy ratio.

Because the bank has failed to raise its charter capital for many years, VietinBank's operational resources are assessed “to reach the limit”. However, it is more difficult for VietinBank to raise capital because the foreign ownership rate in the bank was filled while the State ownership fell below 65 per cent. Therefore, the bank is facing difficulty in issuing shares to foreign investors to raise capital.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.