Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

In the oral care market, the US based toothpaste company Colgate-Palmolive Vietnam is facing fierce competition from P/S and Closed Up and many other specialized brands.

Having joined Vietnam’s market since 1996, Colgate - Palmolive (Colgate), is one of the first global consumer brands to jump into Vietnam. Colgate and Unilever are the two biggest brands in the country in terms of oral hygiene, especially toothpastes, tooth whitening products and toothbrushes.

Initially, both Colgate and Unilever had taken the same development path, in which they acquired a large domestic enterprise to enter the Vietnamese market.

Specifically, meanwhile, Unilever acquired Phong Lan company (owner of P/S toothpaste brand) at $5 million, Colgate spent $3 million purchasing Da Lan, the famous toothpaste brand at that time.

After the acquisition, Colgate quickly eliminated Da Lan brand to develop its own Colgate-branded toothpaste products. By 1998, Colgate also asked to dissolve the joint-venture for the reason of loss.

Over two decades of presence in Vietnam’s market, Colgate has built a strong brand in the minds of Vietnamese people. Statistics issued by the Ministry of Health show that currently, more than 90 per cent of Vietnamese people have oral problems but they rarely go to see dentists.

About 85 per cent of children aged from six to eight have tooth decay and most of them don't get the treatment, which will boost sales of dental care products. Euromonitor predicts that the sales of oral care products will have an average growth rate of 5 per cent in the period of 2017-2022.

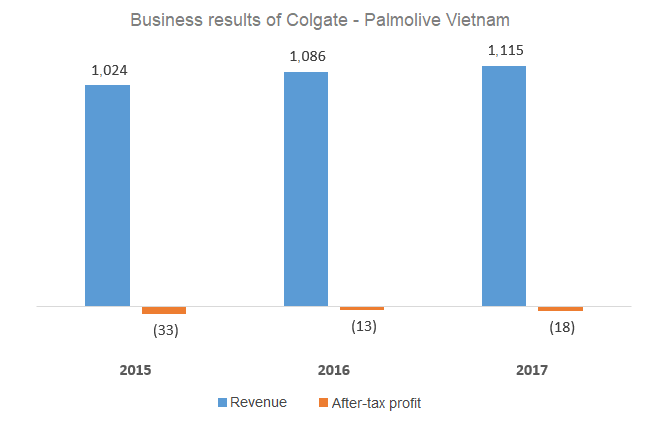

However, Colgate's business results in the past few years have not been as positive as the potential of the market. From 2015 to 2017, the company's revenue was around VND 1,000 billion ($43.2 million) per year and hardly grew.

While sales grew slowly, Colgate's selling and management costs increased faster. In 2017, selling and management expenses reached VND431 billion ($18.6 million), up 6 per cent over the same period. Increase in selling costs shows that Colgate must spend more on advertising and discount for distributors.

Colgate's biggest rival in Vietnam is Unilever, the world's largest consumer goods group. In the field of oral care, Unilever Vietnam accounted for 47 per cent of market share in 2017 with two very prominent brands P/S and Close-up.

Unilever has made a huge investment to introduce its products to rural and remote areas, which are considered the most booming market in Vietnam in the coming years. Besides foreign rivals, Colgate is also competing with some domestic companies such as Dai Viet Huong or Aloe.

On the other hand, in urban areas where people are willing to spend more on dental problems, Colgate faces competition not only from Unilever but also a range of global brands and other specialized care products.

The difficulty has resulted in Colgate's continuous losses in the past years. In 2017, the company reported a loss of VND 15.7 billion ($678,039), up VND2.7 billion ($116,605) compared to the previous year.

By the end of 2017, the company accumulated a loss of VND253 billion (nearly $11 million), higher its charter capital of only VND181.5 billion ($7.84 million). This is also the year the company incurred short-term loans of VND 30.6 billion ($1.3 million), showing that the company needs external resources to solidify its operations.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.