Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

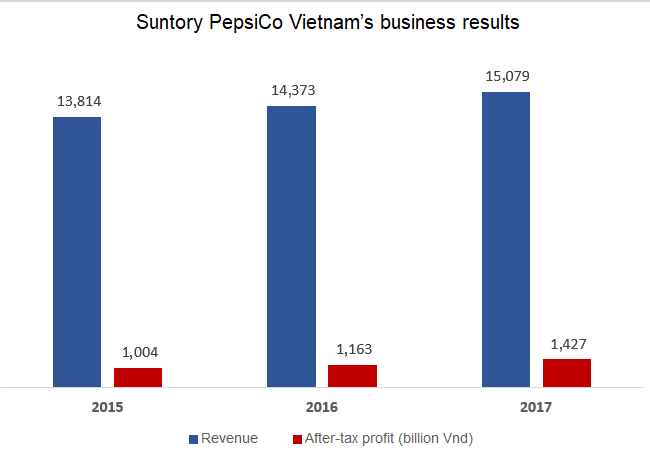

After being raised doubts over the price transfer, Suntory PepsiCo Vietnam has recorded an impressive business delivery of over $150 million in net profit in recent years.

Having been present in Vietnam since 1994, PepsiCo Vietnam (now transformed into Suntory PepsiCo Vietnam – Pepsi joint-venture) and Coca-Cola quickly became the two biggest brands in the non-alcoholic beverage market in Vietnam.

Similar to the prolonged war between Pepsi and Coca-Cola taking place globally, the two giants have been competing fiercely with each other domestically. Pepsi has in recent years outperformed revenues, which are two times higher than those of Coca-Cola.

In each segment, the two companies have the same key products as each other. If Coca-Cola has Coca-Cola, Nutriboost, Samurai, Aquarius, Dasani,… Pepsi offers Pepsi, 7Up, Revive, Mirina, Aquafina, Twister, etc.

Like many other FDI companies investing in Vietnam, the two largest beverage companies in the world have recorded huge losses for a long time. This resulted in Coca-Cola and Pepsi being questioned about the price transfer by the local tax authorities.

However, in recent years, both Pepsi and Coca-Cola have shown positive business results. Even Pepsi has erased accumulated losses and accumulated a profit of VND2,735 billion ($117 million).

Specifically, in 2017, Pepsi achieved a revenue of VND15 trillion ($645 million) and an after-tax profit of VND1,427 billion ($61.3 million), up 5 per cent and 27-per cent respectively compared to last year.

Coca-Cola’s revenue grew at six per cent last year, reaching VND7,218 billion ($310 million). However, due to steep increase of costs, the company recorded only a net profit of VND227 billion ($9.75 million), equal to half of that of the previous years. Coca-Cola has reduced about VND1 trillion ($43 million) in accumulated losses thanks to its accumulated profits in recent years.

Business performance of both Pepsi and Coca-Cola in Vietnam is expected to continue improving in the coming years thanks to the growth of the non-alcoholic beverage market, especially in rural areas where sweetened beverages are still popular.

Pepsi and Coca-Cola’s biggest local rival is Tan Hiep Phat, which is leading the green tea segment with Zero-Degree Lemon Green Tea and Dr. Thanh products.

According to Euromonitor’s report, the non-alcoholic beverage market share based on PepsiCo's off-trade sales has risen sharply from 27 per cent to 33 per cent in the past five years. Meanwhile, that of Coca-Cola was only around 10 -11 per cent and Tan Hiep Phat was down from 16.5 per cent to 13.1 per cent due to the scandal which accused its product of containing a fly.

Off-trade is a sales channel (such as supermarkert, agent) that accounts for about 60 per cent of the non-alcoholic beverage market, while the remaining 40 per cent is represented by on-trade (products are directly sold at restaurants, eateries, etc).

However, despite its lower market share, Tan Hiep Phat's profit margin far exceeded that of Pepsi and Coca-Cola. In 2017, total revenue from two plants of Tan Hiep Phat in Binh Duong and Ha Nam provinces reached nearly VND7 trillion ($300 million), but pre-tax profit was reported at VND1.8 trillion ($77.3 million), equivalent to profit margin of 26 per cent. This rate is only about 10 per cent in the two foreign companies.

The reports show that the cost of goods sold by Tan Hiep Phat is around 60 per cent of revenue while in the two foreign companies, it accounts for 70 per cent. In particular, Coca-Cola’s selling cost is twice as high as that of Tan Hiep Phat. Pepsi is four times higher, but its turnover is only two times higher than that of Tan Hiep Phat.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.