Indochina Kajima breaks ground on Grade A office building in Hanoi’s emerging hub

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.

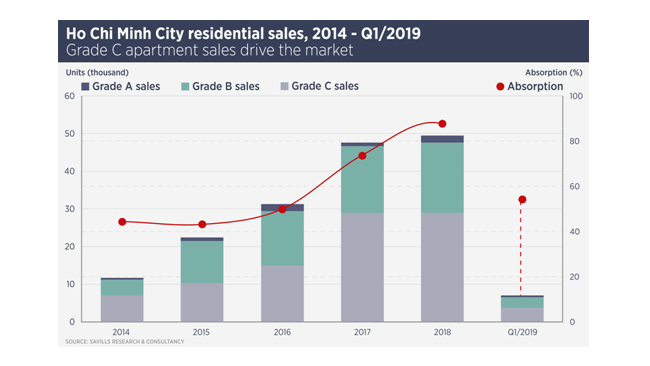

The residential sector is at the apex of Ho Chi Minh City’s growth, driven by a need for better housing, a growing middle class and an increasing number of overseas buyers.

.png)

According to Savills Vietnam, Ho Chi Minh City is undergoing massive change, through demographics, infrastructure and a burgeoning middle and affluent class. The future looks sound and the city will benefit from external drivers such as trade tensions, the domestic economy is in good shape and the government’s drive to improve governance is paying dividends.

“Ho Chi Minh City is the nation’s gateway city and hub of commerce, capturing this growth in its dynamic residential market. With strong immigration and a low urbanisation ratio, relatively high household occupancy and a large qualitative deficit then conditions are ripe for residential development. This is also the first generation of high-density apartment living, which now allows affordable homes for the mass market,” said Troy Griffiths, deputy managing director at Savills Vietnam.

New residential developments, as the real estate service provider noted, can sell up to 30 per cent to foreigners and this allocation tends to sell quickly.

According to Griffiths, historical supply in the city has been predominantly C grade dwellings and future supply, handovers and launches will also be mostly C grade. This is driven by owner-occupiers, who in Vietnam are not overly exposed to debt, so the chance of a housing bubble is low.

“While C grade has been the market driver, there are now many more launches of upper B and A grade apartments - in a few cases at eye watering prices. New A grade apartments tend to be located near the city centre and built to international standards.”

Meanwhile, Ho Chi Minh City retail has performed steadily in recent years; supply has risen, but so has take-up and rents. Savills estimated total retail stock to be around 1.4 million square metres and this is predicted to increase by one-third by 2021.

Ho Chi Minh City consumers prefer large-scale shopping centres as a destination for shopping and leisure, so malls outside the CBD have restructured their tenant mix by adding more service tenants such as F&B, healthcare, education, and gyms. These types of tenants typically seek longer leases at lower rents and also boost footfall. New malls tend have a large proportion of service tenants.

So far, e-commerce is a minor part of the Vietnam retail market, but this will inevitably change: one-third of Vietnamese are millennials and e-commerce revenues are slated to rise 40 per cent by 2025.

The Ho Chi Minh City office market has held steady for the past five years, with rising rents and take-up, even with rising supply. Rents for Grade A offices continued to lead the market, increasing 2 per cent in the first quarter of this year and 13 per cent since the start of 2018.

Ho Chi Minh City has seen rapid expansion of co-working over the last two years, more than 90 per cent per annum and there is now more than 37,000 square metres of co-working space, the majority of which (56 per cent) is in the CBD. Notable players include WeWork, Up, Dreamplex, Regus, Compass and Kloud. These companies are anchor tenants in many buildings.

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.

While the average price of apartments in Hanoi has reached new heights, with supply primarily concentrated in the premium and luxury segments, there are still no signs of a price slowdown.

The supply of luxury apartments in central Hanoi is becoming increasingly scarce, pushing starting prices to new highs.

Vietnam's hospitality industry is undergoing a major transformation with a brand repositioning strategy that emphasizes unique, sustainable, and community-focused experiences.

High demand and limited supply drive transactions in major urban areas despite soaring costs.

Despite the real estate market's lackluster performance, several companies are accelerating land acquisition efforts.