Property

Savills index reveals investment appeal of Vietnam

While the world city luxury home price growth slows, Vietnam luxury residential sector remains attractive to international buyers, Savills Vietnam’s latest spotlight reveals.

Price growth across the world’s leading prime city housing markets slowed significantly in the second half of 2018, according to latest data from the Savills world cities prime residential index, which recorded its smallest annual increase since the global financial crisis.

The index appears to be hitting a high plateau, Savills said. The index rose by just 2.3 per cent across 2018 as a whole, slowing to a marginal 0.4 per cent in the second half of the year. This compares to annual growth of 3.3 per cent in 2017. Rental growth also slowed across the index, leaving average world city yields for prime residential assets at a 10-year low of just 3.2 per cent.

“Prime residential real estate values are settling into a pattern of slower, steadier price growth and we do not expect to see a repeat of the double-digit annual price growth seen pre GFC,” said Sophie Chick, director, Savills world research.

“Back in 2007, spiralling global wealth generation and competition for trophy assets in established and emerging world cities, saw our prime sales index rise by 15.4 per cent in the year. But while growth is now expected to slow, we expect the search for security of tenure and title in cities where the world’s high net worth individuals wish to live and do business, to underpin values.”

World cities’ stories

Beyond the weakening Big Apple story, the major themes across the index are of cooling measures taking the heat out of price growth, the Brexit story stalling the London market and boosting demand for lower value mainland European cities, and the continued rise of West Coast city tech economies.

Hong Kong remains in a league of its own pricewise, having dominated the index over the past 10 years. Average prime residential values now stand at $4,660 per square foot 50 per cent higher than second ranked Tokyo. New York ($2,610 psf) and London (US$1,880 psf) complete the top four ranking, while Shanghai takes fifth spot from Sydney, where values slipped -1.7 per cent in the face of cooling measures, tighter lending criteria and increases taxes.

“Without doubt, the world’s wealthy will continue to want to hold one or more world city prime residential properties as part of their investment portfolio, both as a store of wealth and as a base for work and leisure,” said Sophie Chick.

“But as cities reach maturity on the world stage there will be less potential for rocket-fuelled price growth and we expect prime residential markets to settle a more steady growth trend over the foreseeable future.”

“There will be exceptions as new global cities emerge or economic conditions improve. In the short term, it’s the European cities that are likely to see the highest rates of price growth, benefitting from Brexit, lower prices and renewed confidence in markets like Spain.”

Vietnam cities’ stories

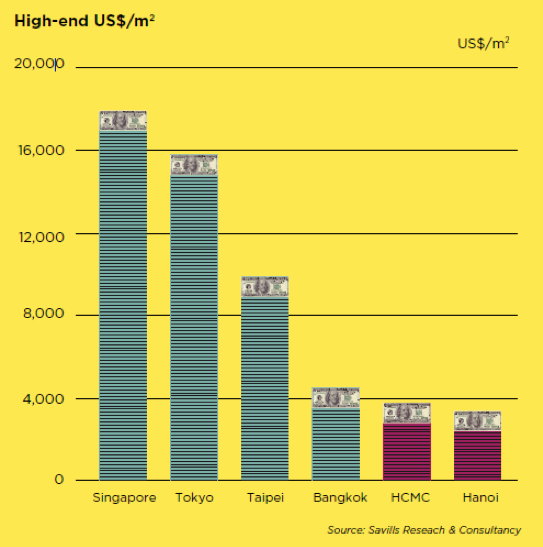

According to Savills Vietnam’s spotlight “Vietnam residential: Where to from here”, apartment prices in Ho Chi Minh City and Hanoi are generally still lower than regional peers such as Kuala Lumpur and Bangkok, despite much stronger growth rates in Ho Chi Minh City when compared with these markets.

Neil Macgregor, managing director of Savills Vietnam said: “The average price across the broader market is expected to continue to increase, albeit at a somewhat slower pace, with price increases linked to higher development standards and continued strong residential demand driven by urbanization, the rapid growth of the middle class, as well as new infrastructure.”

New home prices in Ho Chi Minh City’s CBD now average around $5,500 to $6,500/sqm, a fraction of the eye watering levels seen in Hong Kong where prices are at all-time highs.

“With many countries also introducing cooling measures, resulting in higher taxation, the relatively low taxation in Vietnam appears increasingly attractive to buyers both at home and abroad,” he said.

“With the distinct shortage of prime property in Vietnam’s key cities, many buyers can see the potential for significant capital gains over the longer term. Whilst in the meantime, rental yields in excess of 5 per cent, represent an attractive investment versus falling returns elsewhere in the region,” he added.

Foreign investors looking to acquire operating cash-generating assets

Hai Phong industrial property powers up with new project from Indochina Kajima

The project Core5 Hai Phong from Indochina Kajima and Itochu Corporation will deliver approximately 80,000 square metres of world-class ready-built factory for lease, handover expected in the first quarter of 2027.

A decade of unprecedented apartment price surge

A decade of relentless apartment price growth has pushed the dream of homeownership further out of reach for Vietnam’s middle- and lower-income earners.

Essensia Parkway sells out within hours, marking an outstanding partnership with WorldHotels

Essensia Parkway makes significant impact in the high-end real estate market as 100 per cent of the limited collection was successfully registered within just a few hours at the launching event with the theme “Live lux-well, in a truly refined world”.

Essensia Parkway gains global prestige through WorldHotels - Phu Long collaboration

Essensia Parkway is set to mark a significant milestone as the first branded residences project in Ho Chi Minh City to be operated by WorldHotels – one of the finest portfolios of independent hotels and resorts within BWH Hotels.

Indochina Kajima breaks ground on Grade A office building in Hanoi’s emerging hub

Parc Hanoi marks Indochina Kajima's first office-for-lease project in its $1 billion investment plan in Vietnam.

![[Hỏi đáp] Tại sao hộ kinh doanh nên 'tập dượt' kê khai thuế ngay trong năm 2025?](https://t.ex-cdn.com/theleader.vn/192w/files/news/2025/12/03/ho-kinh-doanh-1450.jpg)

![[Hỏi đáp] Bán hàng đa kênh: Sàn thương mại điện tử đã nộp thuế thay, phần bán tại cửa hàng kê khai thế nào?](https://t.ex-cdn.com/theleader.vn/320w/files/news/2025/12/03/ke-khai-thue-1134.jpg)