Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

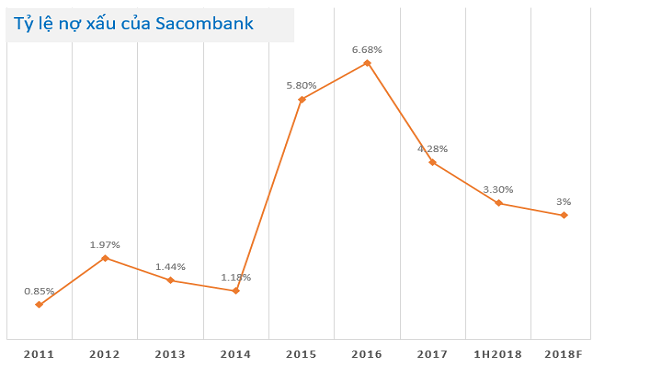

Sacombank's bad debt ratio was reduced to a little over three per cent, which is considered the safety limit, in less than two years.

According to Sacombank, its total assets increased by 8.7 per cent to about $17.4 billion in the first half of 2018.

Sacombank’s asset size has increased mainly due to the growth of capital mobilisation from economic organisations and individuals. Specifically, this source raised by 12 per cent, higher than the industry average, and reached roughly $15.8 billion at the end of June. The bank said its market share in capital mobilization increased from 4.7 per cent to 4.9 per cent.

Regarding lending activities, Sacombank's total credit reached over $10.7 billion, up 9.6 per cent compared with the beginning of the year. Its market share in lending increased to 3.6 per cent from 3.5 per cent of the beginning of the year.

Sacombank’s total revenue is over $217.3 million, up 49.1 per cent year on year. In particular, the service income continued to grow by 35 per cent year on year and reached about $49.3 million. Its profit before tax in the first six months of 2018 reached nearly $43.5 million.

Notably, Sacombank said it had collected more than $156.4 million of bad debt and outstanding assets in the first half of 2018. Its bad debt ratio, which reached 4.28 per cent at the end of 2017, has now reduced to 3.3 per cent.

In 2017, the bank's bad debt fell sharply to 4.28 per cent from 6.68 per cent in 2016. This excellent result was obtained thanks to the success of tackling more than $825.6 million of bad debt and outstanding assets.

Over a half of that debt was land use rights in Duc Hoa III industrial park, Long An province. These assets were assumingly related to Tram Be, former Vice Chairman of the Board of Directors of Sacombank from 2012 to 2015.

Recently, Sacombank has continued to announce a large-scale real estate auction, mainly in Ho Chi Minh city. To be more specific, it was announced that on June 28, land lots in Long An province, Ho Chi Minh City and Ba Ria Vung Tau province, which would be worth roughly $134.2 million.

Among those, the most notable are six land lots of Tan Kim industrial park (Can Giuoc district, Long An province), which have an area of over 291,000 square metres. Their initial value is nearly $45 million.

Other properties being auctioned are also located in District 8, Binh Thanh district or Tan Phu district, Ho Chi Minh city. Their value ranges from $16.6 million to $19.4 million.

On the website, the bank also offers other high-value real estates for sale such as industrial land lots in Binh Duong ($55 million), land lots in District 3 ($17.5 million), land lots in District 7, Ho Chi Minh city ($8 million).

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.