Business

Proactive transformers earn higher returns

Possible correlations between the companies’ performance and their transformation approaches are found in a recent EY-Parthenon study.

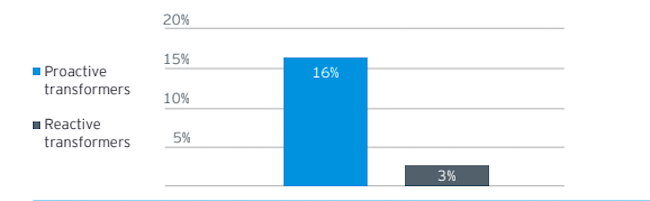

Proactive transformers saw an average difference of 13 percentage points in total shareholder returns (TSR) compared to reactive transformers, according to a recent EY-Parthenon report which studied the top 70 listed companies by market capitalization in Southeast Asia.

Transformative actions can include but are not limited to environmental, social and governance initiatives, digital transformation, supply chain management, and portfolio optimization.

Sriram Changali, EY Asean value creation leader, said that during the pandemic, businesses scrambled to adapt to the new normal, and drew up crisis management strategies to respond to an alphabet soup of possible recovery trajectories. Yet, many of these transformation actions have not translated into value creation for the companies.

“Hence, it is important for companies to understand how their transformation approaches and their execution impact the success of their transformation journey and enhance the value of their organization,” said Sriram Changali.

“There is no one single transformative approach that companies should look to. Instead, it can be a multitude or combination of approaches, which include acquisitions, digitalization or even divestments and restructuring, to help optimize the value of the business,” Angela Ee, EY Asean and Singapore restructuring leader added

The transformation approach impacts business performance

The EY-Parthenon study called "Transformation in Southeast Asia: Four archetypes of outperformed" found possible correlations between the companies’ performance and their transformation approaches. The study also identified four types of transformation actions that led to the companies’ outperformance relative to peers.

Companies that undertake transformation even when they are already outperforming the industry are considered proactive transformers. In contrast, companies that undertake transformation when underperforming against the industry are considered reactive transformers.

The EY-Parthenon report highlights that in the periods following transformation, proactive transformers in SEA saw a 13 percentage point outperformance on TSR compared to reactive peers.

Serial transactors are a subset of proactive transformers, and they transact more than reactive companies. The EY-Parthenon study found that proactive transformers who are serial transactors in SEA transacted more than their reactive peers by 13 per cent between 2018 and 2021 and were 23 per cent more active during the economic slowdown in 2021. Historical evidence also suggests that transactors had a 25 per cent increase in TSR over non-transactors in the period after the global financial crisis.

Active investors are companies that invest more, which is reflected in their TSR outperformance. The EY-Parthenon study highlighted that companies that outperformed the industry in the years following their transformation also consistently had a higher investment rate compared to their counterparts. The outperformers have, on average, a 17 per cent higher capital expenditure spending as indicated by their Capex-to-sales ratio, compared to their underperforming peers in the period before and during the pandemic.

Holistic transformers are the companies that undertook transformation on multiple fronts. Over 90% pursued ESG initiatives; 83 per cent invested in digitalization, while 51% invested in supply chain management. However, the study also found that companies gave little attention to the key levers of transformation, including balance sheets and financial restructuring.

Changali said that initiatives such as digital transformation are typically expensive, with unclear business cases that some boards may struggle to navigate.

“It is critical that such initiatives are combined with cash release through cost optimization, working capital optimization, and financial restructuring,” said Changali.

Five imperatives to successful transformation

The EY-Parthenon study also highlighted that execution would determine the success of the transformation initiative. There are five imperatives that companies should note when undertaking any transformative actions.

Firstly, align CEO and board on the purpose of the transformation and the value for the organization.

Secondly, set aspirational targets and incentivize success over and above what is available in a business-as-usual setting that aligns with the objective of transformation and is linked to clear outcomes

Thirdly, set up execution rigor and get commitment from the top is crucial to maintaining accountability.

Fourthly, calibrate the journey to balance the costs with the potential upsides and communicate with key stakeholders along the journey.

Finally. build capabilities to improve functional, technical, and leadership expertise and equip employees with the right tools.

Transformation is not just for companies in distress. Companies that have been resilient during the pandemic have also undertaken transformative actions that helped to position them for long-term success. Transformation via business restructuring can be vital to preserving value for a company and its stakeholders. From refinancing and cash flow improvements to the divestment of assets and management of liabilities, there are numerous ways that executives can maintain or create value in their organization.

“Hence, when undertaking a transformation project, companies should not discount restructuring, which can be a way to turn adversity into opportunity,” Ee concluded.

Transforming towards sustainable business models

Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

Grab and Charge+ partner to develop electric vehicle charging network in Vietnam

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek secures $200 million IFC loan following revenue drop

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

Leading with empathy in Vietnam’s billion-dollar investment flows

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.