Business

Pitfalls in Vietnam's promising retail market

Vietnam is a still young retail market and has lots of development potential.

Demographic and macroeconomic data shows that Vietnam is in the golden phase for economic development in general and retail in particular, Le Thi Huyen Trang, head of research and consulting services, JLL Vietnam said.

The country is forecast to produce the highest GDP growth rate in the dynamic Southeast Asia region with 6.6 per cent, far outpacing the 5 per cent annual growth of the region in the next decade.

Urbanisation is one of the main factors driving Vietnam’s GDP growth. Vietnam’s urban population is expected to increase at a 2.6 per cent compound annual growth rate (CAGR) until 2030, the highest in Southeast Asia. 36 per cent of the Vietnamese population lived in cities in 2018, compared to 55 per cent and 60 per cent in Indonesia and China.

As more people move into cities and take on higher-value manufacturing and service jobs, their incomes also increase. According to data from Brookings Institution, Vietnam is expected to have the highest middle-class population growth in the region, at 19 per cent CAGR in 2020-2025.

This is much higher than the 14 per cent recorded in the past decade and higher than the projected regional average of 11 per cent.

Demographics are also a favourable factor in the Vietnamese market. With 90 million people, Vietnam is attracting retailers with its relatively young population with 70% between the ages of 15 and 64 – promising to be a key driver of strong market growth.

Other factors such as the growth of tourism also helps bring more demand for retail. The development of infrastructure also provides investors with more opportunities to develop retail projects outside the central areas.

The potential of the Vietnamese retail market has attracted the attention of many regional mall investors as well as retail investors in the region. Since 2014, the market has witnessed a series of mergers and acquisitions (M&A) deals.

An example is Berli Jucker’s acquisition of Metro Cash & Carry Vietnam, the largest M&A deal ever in Vietnam. Shortly after, Central Group – another Thai giant – acquired Nguyen Kim Trading JSC, Vietnam’s leading electronics retailer, and Big C Vietnam, the second-largest supermarket chain in terms of the number of stores in the country.

E-mart – South Korea’s leading retailer – also officially joined the playground in 2015 with a $60 million shopping mall in the north of Ho Chi Minh City.

Also from Korea, Lotte Mart has been quite successful with a series of supermarkets and shopping centres across the country. Aeon, one of the world’s leading retail groups from Japan, is also gradually expanding its network with a fifth centre in Hadong, Hanoi, going into operation in November 2019.

From Japan, Takashimaya has been present in Vietnam since 2016 at a prime location in the heart of Ho Chi Minh City.

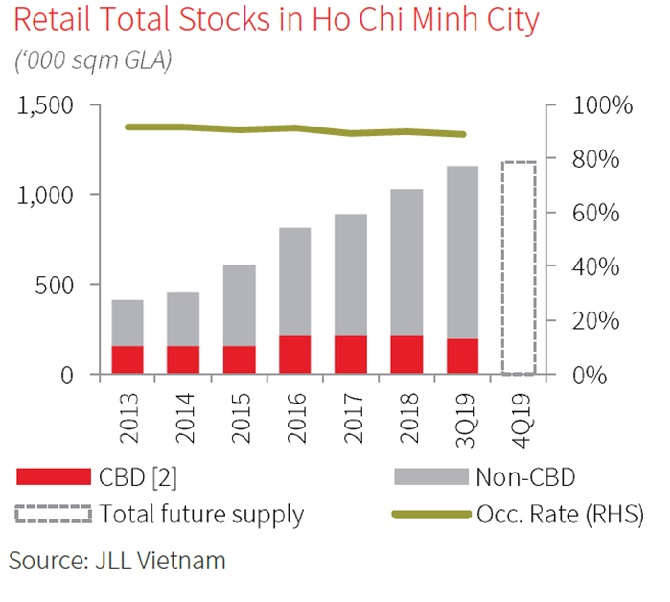

Good rental demand has made prospects brighter for shopping centres, especially projects in the Central Business Districts (CBD). In the third quarter of 2019, occupied space remained stable at about 90% CAGR in both the CBD and non-CBD areas.

The market is currently seeing tenants looking for properties with more than 1,000 square metres, making it difficult to find a suitable location at the current retail centres. Most tenants are thus waiting for future supply or retail centres that are currently undergoing renovation and upgrade. Rents at the centres remain stable.

Lessons and directions for the future

The ups and downs of popular brands in the market tell of the potential of the local retail market – but also show that the apples are not just for anyone to pick.

In addition to the prerequisite of choosing a location with high population density and strong purchasing power, changes in consumer habits, as well as competition from e-commerce, led to the development of new retail models. Retailing in accordance with the target market is the factor deciding a brand’s success or failure.

The withdrawal of big brands like Auchan, the shrinking domestic network of Parkson, and the series of foreign convenience store brands struggling to gain market share or having to transfer to domestic rivals (Shop and Go being prime examples) show the fierce competition.

AEON’s success with its “slow and steady” market entry strategy shows that it is extremely important to understand consumer behaviors and select the right retail model. Having a representative office in Vietnam since 2008, it was not until 2014 that AEON officially opened its first centre, Aeon Mall Tan Phu Celadon (Ho Chi Minh City).

Choosing the right model that offers a prime spot for families to shop and play in line with the market trends has brought this brand a great deal of success in its five years of operation.

For every success, there are multiple instances of failure. Parkson’s less diversified tenant structure which focuses too much on fashion and cosmetics while neglecting dining and entertainment or Auchan and Shop & Go’s disappearance from the market all profess to the dire need to align with market trends.

To succeed, retail operators need to conduct careful studies to better understand the trends that will shape the retail market. According to JLL’s observations, in addition to the tendency to focus on food and beverage as well as entertainment to increase traffic, developing green retail space, the application of technology and big data, setting up omni-channel shopping, and other creative efforts to enhance the shopping experience will also become more pronounced in the retail market.

In the face of changing shopping behavior and intense competition from e-commerce, experience and the right model will be the key words for the success of traditional physical shopping and real estate properties.

Immersive cultural and entertainment concepts enhance retail experience

Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

Grab and Charge+ partner to develop electric vehicle charging network in Vietnam

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek secures $200 million IFC loan following revenue drop

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

Leading with empathy in Vietnam’s billion-dollar investment flows

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.