Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

The race of convenience stores in Ho Chi Minh City is becoming fiercer than Hanoi despite the increasing cost and lack of space in the metropolitan area, according to the world's leading real estate investment and advisory firm JLL.

According to JLL, by the end of March 2018, Ho Chi Minh City has more than 1,800 convenience stores and mini supermarkets covering the inner city and the suburbs. The total area of these stores takes up 272,000 square metres of the city’s floor area, up 5.1 per cent over the previous quarter.

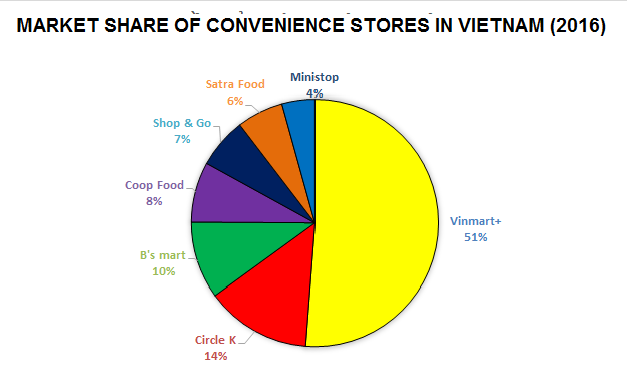

In Hanoi, the battle seems less intense as the total floor area of convenience stores is only about 62,000 square metres, mainly concentrated in suburban districts. Unlike Ho Chi Minh City, Vinmart+ holds the dominant position in Hanoi.

AC Nielsen has recently reported that almost 80 per cent of Vietnam's retail market currently belonged to traditional retailers. Modern retailers with convenience stores owned only over 20 per cent of the market. AC Nielsen forecast that the balance would gradually tilt to modern retailers, especially in big cities like Ho Chi Minh City and Hanoi.

The Association of Vietnam Retailers (AVR) estimated that the size of the retail sector in 2016 was $158 billion, nearly double the figures of 2010. It is estimate that the average annual growth of this profitable sector increases by over 10 per cent and Vietnam has become a thriving market that retail giants cannot afford to ignore.

Convenience stores, in short, offer similar items to the traditional grocery stores, but they are centrally operated under a brand. In Vietnam, we can mention big names such as Vinmart, Circle K, 7-Eleven, Ministop.

They all aim at young customers, who have a stable income and enjoy the convenience. To attract this customer segment, each brand has its unique charm.

Circle K, the 24-hour convenience store from the United States, often leases commercial space whose size is larger than the average and has two floors for a cafeteria upstairs. Apart from common consumer goods, Circle K also sells fast food and customers can sit there for hours.

7-Eleven, who joined Vietnam last June, chose another strategy. It sells fresh porridge, half-hatched quail eggs and many other fresh dishes of Vietnamese flavour.

Vinmart+, Vingroup’s chain retailer, chose the "hybrid" model with a mini supermarket inside. Instead of selling fast food, Vinmart+'s strategy originates from the perspective that the Vietnamese prefer fresh food to the frozen one. Vinmart+ is currently having nearly 1,000 stores in Vietnam.

Experts said that although each brand chooses a different way to position themselves, the key to success is just about commercial space. It can be seen most clearly in Ho Chi Minh City, the most exciting city and also the first destination of any businesses that want to develop in Vietnam.

A contest of big spenders

Despite the potential, most businesses have to accept losses.

Launched in 2015, Vinmart+ is the fastest growing convenience store chain in Vietnam. In 2017, the revenue of Vinmart and Vinmart+ reached more than $433 million, but this segment has not produced profits yet.

Similarly, 7-Eleven or other large convenience stores also have to accept to earn profits after at least five to ten years of investment.

The convenience store market shows a similar feature to e-commerce in Vietnam, as businesses are constantly burning money, hoping to become a pioneer to control the market.

This race is not for enterprises which have a shortage of capital sources. Recently, Vissan's leaders said that they had to close nearly 60 of the 100 convenience stores that the company had opened.

FamilyMart, Japan’s famous convenience store chain, joined with Phu Thai to develop in Vietnam. After a period, it also announced to withdraw from the alliance because they cannot bear the loss. Ministop of Trung Nguyen has also gone into the past.

In spite of the harsh market, new enterprises still set long-term goals. GS25 sets a target of 2,500 stores and 7-Eleven aims at opening 1,000 stores after ten years, and Vinmart+ even sets a bigger goal. It is estimated that by 2021, there will be more than 5,000 Vinmart and Vinmart+ stores nationwide, with sales increasing eight times compared to 2017, reaching revenue of over $3.7 billion. Some other domestic brands such as Saigon Co.op and Satra also showed their serious attitude.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.