Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Jetstar Pacific, the first low-cost carrier in Vietnam, has repeatedly reported losses over the past few years with the accumulated loss of $184 million, exceeding its charter capital.

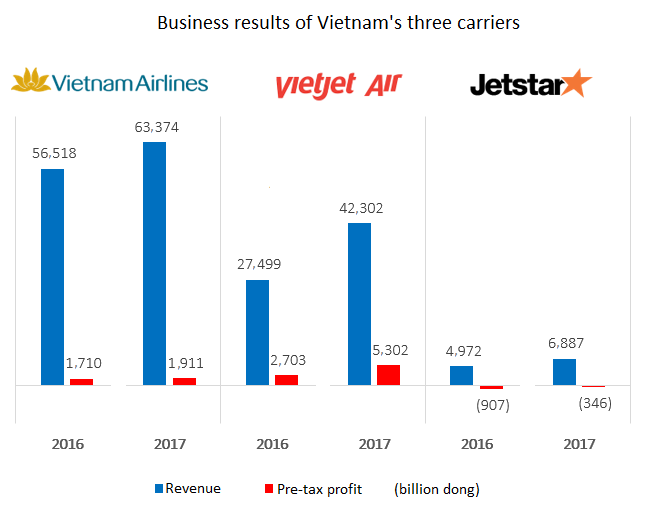

The aviation industry in Vietnam has grown dramatically in recent years, bringing impressive profits to airlines and other service companies in the industry.

Both Vietnam Airlines and VietJet Air, the two biggest airlines in the country, have obtained steep profits thanks to the increase in the number of passengers over the years. Even, the recent surge in jet fuel prices has not affected these airlines’ profits.

However, Jetstar Pacific, the joint-venture between Vietnam Airlines and Qantas Airways, has repeatedly suffered losses over the years. At the end of 2017, its accumulated loss reached around $184 million.

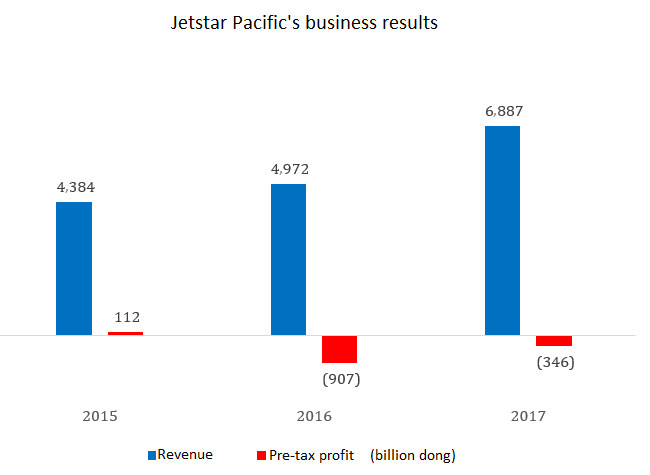

In the last three years, Jetstar Pacific has shown a growth similar to the overall trend of the industry. In 2017, the company's revenue reached $296 million, an increase of nearly 60 per cent and 40 per cent compared to 2015 and 2016, respectively.

However, Jetstar Pacific’s problem for years is that its cost of capital (including fuel costs, aircraft rental/purchase costs, etc.) has been always higher than its revenue which results in the airline’s losses without including the sales and management costs.

In 2017, Jetstar Pacific suffered VND357 billion ($15.4 million) in negative gross profit which combined with costs of sales, corporate management and finance expenses of $12.3 million to bring total operation loss to $45.3 million.

Thanks to another profit of more than $30 million earned in 2017, its pre-tax loss dropped to VND346 billion ($14.9 million).

Negative business results partly reflected that Jetstar Pacific must increase its cost of purchasing and leasing aircraft as planned to expand its fleet to 30 Airbus A320 aircraft by 2020.

Jetstar Pacific’s poor business performance despite the growth of the airline industry comes as no surprise. The airline has suffered huge losses for a long time. In spite of being the first low-cost airline in Vietnam, Jetstar Pacific failed to take advantage of this model and was quickly crushed when VietJet Air, another low-cost carrier, entered the industry.

To maintain operations, Jetstar Pacific has to use a large financial leverage. The short-term debt of the carrier reached $106 million in 2016 and dropped to $14.8 million last year. However, Jetstar Pacific increased its unearned revenue to nearly $148 million last year.

Beside Vietjet Air, Jetstar will soon have to compete with FLC Group's Bamboo Airways which is awaiting license.

With regard to international flights to Vietnam, Jetstar Pacific will be facing low-cost regional airlines such as Air Asia, Lion Air and Tiger Airways. Fierce competition will make Jetstar Pacific take many years to offset its accumulated losses of more than $184 million although the domestic aviation market is likely to grow in the future.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.