Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

Vietnam has a rather similar export manufacturing capacity with China and this is helping the nation take over some of China’s key export items to the US as the US-China trade war is escalating, according to Fiingroup.

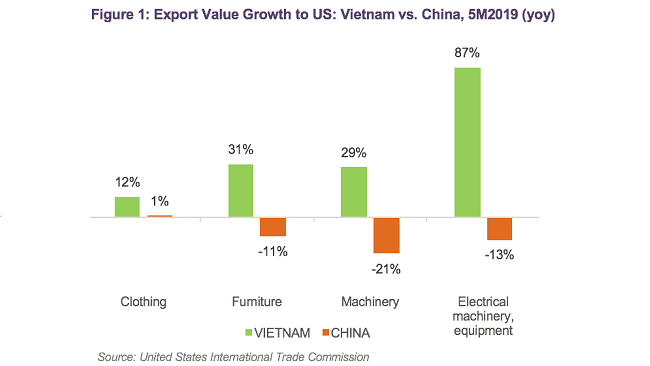

While electrical machinery and equipment, machinery, furniture and clothing represent 61 per cent of the total export value China sent to the US, they have taken up 65 per cent of Vietnam’s total export value there.

Given such similarity and the on-going tensions between the US and China, financial and business information service provider Fiingroup is observing a shift of import orders from China to Vietnam by US importers. The country has accordingly witnessed 87 per cent growth in export of electrical machinery and equipment over the first five months of 2019, compared to the same period last year. For China, it was a decline of 13 per cent.

FDI firms taking the crown

Yet, despite the promising outlook, it is worthwhile to note that main exporters of these items are FDI companies. Vietnamese companies merely accounts for a small proportion of the country’s exports to the US.

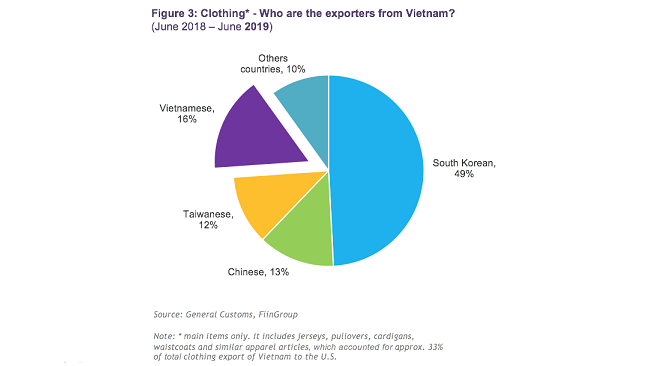

Clothing exported by Vietnamese companies to the US, for instance, only took up 16 per cent of the item’s export value in the past 12 months

To tap into such opportunity from the trade tensions, FDI companies from South Korea, Japan and China (including Taiwan) are those who have been actively expanding and establishing their facilities in Vietnam.

South Korean clothing manufacturers, according to Fiingroup, is the biggest winner of the US-China trade war, with 143 South Korean companies accounting for approximately 50 per cent of the export value initiated from Vietnam.

Most of them are subsidiaries of giant South Korean OEM manufacturing corporations, such as Hansoll, Sae-A, Nobland and Hansae. These corporations entered Vietnamese in early 2000s and have developed well-established supply chains. Some companies such as Hansae and Nobland even opened supporting factories such as fabric dyeing factory, packaging factory in Vietnam to support its main production.

Local companies’ contribution in clothing export remained modest, at 16 per cent throughout the past 12 months ending June 30. Only prestigious local manufacturers such as Ha Phong, Gia Phu, Song Hong, L&T, some others have sufficient capacity and experience to approach foreign buyers. The majority of Vietnamese companies are still small-sized and do not meet foreign buyers’ requirements, regarding quality, quantity and cost.

Small part in the value chain

For phones and parts export, FDI companies also seem to be the net beneficiaries of the trade conflicts. This happens as no domestic firm has chipped into the value chain of manufacturing phones and parts.

South Korean and Taiwanese companies, with the dominance of Samsung and Foxconn, have been contributing some 98 per cent of Vietnam’s total export of phones and parts. Exponential growth (87 per cent) of export value of electrical machinery, equipment in first five months of 2019 was in fact initiated by these two corporations. To avoid high tariffs, both Samsung and Foxconn have trimmed their production in China and shifted some to Vietnam.

Without enough raw materials, skills and supply chain, most local companies, meanwhile, only manufacture mobile phone parts and accessories to supply for Samsung and Foxconn, indirectly contributing to the export value of these items.

With regards to furniture and machinery, top exporters to the US markets are also foreign-invested companies. Chinese, Japanese and US manufacturers of furniture and machinery in Vietnam are seen to be those directly influenced by the trade war.

Very few Vietnamese companies witnessed exceptional revenue growth in 2018. Like clothing and electrical equipment and machinery industries, furniture and machinery also suffer from the lack of raw materials. Importing goods and machinery parts from overseas has raised the production cost of local companies, and such cost represents a bigger burden for them if compared with the FDI companies.

Local companies typically import many of their materials from China for production. Many American customers continue to buy from their partners in China, or from FDI companies manufacturing in Vietnam. For example, to the same design of reflective clothing item required by an American buyer, Vietnamese partners can only sell at FOB (freight on board) $55/ an item, while Chinese companies are selling at $27 an item. The reason is that Vietnamese companies have to import most of the raw materials (fabrics, reflective piece) from China. With tariffs added, Chinese companies can still provide at lower costs than Vietnamese companies.

Empowering local companies

According to Fiingroup, opportunity for Vietnam from the trade was is clear but realising the parties benefiting from it will need a serious effort from both policy makers and businesses.

By increasingly integrating with the global economy, Vietnam is getting higher benefits than ever. However, these benefits will be limited if the core problem is not solved. Lack of raw materials, skilled human resources and technology will continue to prevent Vietnam from reaching its full potential. The local government should provide training and subsidies to local firms to raise Vietnamese firms’ footprint in the total export.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.